Keep knowledgeable with free updates

Merely signal as much as the US inflation myFT Digest — delivered on to your inbox.

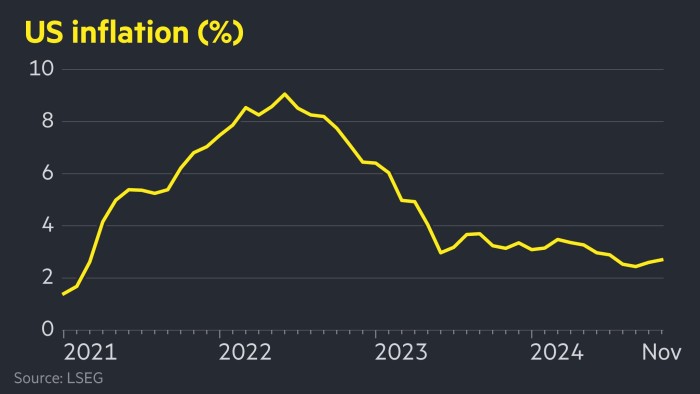

US inflation ticked as much as 2.7 per cent final month, matching Wall Road’s forecasts and clearing the best way for an anticipated Federal Reserve charge reduce subsequent week.

Wednesday’s knowledge from the Bureau of Labor Statistics was in keeping with the expectations of economists polled by Bloomberg. However it was larger than the two.6 per cent charge in October, which itself marked a rise on the earlier month.

Market pricing indicated that buyers now assign a 98 per cent likelihood to a quarter-point charge reduce in December, up from lower than 90 per cent earlier than the discharge of the newest inflation figures.

Brian Levitt, international market strategist at Invesco, mentioned the figures have been “very a lot inside the Fed’s consolation zone and help[ed] a charge reduce on the subsequent assembly”.

1 / 4-point reduce subsequent week would take rates of interest to a brand new goal vary of 4.25-4.5 per cent.

The trajectory subsequent 12 months is much less sure, because the central financial institution wrestles with its twin mandate to maintain inflation near 2 per cent and preserve a wholesome labour market.

In a reference to President-elect Donald Trump, who takes over from President Joe Biden in January, David Kelly, chief international strategist at JPMorgan Asset Administration, mentioned: “If the Fed didn’t reduce subsequent week . . . I feel you’d get a Tweet popping out saying ‘Why are they not reducing? They reduce for the previous man’.”

However Kelly mentioned a reduce in January was unlikely and that the Fed now had the “alternative of quietly laying out a extra average path of charge cuts in 2025”.

US shares rose sharply, with the benchmark S&P 500 including 0.7 per cent and the tech-heavy Nasdaq Composite leaping 1.3 per cent.

In authorities bond markets, the policy-sensitive two-year Treasury yield, which strikes inversely to cost, was 0.03 proportion factors decrease at 4.12 per cent.

The greenback barely trimmed an earlier acquire to commerce 0.1 per cent larger in opposition to a basket of six different currencies.

Wednesday’s knowledge confirmed that on a month-to-month foundation, each headline and core inflation — which strips out meals and vitality costs — rose 0.3 per cent in November.

On an annual foundation, core inflation rose 3.3 per cent.

Many of the month-on-month improve in costs was attributable to a 0.3 per cent improve within the shelter index, which tracks housing-related prices. However different indicators counsel such prices have fallen, because the shelter index lags behind different knowledge by 9 months to a 12 months.

As soon as housing, meals and vitality costs have been excluded, companies inflation rose 0.19 per cent for the month, down from 0.3 per cent in October.

Fed officers have mentioned slowing the tempo of cuts as charges attain a extra “impartial” setting that’s excessive sufficient to maintain inflation in verify however sufficiently low to safeguard the labour market.

They argue that in the event that they reduce charges too shortly, inflation could get caught above their 2 per cent goal, however transferring too slowly might danger a pointy rise within the unemployment charge.

Final week, chair Jay Powell advised {that a} sturdy economic system meant the central financial institution might “afford to be a bit of extra cautious” about charge reductions.

Some officers within the outgoing Biden administration have expressed concern that Trump’s insurance policies will injury the economic system after he returns to the White Home subsequent month.

US Treasury secretary Janet Yellen mentioned this week that the sweeping tariffs proposed by Trump might “derail” progress on taming inflation.

“[Tariffs] would have an opposed impression on the competitiveness of some sectors of the USA economic system, and will considerably elevate prices to households,” she mentioned at an occasion hosted by the Wall Road Journal.

Kelly argued {that a} Fed sign subsequent week that it was slowing down the tempo of charge cuts might defer if not remove the chance of an eventual conflict with Trump.

“Some day, one thing’s going to go incorrect within the economic system and the markets, and the Fed’s going to get blamed and that’s going to trigger a confrontation — that’s virtually inevitable,” he mentioned. “However it’s going to be disagreeable when it happens, so I feel the Fed want to delay it as a lot as potential.”