Key Takeaways

- Janover bought 80,567 Solana tokens value $10.5 million, growing its whole Solana holdings to 163,651 SOL.

- The corporate plans to function Solana validators to stake belongings and generate community safety rewards.

Share this text

Software program firm Janover announced Tuesday that it had acquired 80,567 Solana (SOL) for about $10.5 million.

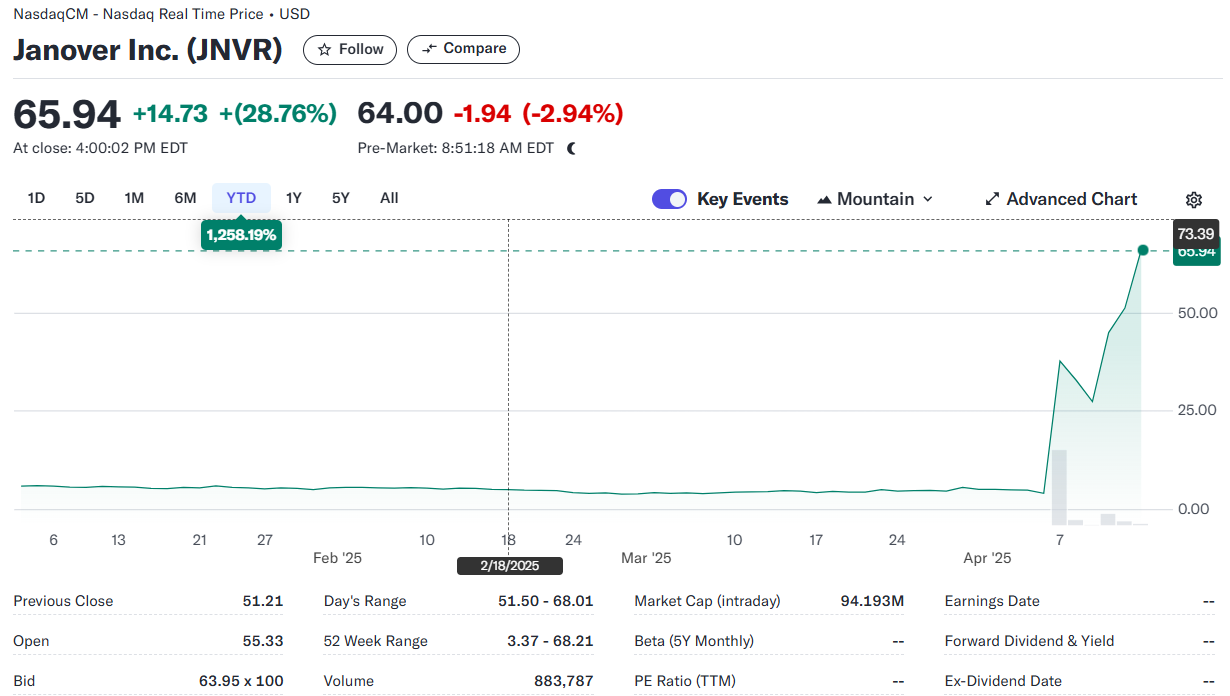

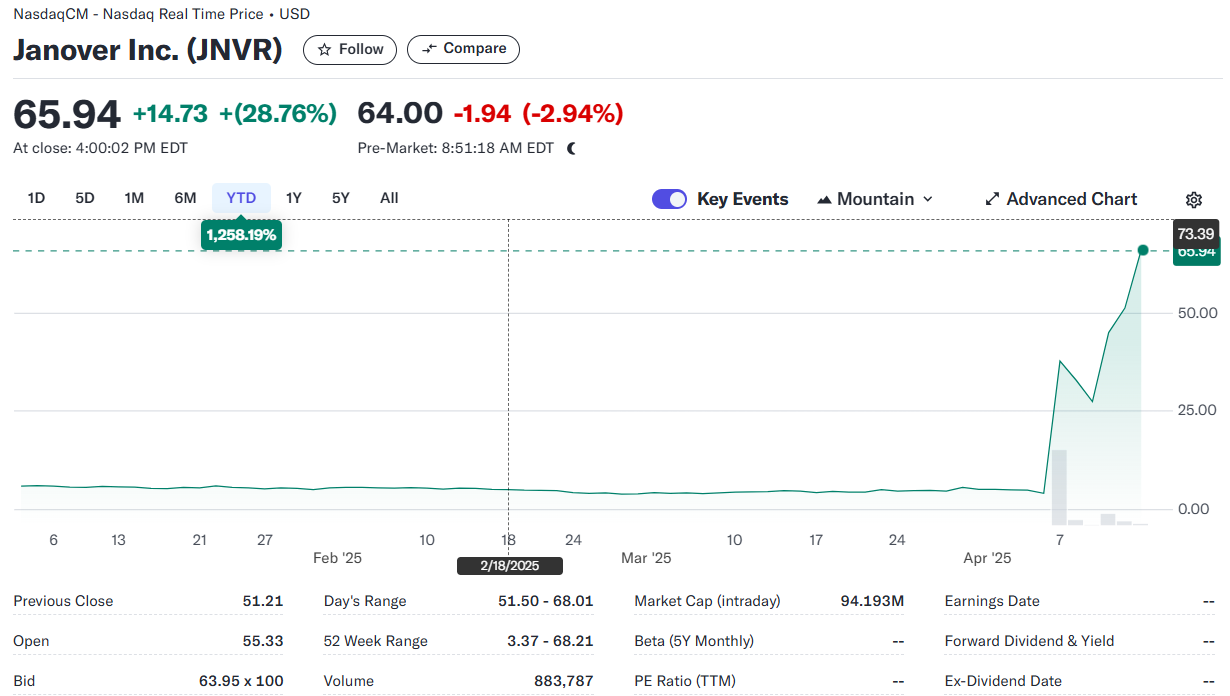

This marked the agency’s third SOL purchase underneath its digital treasury plan, and it was revealed after its inventory hit an all-time excessive of practically $66 at market shut Monday, per Yahoo Finance knowledge.

Shares edged decrease forward of the market open at this time, however they’re nonetheless up greater than 1,200% thus far this yr.

The brand new acquisition boosts Janover’s SOL stash to round 163,651 models, value roughly $21 million. The acquisition was funded by way of the corporate’s not too long ago accomplished $42 million financing spherical.

Janover plans to instantly start staking its newly acquired SOL to generate income whereas supporting the Solana community.

The transfer follows Janover’s current management change, with a workforce of former Kraken executives buying majority possession of the agency. Beneath new management, the corporate is concentrated on bridging the hole between conventional finance and decentralized finance.

Earlier this month, Janover’s board accepted a brand new treasury coverage, authorizing long-term accumulation of crypto belongings beginning with Solana.

Janover additionally plans to function a number of Solana validators, enabling it to stake its treasury belongings, take part in community safety, and earn rewards. The staking income can be reinvested to amass extra SOL.

“Velocity and readability of execution are central to our mannequin,” stated Parker White, COO & CIO at Janover, in a press release upon the corporate’s first buy. “We plan to proceed constructing our SOL place as we scale our technique — and we imagine at this time’s market situations provided a compelling alternative to take our first step.”

The Nasdaq-listed agency additionally plans to alter its identify to DeFi Improvement Company and revise its ticker image.

Other than Bitcoin, international corporations are additionally exploring integrating different main digital belongings into their strategic reserves.

Worksport, an organization specializing within the design and manufacturing of truck equipment, announced final December that it had began adopting XRP, alongside Bitcoin, as treasury belongings.

SOL was buying and selling at round $132 at press time, up practically 24% up to now week, according to TradingView.

The digital asset has fallen roughly 30% year-to-date amid a market-wide pullback triggered by US tariff coverage.

Share this text