Key Takeaways

- Historic patterns present crypto cycle peak will not be but right here.

- Stablecoins more and more function a bridge between fiat currencies and crypto markets, comprising nearly all of crypto buying and selling pairs.

Share this text

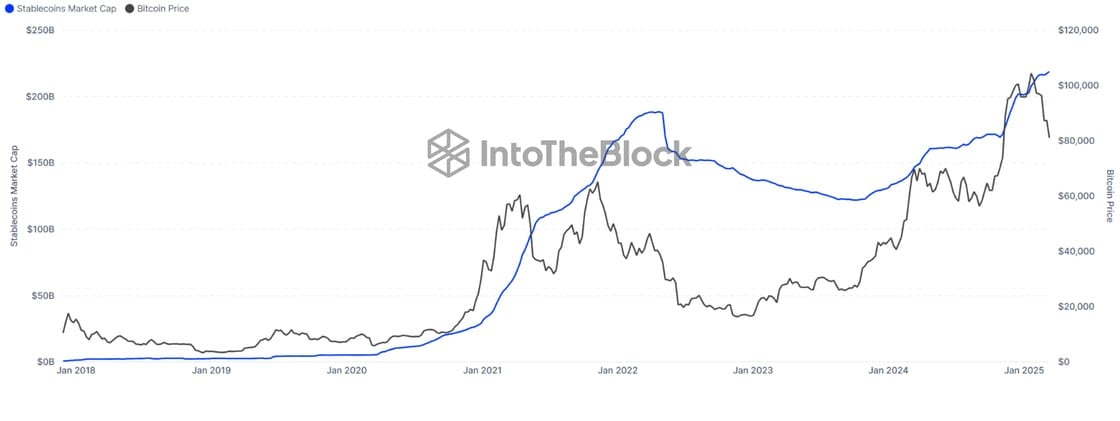

The whole provide of stablecoin has reached $219 billion and continues to climb, suggesting the crypto bull run remains to be removed from over, IntoTheBlock stated in a Friday statement.

In accordance with the crypto analytics agency, historic information reveals stablecoin provide sometimes peaks throughout market cycle highs, with the earlier peak of $187 billion recorded in April 2022 simply earlier than the market began declining.

Since stablecoin provide is now increased than ever and rising, this means the market has not but peaked and remains to be in a development part.

After a drop beneath $77,000 earlier this week, Bitcoin climbed above $85,000 on Friday morning, TradingView data reveals. At press time, Bitcoin was buying and selling at round $84,700, up 4.5% within the final 24 hours.

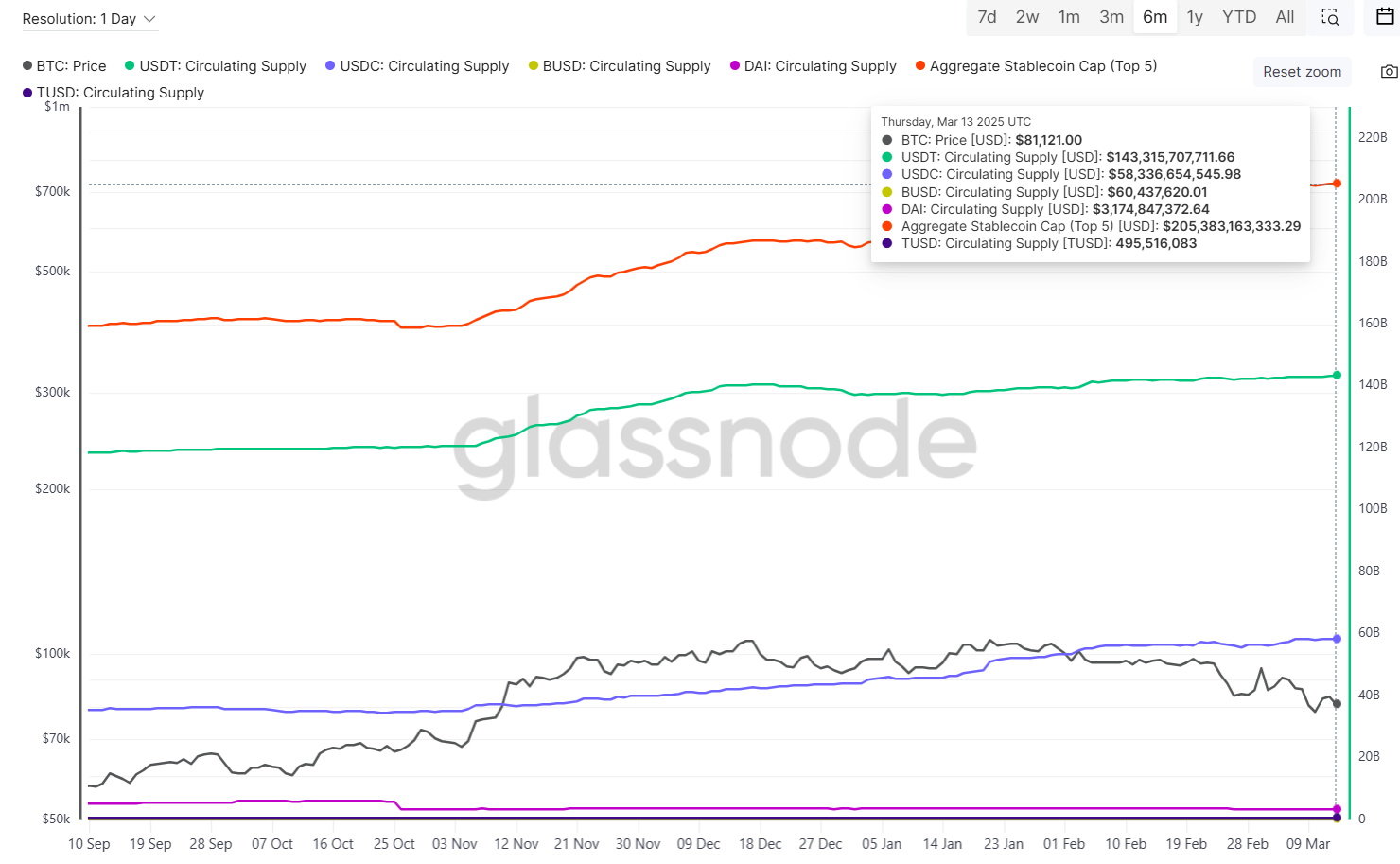

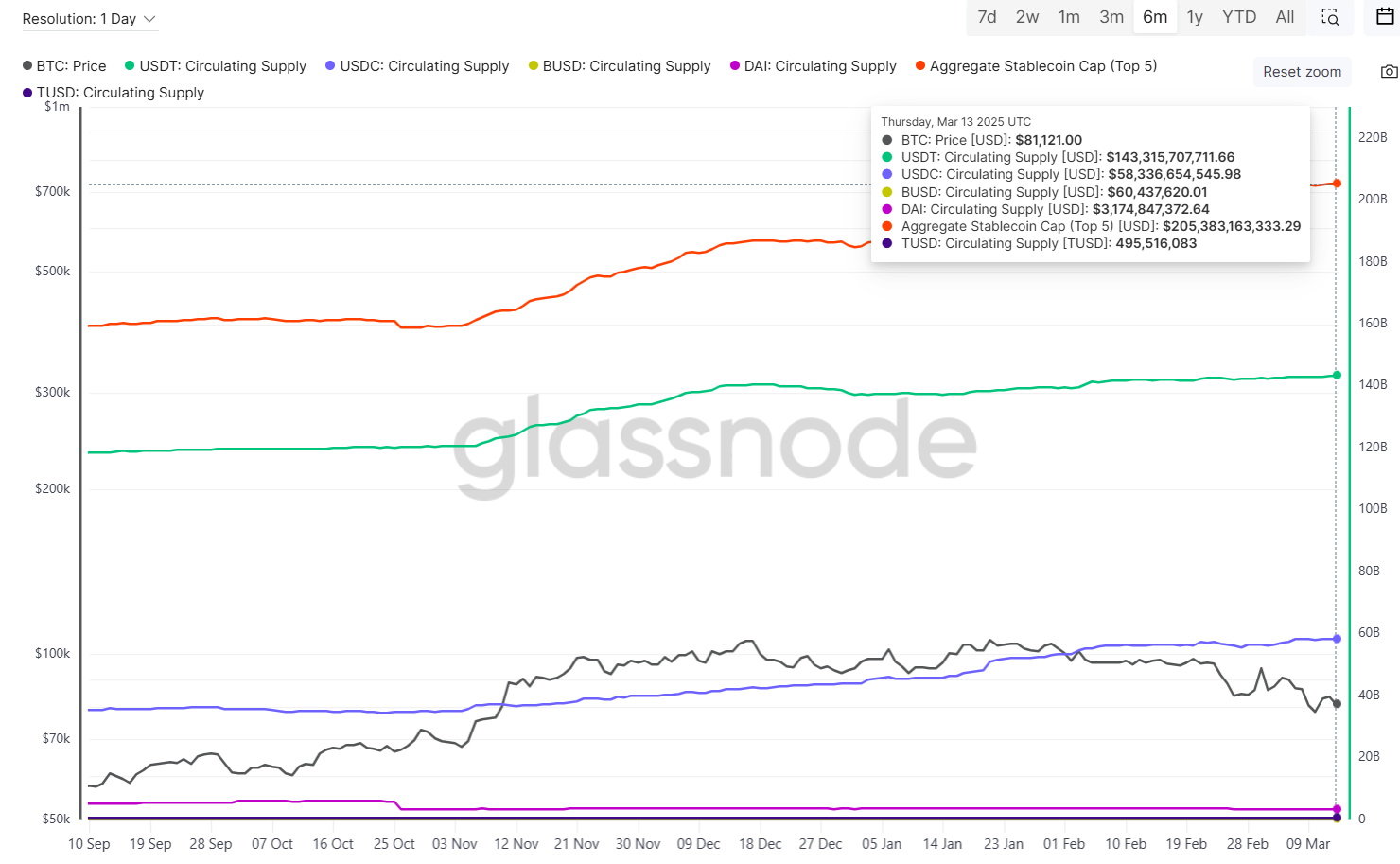

The latest resurgence of Bitcoin coincides with an increase out there capitalization of main stablecoins, together with USDT, USDC, BUSD, and DAI. Their mixed market cap elevated from round $204 billion to over $205 billion between March 10 and 14, in keeping with Glassnode information.

Stablecoins function a bridge between fiat currencies and crypto markets, comprising nearly all of crypto buying and selling pairs and market liquidity. The rising market cap signifies increased stablecoin adoption and their rising function as a most popular medium for crypto transactions.

The rise in provide possible displays a market-wide motion of property into stablecoins in preparation for buying and selling, suggesting anticipated market exercise within the coming weeks.

The mixture market cap of 5 main stablecoins has elevated over 28% since November 5, 2024, US Election Day.

Share this text