The temporary’s key findings are:

- Household caregivers are important to assembly the long-term care wants of older adults, nevertheless it means monetary sacrifices in misplaced earnings or out-of-pocket prices.

- Numerous insurance policies might scale back the burden, nevertheless it stays unclear which of them assist probably the most, so this research requested caregivers instantly.

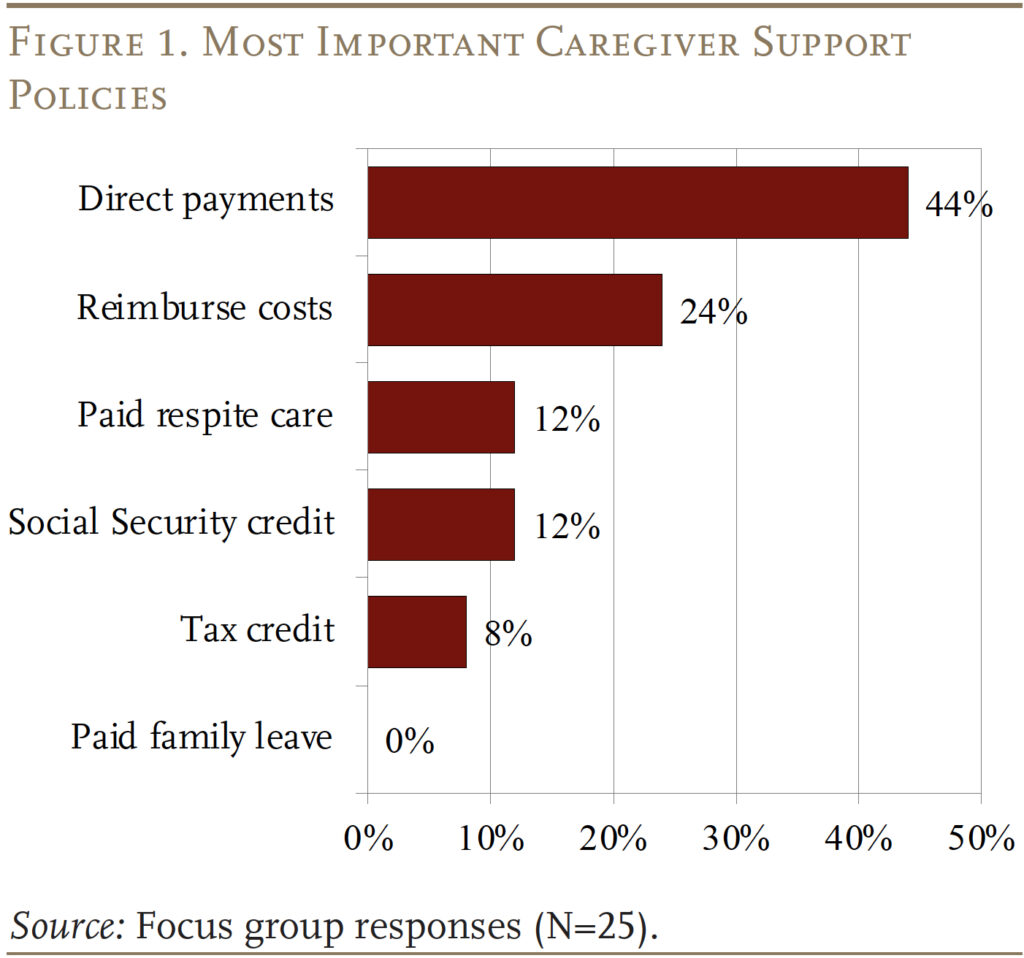

- Caregiver focus teams strongly want direct funds for caregiving and price reimbursement over respite care, tax or Social Safety credit, and paid depart.

- Direct funds are particularly well-liked amongst non-White caregivers, which accords with nationwide knowledge displaying they supply extra care and work much less.

- Lastly, a separate evaluation estimating the financial worth of the coverage choices aligns with the views of focus group contributors.

Introduction

Household caregiving is the cornerstone of long-term look after older adults, particularly in underserved communities. This care, nevertheless, poses vital challenges and sometimes requires monetary sacrifices from caregivers. In response, researchers, practitioners, and policymakers have proposed varied choices to alleviate the monetary pressure, nevertheless it stays unclear which choices would most profit the caregivers. Additionally unclear is how the results would possibly range by caregiver traits, equivalent to race/ethnicity, earnings, and work standing.

To grasp the perceived and precise impression of the choices, this temporary, which relies on a current research, makes use of a mixed-methods strategy.1 The qualitative portion relies on focus group interviews with a various contingent of caregivers to know which insurance policies they consider would enhance their retirement safety probably the most. These discussions are supplemented with knowledge evaluation from nationwide surveys to look at which forms of caregivers may benefit extra from sure insurance policies and the way financial outcomes align with the main focus group responses.

The dialogue proceeds as follows. The primary part describes the monetary burden on caregivers and varied insurance policies that may assist. The second part presents the main focus group outcomes, which present that contributors of every kind want direct funds for household caregiving or reimbursement for caregiving bills over tax credit, Social Safety credit, or household depart. The third part summarizes the quantitative evaluation, which helps clarify why caregivers – particularly non-White people – favor direct funds. It additionally exhibits that back-of-the-envelope estimates of the financial worth of assorted coverage choices align with the worth perceived by focus group contributors. The ultimate part concludes that whereas a lot of the coverage dialogue has centered on paid household depart, this selection is the least well-liked amongst these offering care to older adults, who are inclined to want direct funds for caregiving and reimbursements for care-related spending.

Background

In 2021, about 38 million household caregivers in america offered an estimated 36 billion hours of care to an grownup with limitations in each day actions.2 Whereas household caregiving is the spine of such care, significantly for underserved communities, caregivers usually face a big monetary burden, from each the direct prices of offering care and the diminished earnings from working much less.

Household caregivers are extra possible than non-caregivers to cut back their work hours, swap to jobs which can be much less demanding with decrease pay, cease working altogether, or retire early because of caregiving tasks.3 Not surprisingly, caregivers who present extra care face a bigger detrimental impression on their work and earnings, however even short-term caregiving can have labor market penalties.4

In response, policymakers have proposed methods to ease their monetary burden, however current insurance policies are sometimes restricted and piecemeal, and range dramatically by state. In consequence, the implementation of many of those insurance policies is proscribed.

Household caregivers might declare the federal Baby and Dependent Care Tax Credit score to cowl some out-of-pocket prices, as much as $3,000 for one dependent and $6,000 for 2 or extra. Nevertheless, the credit score is non-refundable, and the caregiver should itemize their deductions. The credit score additionally solely applies to prices incurred so the caregiver can work or search for work, so it excludes prices equivalent to residence modifications or additions, and caregivers who’re retired aren’t eligible in any respect. In consequence, few caregivers of older adults declare it.5

Insurance policies to assist scale back the labor market prices of caregiving are additionally restricted. Some employers could supply restricted paid depart or beneficiant trip or sick time that can be utilized for caregiving. However usually, staff with entry to those advantages are increased earners who work for giant employers. Employees with out such beneficiant employer advantages could also be eligible for the federal Household and Medical Go away Act (FMLA), which offers as much as 12 weeks of unpaid job-protected depart. Whereas this job safety is efficacious, many low- and moderate-income staff would face substantial monetary hardship from 12 weeks of unpaid depart.

In consequence, 14 states have stepped in to supply restricted durations of paid household depart (PFL), with the size and generosity various by state.6 Researchers have discovered that PFL has helped the wives of care recipients stay working, though it has had solely a restricted impression on husbands.7 The worth is bigger for staff with a highschool diploma or much less, suggesting that states with PFL might scale back the differential prices of caregiving. A limitation to lots of the research analyzing PFL, nevertheless, is that PFL just isn’t restricted to these caring for older adults. PFL could also be higher fitted to caregiving that’s anticipated and of restricted period.

Briefly, employer-based depart insurance policies, federal FMLA, and state PFL are useful for brief caregiving durations however present restricted assist for main caregivers who present look after longer durations. Moreover, many staff do not need entry to those applications, and even after they do, take-up is low.8

Lately, some analysis has examined what caregivers really need or need. Qualitative evaluation revealed that household caregivers have various wants and proposals, starting from caregiver pay to improved entry to respite care to medical coaching.9 Equally, a current AARP survey discovered that caregivers would discover many insurance policies – together with earnings tax credit, caregiver pay, and partial paid depart – useful.10 What’s much less clear is why take-up of current applications is so low, which insurance policies can be most useful, and whether or not totally different insurance policies are simpler for various racial/ethnic teams. This research conducts 4 focus teams to look at if coverage preferences range by race/ethnicity, earnings, employment standing, and whether or not the caregiver is the first caregiver. It then makes use of quantitative evaluation to see whether or not the rankings by focus group contributors are per the attainable payoff of the insurance policies.

Focus Teams Findings

The main target teams included a complete of 25 household caregivers. The discussions had been carried out just about to maximise accessibility, and a stipend of $135 was provided to all contributors. To make sure illustration of underserved communities, a number of teams had been oversampled: Blacks, lower-income people, and males (see Desk 1 for pattern traits). The typical age throughout all contributors was 50, with a spread from 26 to 67. 4 focus teams had been carried out, every comprising six to eight contributors. Two of the 4 had been high-income, and the opposite two had been low-income. The main target teams had been 75 minutes in size.

The main target group discussions centered on six insurance policies: 1) paid household depart; 2) direct fee from the federal government for offering household care; 3) tax credit for offering care; 4) caregiver credit towards Social Safety advantages; 5) paid respite care; and 6) reimbursements for caregiver out-of-pocket prices. The next offers a quick description of those insurance policies and contributors’ reactions.

(1) Paid Household Go away. As famous, whereas a federal program protects staff’ jobs in the event that they take brief leaves to look after relations, it’s unpaid. Some states have paid depart applications that substitute a portion of staff’ wages for a brief time frame. The proposed coverage described to focus group members would supply round 60 % of wages for as much as 12 weeks for staff caring for somebody with a severe sickness. Many respondents had been conscious of and famous this system’s constructive elements, however those that weren’t employed felt they might not profit. Different considerations included this system’s limitations, equivalent to profit caps, the restricted time that advantages can be found, and lack of relevance to sure employment sorts. Self-employed people questioned its relevance, and dealing caregivers had been extra prone to spotlight the necessity for job safety.

(2) Direct Funds for Caregiving. Most contributors confirmed nice curiosity in being paid instantly for his or her caregiving time. They emphasised the rapid reduction such funds might present, particularly in pressing conditions, and the way it might ease balancing work and caregiving. Issues about this kind of program included anticipated delays in receiving funds, the non permanent nature of assist, and accessibility points like eligibility standards and prolonged approval processes. Respondents steered that it could be essential to streamline approval processes and broaden protection to make sure equitable entry.

(3) Tax Credit score for Caregiving. An earnings tax credit score for caregiving for an older grownup fewer respondents, however some nonetheless discovered it related. Contributors famous it won’t profit them if they don’t pay taxes or want rapid help. Some discovered direct authorities funds much more useful than a tax credit score. Issues a couple of tax credit score strategy included having to attend till tax season to obtain the credit score.

(4) Social Safety Caregiver Credit score. This coverage includes counting caregiving outing of the labor power as “employment” for the needs of accruing Social Safety advantages.11 The concept of augmenting for caregivers unable to work exterior the house was considered positively by some contributors. However, total, few confirmed curiosity on this coverage largely because of its give attention to future, somewhat than rapid, monetary wants. By way of curiosity, higher-income caregivers discovered this coverage extra useful than their lower-income counterparts. Strategies for strengthening such an strategy included combining rapid assist with long-term advantages to raised handle caregivers’ monetary wants.

(5) Paid Respite Care. Respite care permits caregivers a short-term break, both by means of the acquisition of residence care providers or short-term residential look after the recipient.12 A couple of respondents confirmed curiosity in receiving paid respite care, seeing potential advantages in lowering their caregiving burden. The benefits they cited included improved time administration and alternatives for self-care. Issues centered on respite care high quality, availability, and security, and care recipient compliance. Total, respondents discovered respite care useful however emphasised the necessity for sufficient fee to make sure high-quality suppliers.

(6) Reimbursements for Caregiver Prices. This coverage includes overlaying caregiver spending on gadgets equivalent to residence modifications and assistive units, together with ramps, accessible bedrooms, or vehicles modified for wheelchairs. Respondents noticed vital advantages to such a coverage, noting how these reimbursements might enhance caregiving duties and high quality of life. This coverage was considered as promising since insurance coverage usually doesn’t cowl such bills. Whereas some didn’t see rapid advantages for themselves, they acknowledged its potential for different caregivers. Issues included the reimbursement course of and the pace of receiving funds.

Of the six insurance policies, being paid instantly by the federal government for household caregiving was the most well-liked (see Determine 1). Particularly, 11 focus-group contributors (44 %) chosen direct funds as probably the most useful coverage. This selection was adopted by reimbursing caregiving-related prices. Having paid respite care and receiving caregiver credit score for Social Safety advantages had been every favored by solely 2 contributors (8 %). Not one of the contributors recognized paid household depart as a very powerful coverage.

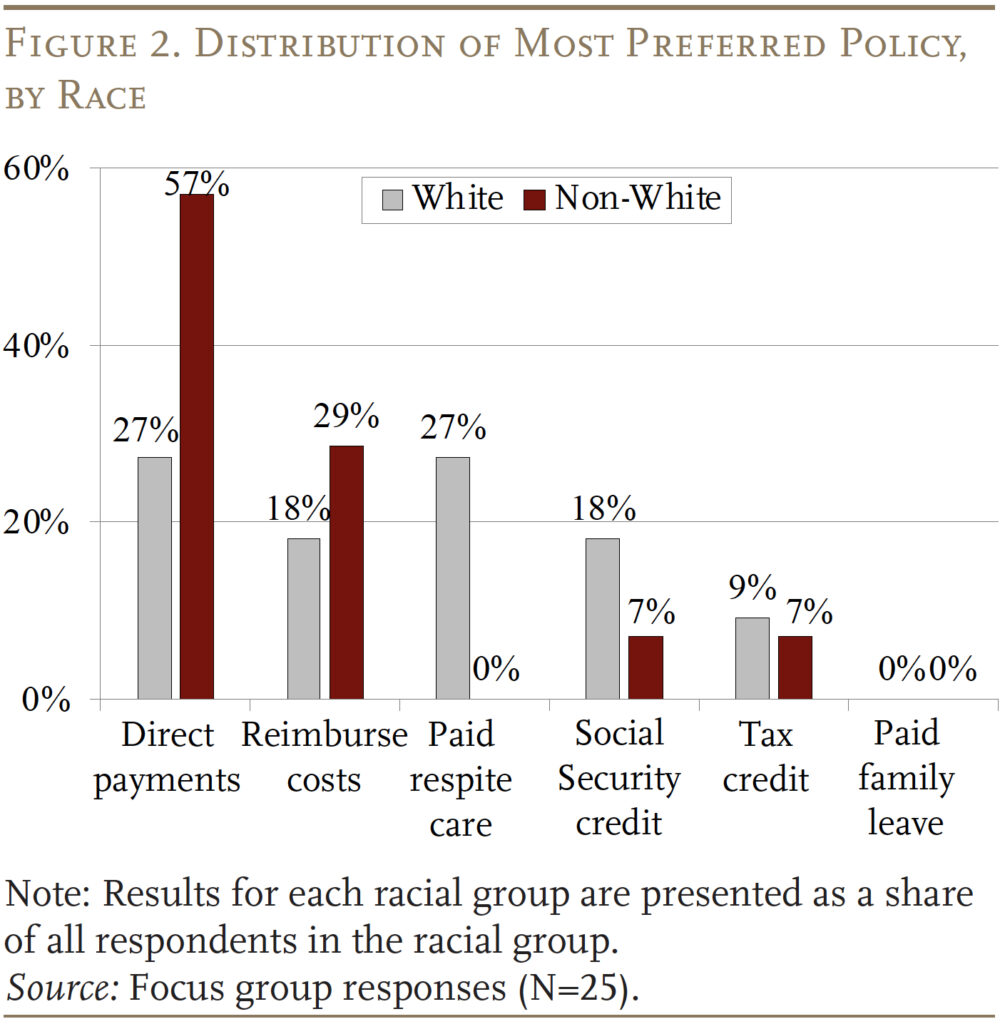

Whereas the rankings of a very powerful insurance policies had been extremely constant throughout sociodemographic teams, some variations existed. The next dialogue focuses on the sample by race (see Determine 2); the total research additionally seems to be at variation by earnings, employment standing, and caregiving burden. Probably the most noticeable variation is that whereas each non-White and White caregivers ranked direct funds extremely, it was by far probably the most favored coverage for non-Whites. In distinction, non-Whites had no real interest in respite care, whereas this coverage did attraction to some Whites. Lastly, whereas neither group was very enthusiastic concerning the Social Safety caregiver credit score, White caregivers noticed extra promise. One query, addressed under, is the extent to which this variation by race may be defined by the traits of the caregivers.

Findings from the Quantitative Evaluation

The quantitative evaluation dietary supplements the interviews in two methods. First, it explores the extent to which the variation in preferences throughout teams may be defined by their traits. Second, the evaluation can be utilized to match the financial worth of the varied coverage choices to the worth perceived by focus group contributors.

The evaluation makes use of the Nationwide Well being and Ageing Developments Examine (NHATS), linked with the Nationwide Examine of Caregiving (NSOC), each for descriptive statistics and to calculate the likelihood that caregivers from totally different racial/ethnic teams face varied monetary challenges.

Traits by Race

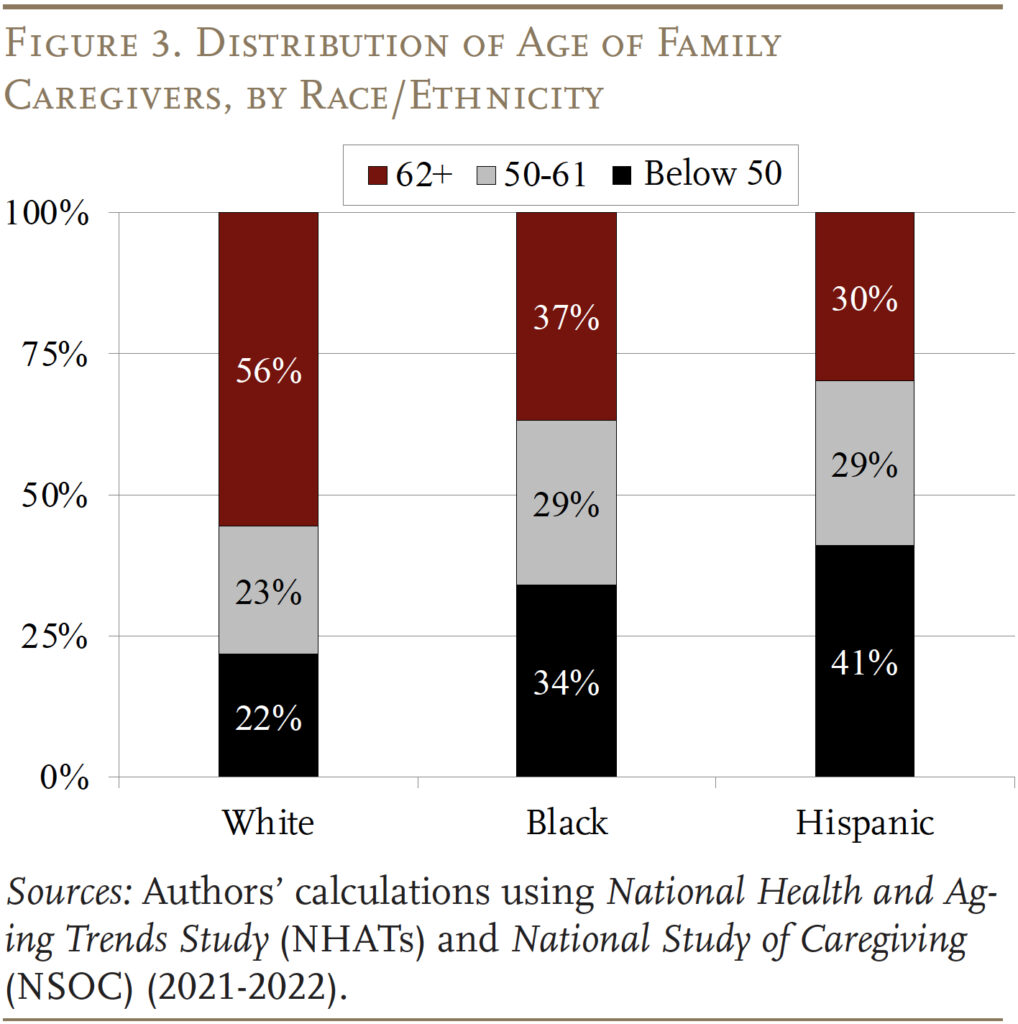

Information from NHATS/NSOC present that Black and Hispanic caregivers are youthful and more likely to be the youngsters or grandchildren, somewhat than spouses, of care recipients in comparison with their White counterparts. In consequence, 34 % of Black and 41 % of Hispanic caregivers are below age 50 relative to 22 % of White caregivers (see Determine 3).

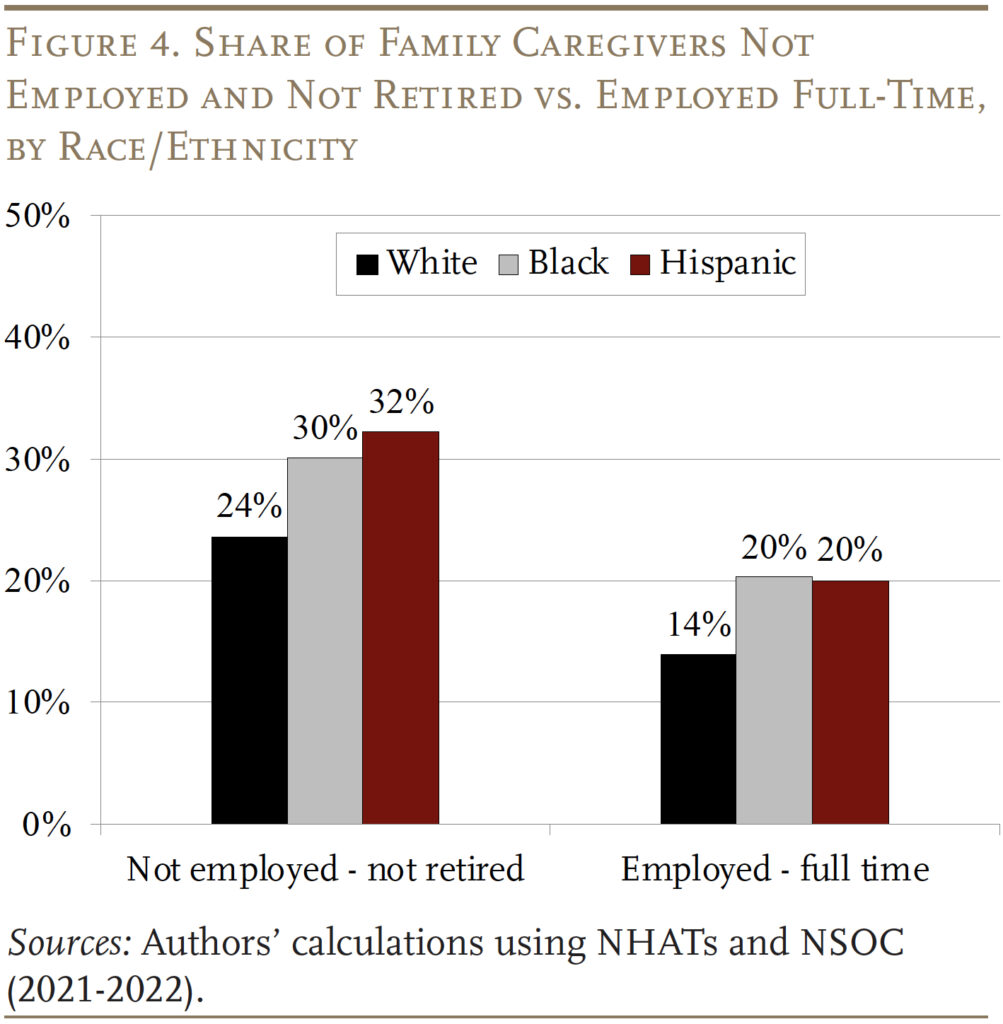

As well as, Black and Hispanic caregivers are more likely to supply excessive ranges of care, with near half of them offering greater than 60 hours a month in comparison with 31 % for White caregivers. Consequently, Black and Hispanic caregivers are more likely to be working part-time or have dropped out of the labor power regardless of being youthful, which considerably impacts their lifetime earnings and their very own monetary safety in retirement (see Determine 4). The mix of being youthful, offering excessive ranges of care, and being much less prone to be employed helps clarify non-Whites’ robust choice for direct funds and their lack of curiosity in Social Safety credit relative to Whites.

Estimates of the Lifetime Worth of the Coverage Choices

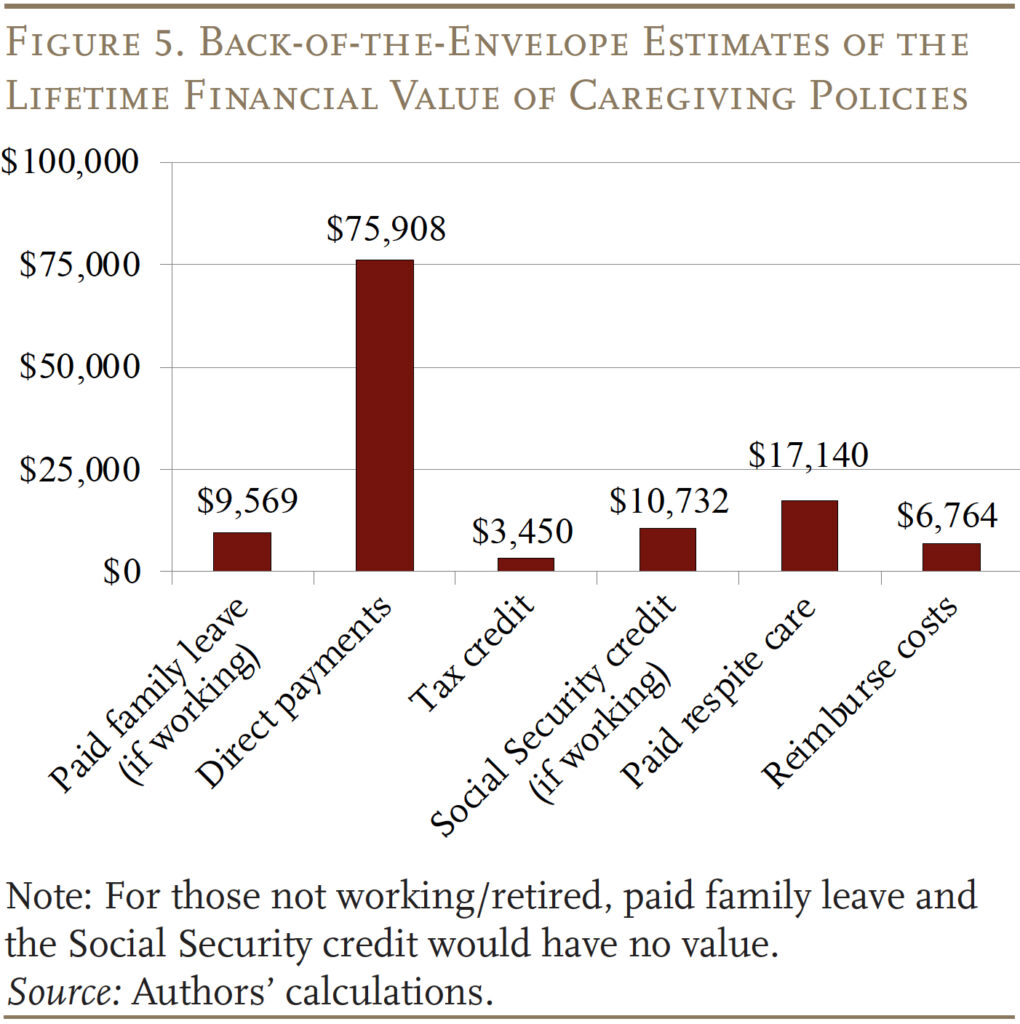

Lastly, the evaluation offers some back-of-the-envelope estimates of the monetary good thing about the insurance policies to see how they align with the preferences of focus group respondents. A quick abstract of assumptions underlying these calculations is printed under:

Paid Household Go away. State applications range considerably within the share of wages changed and the size of the fee interval. The instance used right here assumes caregivers obtain 60 % of their wages for 12 weeks and earn the common wage in 2022 of $63,795, which equates to $9,569 a yr. The theoretical lifetime worth may very well be a lot increased since, technically, workers are eligible for this system each calendar yr. Nevertheless, it might be unlikely for staff to remain on the identical employer in the event that they take depart yearly. Moreover, this coverage wouldn’t present any profit for caregivers who had been retired or had dropped out of the labor power.

Direct Funds for Caregiving. Some states pay relations a certain quantity for offering care.13 Our evaluation exhibits that caregivers don’t change their labor power choices except they supply greater than 60 hours of care per 30 days. The belief for this calculation is that such a caregiver is paid $15/hour. On common, household caregivers present 74 hours of care a month, which might end in a fee of $11,000 per yr. Since people on common present care for six.9 years, the lifetime worth of this coverage equates to virtually $76,000.14

Tax Credit score for Caregiving. Probably the most related tax credit score is the federal Credit score for Different Dependents, which offers as much as $500 for dependents of any age. The lifetime worth of this credit score is simply round $3,500 for many household caregivers.

Social Safety Caregiver Credit score. This proposal usually includes changing an individual’s lacking earnings with a credit score equal to half of the common wage index for as much as 5 years.15 As soon as they retire, their profit can be barely increased as a result of they’ll have fewer zero years of their earnings historical past. This distinction in annual advantages for receiving credit score for as much as 5 years is $1,172 a yr, assuming caregivers declare at age 65. However since caregivers is not going to obtain these advantages till they declare Social Safety, the worth needs to be discounted again to age 50 at a reduction price of three %, leading to a price of about $10,700.16 The coverage additionally wouldn’t profit caregivers who’re already retired.

Paid Respite Care. The assumed coverage would cowl sooner or later of respite care per 30 days; the annual worth can be $1,140 for grownup day care and $2,484 for a house well being aide.17 The lifetime worth is roughly $7,870 for grownup day care and $17,140 for a house well being aide.

Reimbursements for Caregiver Prices. Reimbursements on care-related gadgets might cowl prices which can be typically not lined by insurance coverage. Information from the NHATS/NSOC present that common out-of-pocket prices on this stuff are round $980 yearly for caregivers who incur prices. The lifetime worth of this coverage is $6,764.

Determine 5 compares the potential monetary worth of the varied insurance policies for household caregivers. Being paid instantly for offering care affords the best worth. Due to this fact, it’s not shocking that it is among the favorites amongst caregivers in our focus teams. Paid respite care, the third hottest coverage amongst contributors, offers the second highest monetary worth. Curiously, whereas having out-of-pocket prices reimbursed ranked extremely amongst focus group contributors, the precise worth of this coverage is comparatively low. However the monetary reduction is rapid, which many contributors valued. Total, the values assigned to the six coverage choices are absolutely per the rankings offered by the focus-group contributors.

Conclusion

The main target group discussions confirmed that the insurance policies perceived to take advantage of vital distinction for caregivers concerned direct financial compensation from the federal government, both by being paid for caregiving or by means of reimbursements for out-of-pocket prices. Conversely, the coverage perceived as least useful was paid household depart or expanded sick depart. The responses align with our quantitative evaluation, which exhibits that caregivers, significantly these from various backgrounds, incurred out-of-pocket prices for offering care and plenty of needed to reduce on work or depart the labor power altogether. Total, these outcomes present priceless insights for policymakers on the simplest interventions for assuaging the monetary burdens related to caregiving.

References

AARP. 2023. “Valuing the Invaluable 2023 Update: Strengthening Supports for Family Caregivers.” Washington, DC: Public Coverage Institute.

Bana, Sarah H., Kelly Bedard, and Maya Rossin-Slater. 2020. “The Impacts of Paid Family Leave Benefits: Regression Kink Evidence from California Administrative Data.” Journal of Coverage Evaluation and Administration 39(4): 888-929.

California Employment Growth Division. 2023. “Paid Family Leave (PFL) Program Statistics.” Sacramento, CA.

Cohen, Marc, Claire Wickersham, Christian Weller, Anqi Chen, and Brandon Wilson. 2024. “Which LTSS Financial Support Policies Are Preferred among Caregivers and Can They Reduce Racial/Ethnic Disparities in Retirement Security?” Working Paper 2024-17. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Coile, Courtney, Maya Rossin-Slater, and Amanda Su. 2022. “The Impact of Paid Family Leave on Families with Health Shocks.” Working Paper 30739. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Crandall-Hollick, Margot L. and Connor F. Boyle. 2021. “Child and Dependent Care Tax Benefits: How They Work and Who Receives Them.” R44993. Washington, DC: Congressional Analysis Service.

Ettner, Susan L. 1996. “The Opportunity Costs of Elder Care.” Journal of Human Assets 31(1): 189-205.

Fahle, Sean and Kathleen M. McGarry. 2017. “Caregiving and Work: The Relationship Between Labor Market Attachment and Parental Caregiving.” Working Paper 2017-356. Ann Arbor, MI: Michigan Retirement Analysis Middle.

Favreault, Melissa M. and Brenda C. Spillman. 2018. “Tax Credits for Caregivers’ Out-of-Pocket Expenses and Respite Care Benefits: Design Considerations and Cost and Distributional Analyses.” Analysis Report. Washington, DC: City Institute.

Feinberg, Lynn Friss. 2019. “Paid Family Leave: An Emerging Benefit for Employed Family Caregivers of Older Adults.” Journal of the American Geriatrics Society 67(7): 1336-1341.

Hartmann, Heidi I. and Jeffrey Hayes. 2021. “Estimating Benefits: Proposed National Paid Family and Medical Leave Programs.” Modern Financial Coverage 39(3): 537-556.

Jacobs, Josephine C., Courtney H. Van Houtven, Audrey Laporte, and Peter C. Coyte. 2017. “The Impact of Informal Caregiving Intensity on Women’s Retirement in the US.” Inhabitants Ageing 10: 159-180.

Johns Hopkins College, Bloomberg Faculty of Public Well being and College of Michigan, Institute for Social Analysis. National Study of Caregiving, 2021-2022.

MedicaidLongTermCare.org. 2024. “Getting Paid as a Caregiver.”

Nadash, Pamela, Eileen J. Inform, and Taylor Jansen. 2023. “What Do Family Caregivers Want? Payment for Providing Care.” Journal of Ageing & Social Coverage 1-15.

Nadash, Pamela, Eileen Inform, Carol Regan, Taylor Jansen, Andrew Alberth, and Marc Cohen. 2021. “Findings from RAISE Act Research: Family Caregiver Priorities.” Innovation in Ageing 5(1): 63-64.

National Health and Aging Trends Study. 2021-2022. Produced and distributed by www.nhats.org with funding from the Nationwide Institute on Ageing (Grant Quantity NIA U01AG032947).

Quinby, Laura D. and Robert L. Siliciano. 2021. “Implications of Allowing US Employers to Opt Out of a Payroll-Tax-Financed Paid Leave Program.” Particular Report. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Reinhard, Susan C., Selena Caldera, Ari Houser, and Rita B. Choula. 2023. “Valuing the Invaluable 2023 Update: Strengthening Supports for Family Caregivers.” Washington, DC: AARP Public Coverage Institute.

Skira, Meghan M. 2015. “Dynamic Wage and Employment Effects of Elder Parent Care.” Worldwide Financial Assessment 56(1): 63-93.

Truskinovsky, Yulya and Nicole Maestas. 2018. “Caregiving and Labor Force Participation: New Evidence from the American Time Use Survey.” Innovation in Ageing 2(1): 580.

U.S. Congress. 2023. “S.1211 – Social Security Caregiver Act of 2023.” Launched within the Senate April 19, 2023.

Van Houtven, Courtney Harold, Norma B. Coe, and Meghan M. Skira. 2013. “The Effect of Informal Care on Work and Wages.” Journal of Well being Economics 32(1): 240-252.

Wolff, Jennifer L., Brenda C. Spillman, Vicki A. Freedman, and Judith D. Kasper. 2016. “A National Profile of Family and Unpaid Caregivers Who Assist Older Adults with Health Care Activities.” JAMA Inside Drugs 176(3): 372-379.