Picture supply: Getty Photos

As I write, Warren Buffett’s web value is considered simply in extra of $140bn. So it could come as no shock to listen to that he’s referred to as the ‘Oracle of Omaha’, with buyers around the globe keen to listen to and interpret his each phrase. And regardless of his unimaginable wealth, his teachings are extremely precious for novice buyers.

No financial savings? No worries

Many Britons haven’t any financial savings at 30. However whereas it could be frequent, it doesn’t imply it’s comfortable scenario to be in. Standard knowledge tells us we must always have sufficient financial savings for at the least six months. Past constructing a small reserve, many people need to construct wealth, and investing frequently and over a sustained time frame, is among the greatest and hottest methods of doing it.

Fortunately, Britons begin can investing with little or no cash in any respect. Traders may look to place apart as little as £50 a month from our salaries with a view to get began. Or if an investing had been keen to make cutbacks in different elements of our lives — comparable to a day by day espresso out — that £50 determine may very well be expanded upon.

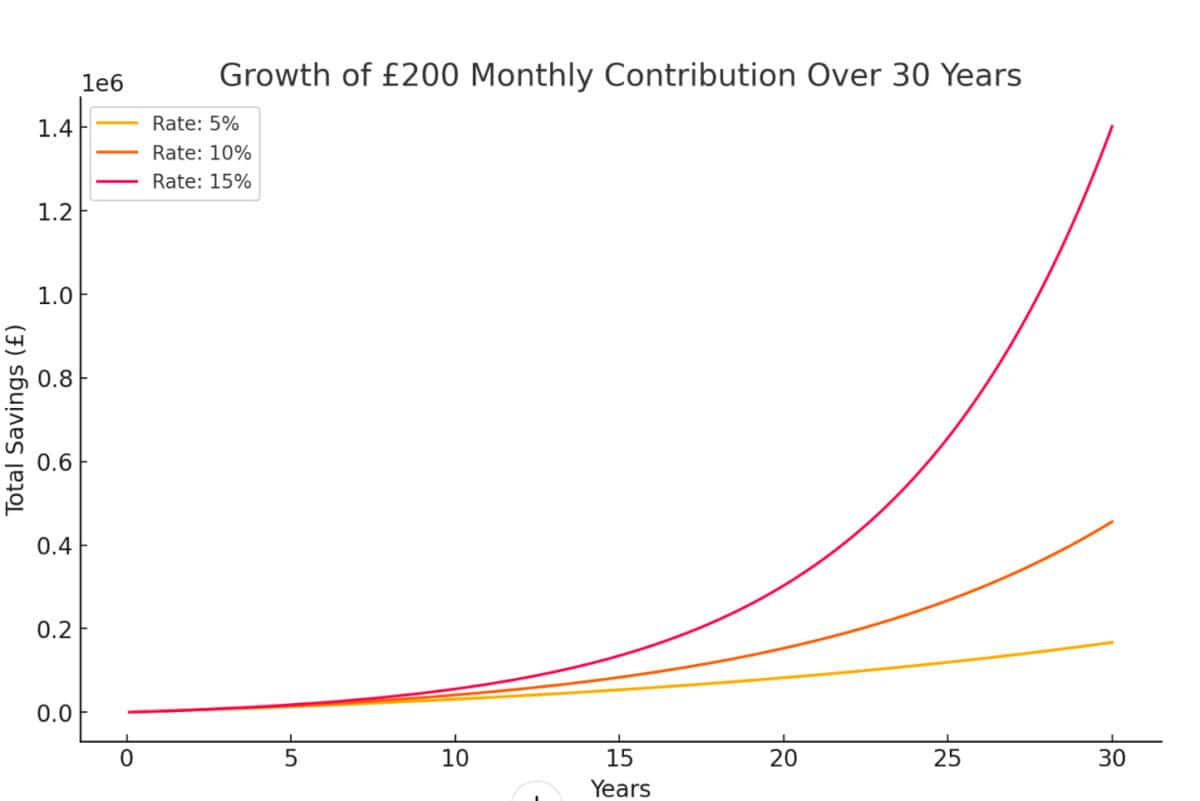

Right here’s a graph displaying how £200 month-to-month contributions compound over 30 years at annual charges of 5%, 10%, and 15%. The variations in progress change into extra pronounced over time because of the energy of compounding, with the upper fee reaching £1.4m.

Buffett’s golden rule

So, what does this should do with Warren Buffett? Properly, it’s merely about how we make investments. Many novice buyers lose cash chasing huge returns. And that’s why Buffett’s first rule of investing is “don’t lose cash”. The factor is, if an buyers makes a poor funding resolution and the worth of that asset — inventory — goes down 50%, the funding has to go 100% as much as get again to the place it began.

It’s actually simpler mentioned than executed — don’t lose cash. Nevertheless, it underscores the necessity to make researched funding selections and never merely comply with our intestine and even the gang. This might imply utilizing quantitative fashions to construct a rationale for our investments.

A robust funding to think about?

One inventory probably worthy of consideration is Blue Hen Company (NASDAQ:BLBD). The American firm is a number one designer and producer of faculty buses in North America. And it has benefitted from the electrification agenda, supported by federal subsidies.

Some latest pullback within the share value could also be related to President-elect Donald Trump’s doubtless repeal of the clear vitality/ EV provisions within the Inflation Discount Act. This does create some dangers for shareholders.

Nevertheless, the corporate boasts a robust backlog of orders, a strong stability sheet, and spectacular profitability grades. Furthermore, the valuation knowledge is extremely engaging. The inventory is buying and selling at 9.7 instances ahead earnings and has a price-to-earnings-to-growth (PEG) ratio of 0.77. It’s additionally a model that prospects know, having been based in 1927. That counts for lots typically.

These contemplating it ought to keep in mind that purchasing US shares will imply that their investments are additionally topic to alternate fee fluctuations. Furthermore, they’ll want to use for a W8-BEN which can enable them to purchase and commerce US-listed shares. This wants updating periodically however it’s nonetheless easy and I don’t assume it ought to put anybody off US investing.