Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana continues to face mounting promoting stress because it struggles to reclaim the $150 degree, with broader market uncertainty weighing closely on worth motion. Down almost 60% from its all-time excessive, Solana displays the weak spot seen throughout the crypto sector, the place worry and volatility have returned to dominate investor sentiment. As macroeconomic instability and risk-off conduct persist, bulls have been unable to regain management, and confidence stays shaky.

Associated Studying

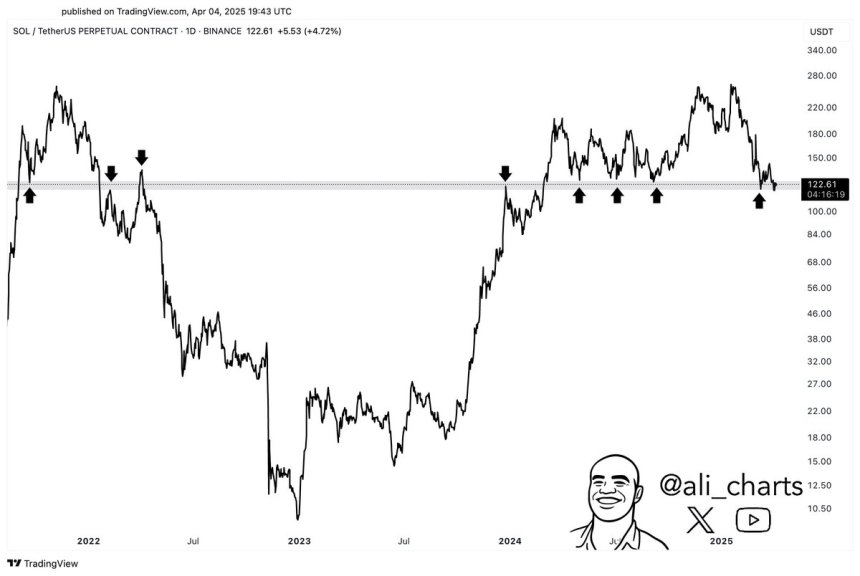

Prime crypto analyst Ali Martinez lately shared an vital technical evaluation, figuring out $120 as a vital make-or-break zone for Solana. In keeping with Martinez, this degree has traditionally marked main shifts in SOL’s worth trajectory, typically appearing because the tipping level between restoration and additional decline. With Solana now hovering dangerously near this threshold, merchants are watching intently to see whether or not it may possibly maintain or break.

If $120 fails to behave as assist, it might set off a deeper correction. On the flip aspect, holding this degree might supply bulls a base to mount a possible comeback — particularly if market situations stabilize. For now, Solana stays in a vulnerable position, and the way it behaves round this key degree could outline its course within the weeks forward.

Solana Holds Vital Demand As World Commerce Struggle Tensions Develop

Solana is buying and selling at a vital demand zone as promoting stress intensifies throughout the crypto market, pushed by escalating international tensions and commerce battle fears. On Liberation Day, US President Donald Trump introduced sweeping new tariffs, sparking robust responses from main economies like China. The fallout has shaken investor confidence throughout all markets, together with crypto, the place threat property are feeling the load of heightened uncertainty and decreased urge for food.

Solana (SOL) has been particularly weak, with worth motion slipping towards key assist ranges. Analysts warn that if present demand fails to carry, the downtrend might speed up. The following few days might be essential, as continued weak spot into subsequent week might affirm a bearish breakdown. Many merchants are already getting ready for extra draw back if the market doesn’t stabilize quickly.

Martinez recently highlighted the significance of the present assist zone. In keeping with his evaluation, the $120 degree is a decisive make-or-break level for Solana. This zone has traditionally marked main pattern reversals and shifts in momentum. A failure to carry above it might result in a deeper correction, whereas a bounce from this degree might spark a restoration.

With SOL already 60% down from its all-time highs, bulls are on the defensive. If they will defend $120, there’s nonetheless hope for a reversal — however dropping it might sign that the broader bearish pattern stays intact. Within the days forward, all eyes might be on Solana’s skill to carry the road as macro stress continues to form the crypto market’s course.

Associated Studying

Key Weekly Help Faces Breakdown Danger

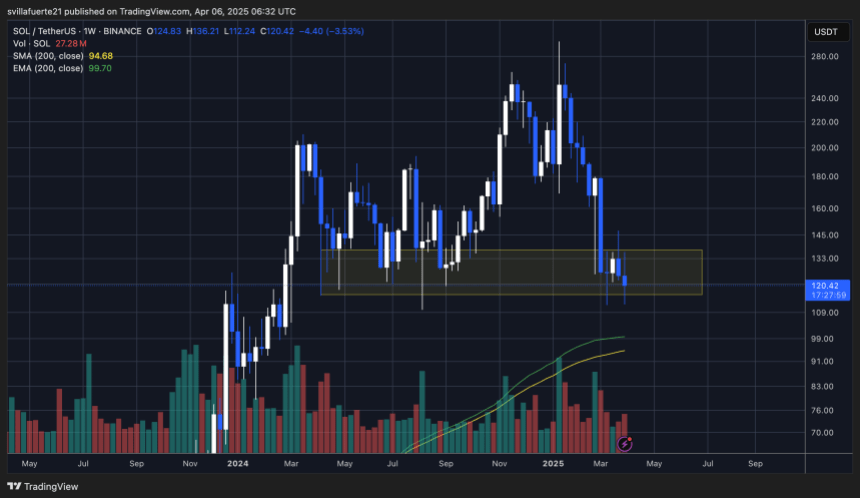

Solana is at present buying and selling at $120, on monitor to report its lowest weekly shut since February 2024. After weeks of promoting stress and repeated rejections under the $150 degree, bulls are operating out of time to defend key assist. The shortcoming to reclaim $150 — a significant resistance zone — has saved SOL trapped in a bearish construction, with momentum firmly in favor of the bears.

For any hopes of a restoration rally to take form, Solana should reclaim $150 within the coming days. That degree stays the gateway to larger demand zones and a shift in short-term pattern. Nonetheless, if worth motion continues to weaken and $120 fails to carry, the following logical goal is far decrease — across the weekly 200-day MA and EMA, each converging close to $95.

Associated Studying

This might characterize a vital breakdown and sure set off extra draw back stress, notably if broader market situations stay fragile. With macroeconomic uncertainty and commerce battle tensions weighing closely on sentiment, Solana’s place seems to be more and more weak. Except bulls step in quickly, SOL could possibly be going through a deeper retracement because it exams long-term assist zones not seen since late 2023.

Featured picture from Dall-E, chart from TradingView