A post on our Dialogue Board lately known as consideration to 2 Closed Finish Funds: Barings Company Buyers (MCI) and Barings Participation Buyers (MPV).

Investopedia describes a closed-end fund as “a sort of mutual fund that points a set variety of shares by means of one preliminary public providing (IPO) to lift capital for its preliminary investments. Its shares can then be purchased and bought on a inventory alternate, however no new shares shall be created, and no new cash will movement into the fund.”

This construction means CEFs can commerce at a premium or low cost to their web asset worth (NAV). The publish famous that each MPV and MCI had been long-term Nice Owl funds, which implies they’ve persistently produced high risk-adjusted returns of their peer group, particularly the Martin Ratio, which is proportional to return over drawdown or “achieve over ache.” Martin Ratio is the idea for our MFO Ranking.

MFO Premium makes use of NAV for all danger and return metrics, together with the willpower of Great Owls, and different designations like Three Alarm funds. Morningstar scores too are NAV-based. With as we speak’s December replace, which displays scores by means of month-ending November, an excellent month for US fairness funds, customers will have the ability to receive price-based metrics and scores, which I discover significantly insightful. The metrics apply to CEFs, alternate traded funds (ETFs), and alternate traded notes (ETNs). Usually, open-ended funds commerce solely as soon as per day on the fund’s NAV. However CEFs, ETFs, and ETNs can commerce on an alternate at a premium or low cost to their NAVs. Any variations are sometimes small and short-lived for the latter two automobiles, due to arbitrage throughout share creation or redemption.

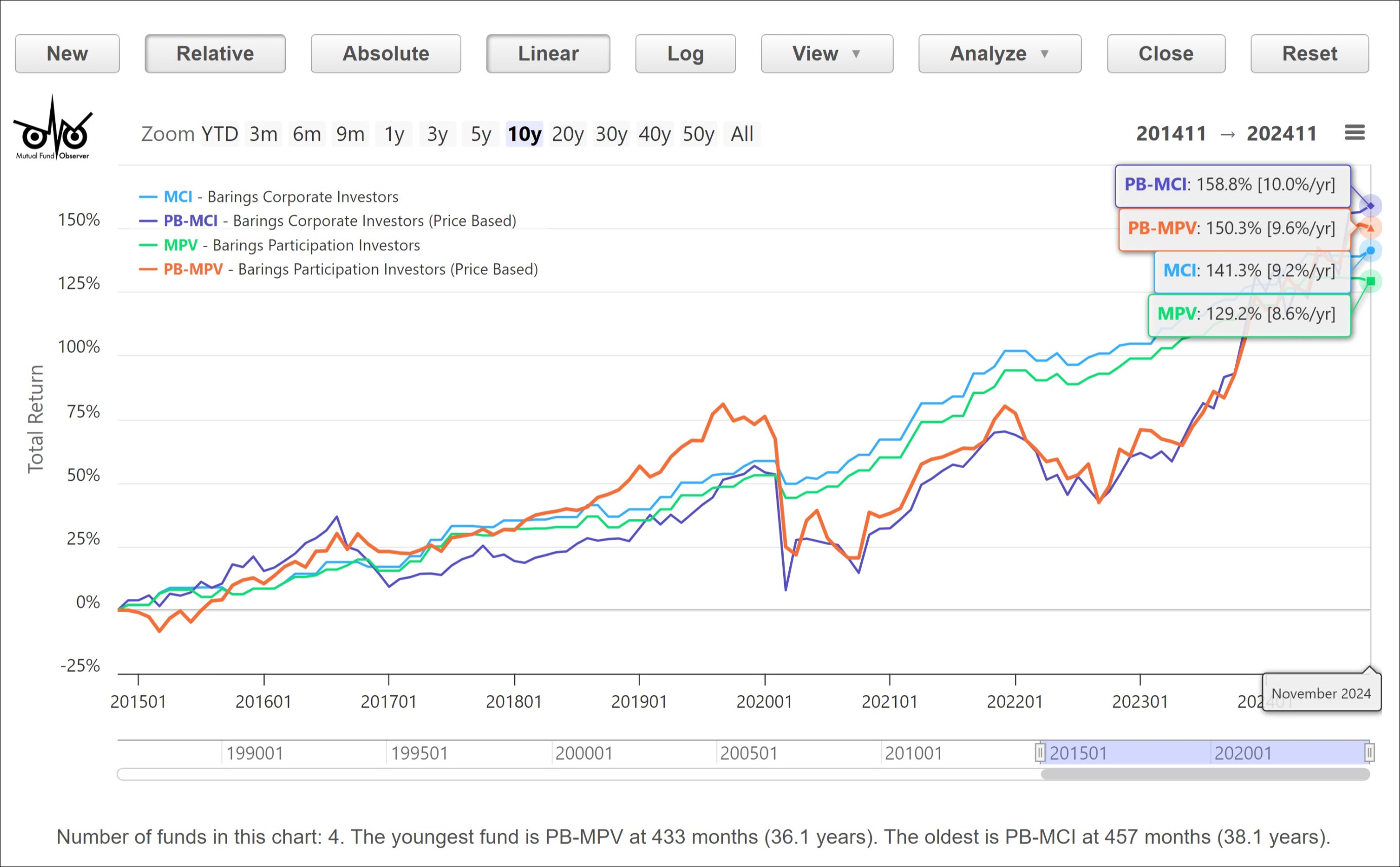

The MultiSearch desk beneath reveals the 10-year danger and return metrics for each MCI and MPV, plus their price-based companions, designated PB-MCI and PB-MPV, respectively, brief for Price Based. Customers can enter the companion ticker instantly or just click on “Embrace Worth-Primarily based Metrics” throughout search standards choice.

Comparability Desk of NAV-Primarily based versus Worth-Primarily based Metrics

The priced-based metrics present considerably extra risky returns than the NAV-based. A part of what contributes to the distinction is that Barings updates the NAV for these funds not every day or month, however extra like every quarter, sometimes. The plot beneath depicts the elevated volatility nicely. Utilizing worth alone, neither fund could be a Nice Owl; that stated, over the long term, absolutely the returns converge, which if “one treats this as a long-term funding,” as a board member prompt, the distinction could also be muted.