A crypto dealer with a eager eye for synthetic intelligence (AI) tasks has reportedly amassed earnings of greater than $17 million from a number of AI-focused tokens, and on-chain information now factors to a pivot towards recent memecoins. In accordance with an analysis shared by Lookonchain on X, the dealer’s largest positive aspects stem from early positions taken in GOAT, ai16z, Fartcoin, and ARC.

Crypto Dealer Turns AI Cash Into $17 Million

Lookonchain experiences through X, “What a sensible AI coin dealer! Earnings exceeded $5.14M on GOAT. Earnings exceeded $4.5M on ai16z. Earnings exceeded $4M on Fartcoin. Earnings exceeded $4M on arc. Let’s check out which tokens he’s shopping for.”

Associated Studying

The dealer’s most important win reportedly got here from GOAT. He entered the token at a time when its total market cap was beneath $2 million {dollars}, spending round $62,000 to buy roughly 11.1 million GOAT tokens. After driving GOAT’s fast ascent, he bought all GOAT with a complete of about $5.2 million, netting an estimated $5.14 million.

His efficiency with ai16z – a decentralized AI-powered buying and selling fund on the Solana blockchain – is equally spectacular, as he spent one $123,000 to accumulate 6.17 million tokens at a market cap of $22 million. Lookonchain’s information signifies that he bought 4.67 million ai16z tokens at round $1.78 every and nonetheless retains 2.65 million tokens presently valued close to $2.9 million. In accordance with Lookonchain, this quantities to a complete ai16z revenue of greater than $4.5 million.

The evaluation additionally highlights vital positive aspects from Fartcoin, which the dealer purchased at a market cap of below $7 million, paying $121,000 for round 9.46 million tokens. He bought 6.81 million of these tokens for $610,000 whereas preserving 2.65 million tokens which are collectively valued at $3.55 million, bringing his web revenue on Fartcoin to roughly $4 million.

An analogous sample emerged in his ARC place, the place he invested $212,000 to accumulate 11.6 million ARC tokens when the venture’s market cap was roughly $15 million. After promoting 1.6 million tokens for $212,000, he presently holds 10 million arc tokens price about $4 million, leading to one other $4 million revenue.

Associated Studying

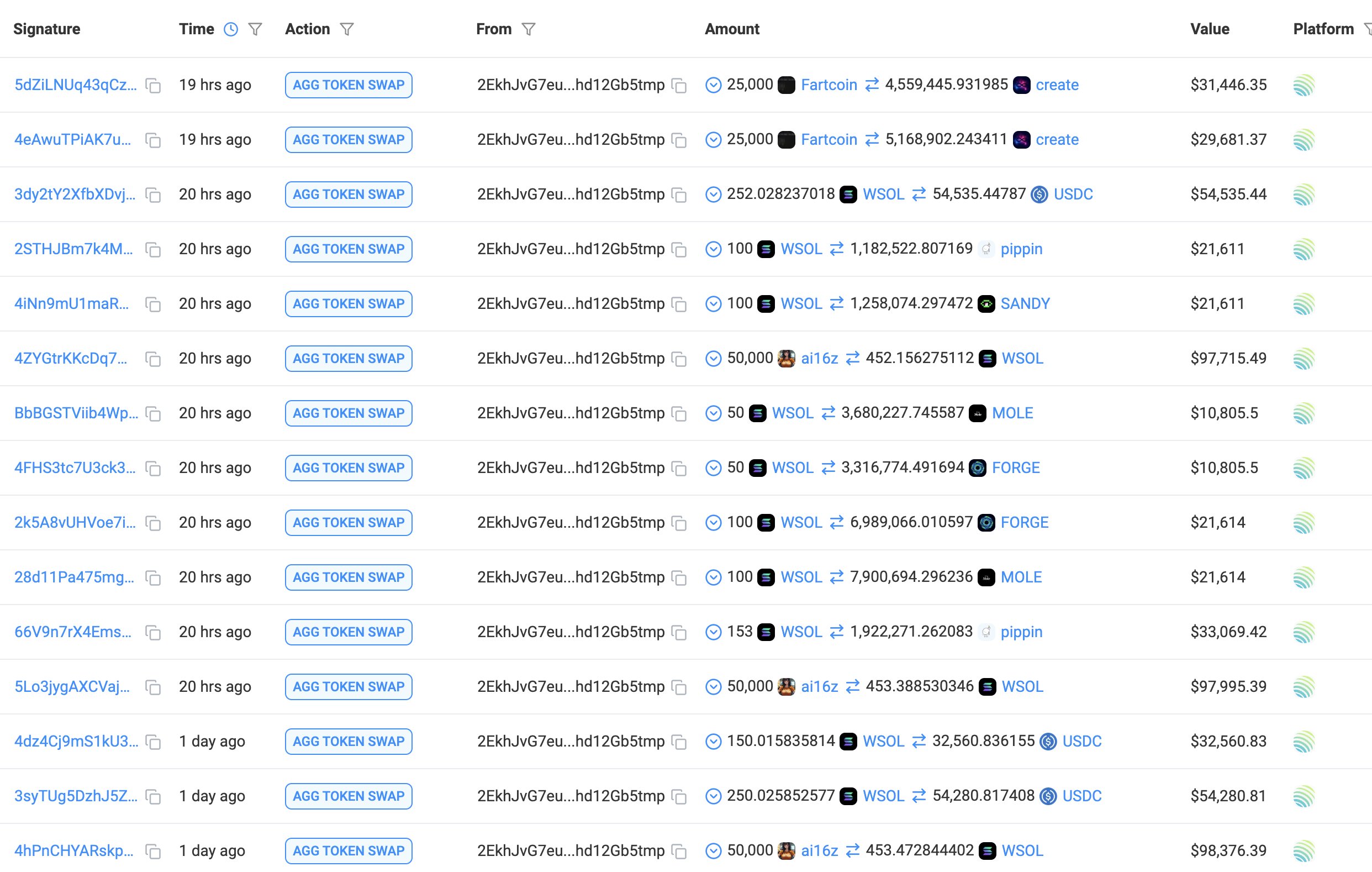

Lookonchain’s put up additionally particulars the dealer’s latest strikes into a number of smaller-cap memecoins, together with CREATE, PIPPIN, SANDY, MOLE, and FORGE. A screenshot offered by Lookonchain exhibits that he financed a part of these purchases by promoting Fartcoin in two batches of 25,000 items for $31,446.35 and $29,681.37, respectively.

Extra funding seems to have come from promoting Wrapped SOL (WSOL) in a number of transactions, together with 100 items for $21,611, 50 items for $10,805.50, and 153 items for $33,069.42.

The distribution of those WSOL gross sales suggests a methodical method to securing liquidity earlier than deploying funds into CREATE, PIPPIN, SANDY, MOLE, and FORGE. In whole, he allotted $202,255 to accumulate stakes within the memecoins. He spent $61,127 on CREATE, $21,611 on PIPPIN, $21,611 on SANDY, $65,486 on MOLE, and $32,420 on FORGE.

At press time, GOAT traded at $0.52.

Featured picture from iStock, chart from TradingView.com