In 20 years of managing cash I’ve by no means witnessed extra dismal sentiment for worldwide shares, worth shares and actually valuations on the whole.

Buyers I come into contact with have all however given up on these things. I do know you may have stated the identical factor the previous 5-7 years or so but it surely feels just like the dam really broke this 12 months. Buyers are falling by the wayside.

I’ve many ideas on this matter however first a market historical past lesson.

Till the Fifties, traders anticipated to earn extra revenue from their shares than bonds. The final thought was that shares are riskier and thus want greater yields to draw traders.

When dividend yields and bond yields converged it was a sign to promote shares. Inventory costs would then fall till dividend yields earned a premium over bonds once more.

It was a reasonably good market sign too. The yields on shares and bonds flipped for a month or two proper earlier than the Nice Despair and most of the greatest bear markets of the late nineteenth century and early twentieth century.

However then a bizarre factor occurred within the late-Fifties…it stopped working.

Bonds yields surpassed divided yields and didn’t look again for a really very long time. In reality, they remained above inventory market yields for 50 years till bond yields lastly received low sufficient in the course of the Nice Monetary Disaster.

This was one thing traders took as gospel for many years after which *poof* hastily it vanished.

Peter Bernstein wrote in regards to the classes he discovered from this phenomenon in Against the Gods:

Though the contours of this new world have been seen nicely earlier than 1959, the outdated relationships within the capital markets tended to persist so long as individuals with recollections of the outdated days continued to be the primary traders. For instance, my companions, veterans of the Nice Crash, stored assuring me that the seeming development was nothing however an aberration. They promised me that issues would revert to regular in just some months, that inventory costs would fall and bond costs would rally.

I’m nonetheless ready. The truth that one thing so unthinkable might happen has had a long-lasting impression on my view of life and on investing particularly. It continues to paint my perspective towards the longer term and has left me skeptical in regards to the knowledge of extrapolating from the previous.

Typically it truly is totally different this time!

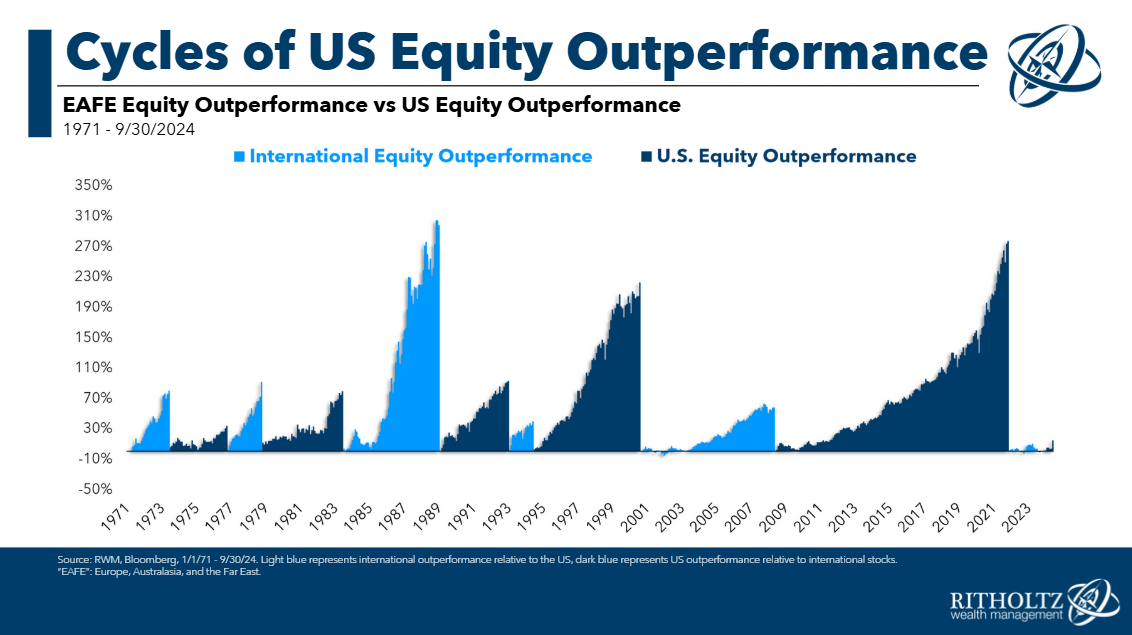

So is it totally different this time? Are we now in a world the place U.S. progress shares are the one ones value investing in?

Are these cycles a factor of the previous?

My sincere reply is I don’t know.

Every thing I’ve ever studied about market historical past tells me there may be nothing extra dependable than cycles. Methods, geographies and components come out and in of favor. Nothing works perpetually.

However I can’t rule out the chance that expertise has modified issues. I wouldn’t guess my life on it however it will be naive to imagine there are not any paradigm shifts within the markets. This could possibly be a kind of shifts.

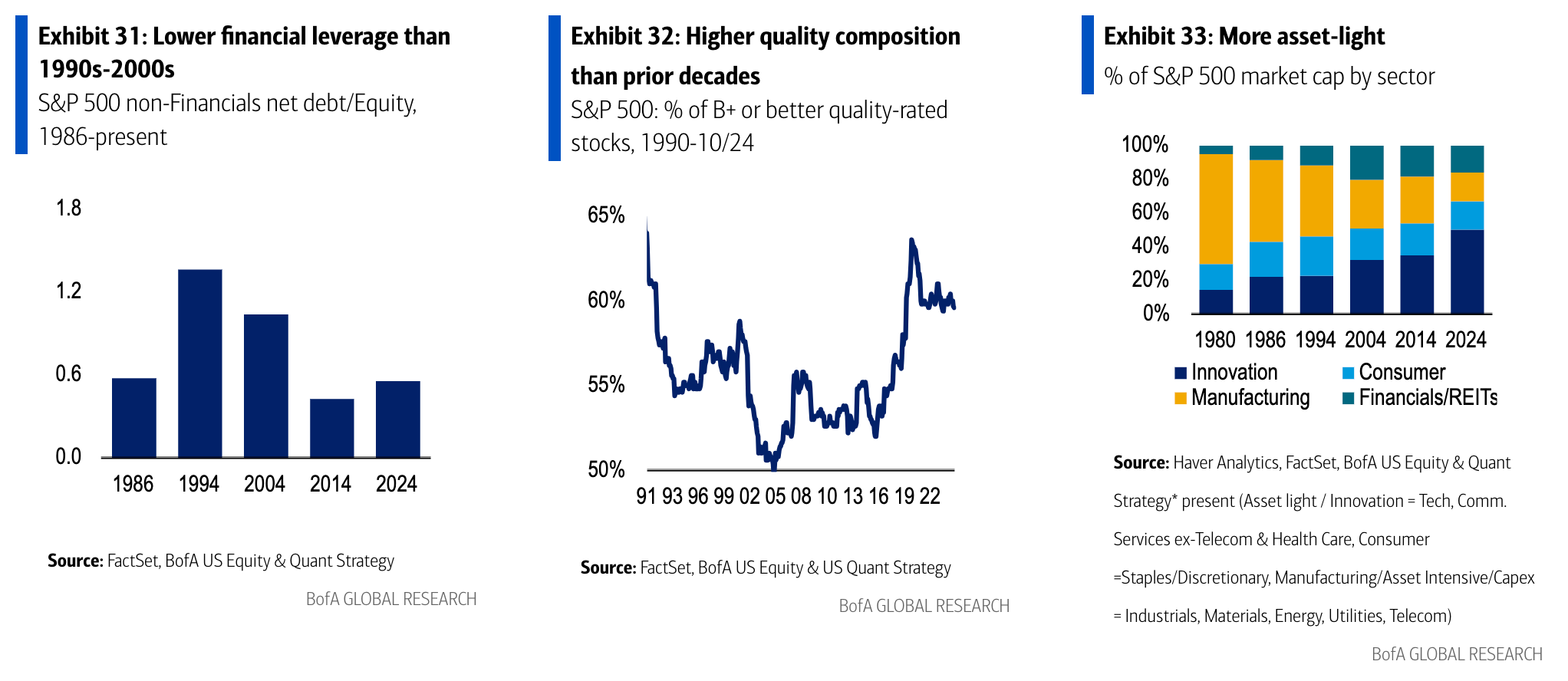

There are causes massive cap progress shares in america are so fashionable. They’ve the most effective fundamentals:

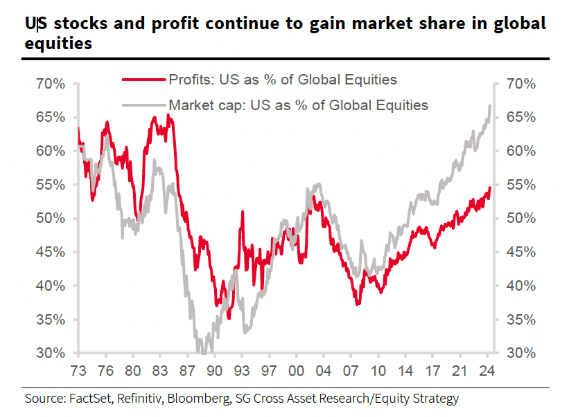

U.S. shares have gained revenue share together with market share:

And these companies are a lot higher quality than they have been previously:

Buyers hate worldwide shares, rising market shares and worth shares for a motive. The businesses on the prime of the S&P 500 and Nasdaq 100 are, frankly, higher companies.

They’re outperformed within the inventory market as a result of they’ve outperformed on enterprise fundamentals.

Perhaps massive cap progress now has overtaken what was the small cap worth premium previously. That is sensible to me.

The trillion greenback query is that this: What’s priced in?

Regardless of the consequence is within the coming 5-10 years it can really feel apparent after the very fact.

In fact U.S. shares continued to outperform as a result of they’re the most effective corporations!

In fact U.S. shares underperformed as a result of valuations have been so excessive!

Once more, I don’t know.

I do know traders right here and across the globe are pouring cash into U.S. shares hand over fist and abandoning different areas of the worldwide inventory market.

I’m nonetheless a believer in diversification for the straightforward indisputable fact that I do not know what the longer term will maintain. Diversification is an admission of ignorance in regards to the future.

However I’m not blind to the truth that generally market relationships change perpetually.

The one factor I do know for certain is I’ve by no means seen sentiment so dour on companies outdoors of huge cap U.S. shares.

Time will inform if that is a kind of generational turning factors in historic relationships or one other instance of traders chasing previous efficiency.

Additional Studying:

Diversification is About Decades