Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

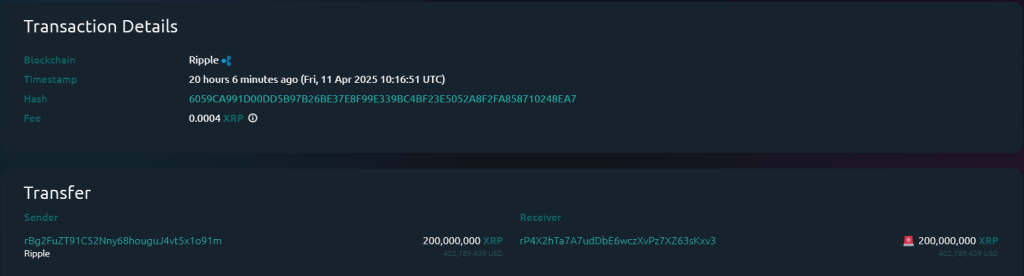

San Francisco-based Ripple has transferred 200 million XRP tokens, price roughly $400 million, between company-controlled wallets. The large motion occurred in the present day and was first noticed by cryptocurrency monitoring service Whale Alert.

Associated Studying

Monitoring The Cash Path

The transaction initially seemed to be heading to an unknown vacation spot when Whale Alert reported the funds transferring to an unidentified handle ‘rP4X2…sKxv3’. However blockchain analytics platform Bithomp later clarified that each the sending and receiving wallets belong to Ripple.

The receiving pockets was created by Ripple on October 2, 2023, with an preliminary funding of 70 million XRP. Since its creation, this pockets has solely interacted with different Ripple-linked addresses, strengthening the proof that this was an inner switch fairly than funds transferring to an outdoor entity or trade.

200,000,000 #XRP (402,739,474 USD) transferred from #Ripple to unknown pocketshttps://t.co/cZz7k5fum8

— Whale Alert (@whale_alert) April 11, 2025

Why The Large Cash Transfer

In response to crypto group determine XRP_Liquidity, who tracks Ripple’s token actions, the transaction represents commonplace treasury administration – Ripple merely shifting cash between its personal accounts. The 200 million XRP tokens stay untouched on the receiving handle, suggesting no quick plans for his or her use.

The receiving pockets now holds round 290 million XRP tokens, valued at about $577 million as of the present XRP price of $2.04 per token, based mostly on figures by Coingecko.

In response to historic traits, the funds can be utilized for varied functions in Ripple’s enterprise operations. They can be utilized to finance On-Demand Liquidity (not too long ago renamed Ripple Funds), finance exchange-traded merchandise that mirror XRP’s worth, or give liquidity to cryptocurrency exchanges the place XRP is listed.

The Greater Monetary Image

The sending pockets didn’t empty its money register with this switch. It nonetheless accommodates 200 million XRP tokens. That pockets had obtained 300 million XRP on April 2 from one other Ripple-linked handle, which itself had obtained 500 million XRP from Ripple’s month-to-month escrow launch.

Ripple maintains most of its XRP holdings in escrow accounts, with programmed releases occurring month-to-month. The April launch confirmed uncommon timing in comparison with Ripple’s commonplace apply.

Associated Studying

Breaking From Routine

Ripple broke from its conventional first-of-month schedule for its April token launch. As a substitute of unlocking the funds on April 1, the corporate first returned 700 million XRP to escrow, then launched 1 billion XRP on April 3.

This shift in schedule runs counter to Ripple’s established custom of releasing tokens on the primary day of every month, though the corporate has not commented publicly on its reasoning for this timing change.

The pockets transactions are vital, as XRP trades at over $2 per token, giving the cryptocurrency such a excessive valuation that even regular transfers are price a number of a whole lot of thousands and thousands of {dollars}.

These large transfers are often adopted intently by crypto market watchers, as they will once in a while be indicative of any potential future market transfer or strategic resolution taken by the corporate.

Featured picture from Gemini Imagen, chart from TradingView