Reinsurance dealer Gallagher Re has reported that it estimates the March thirteenth to sixteenth extreme convective storm (SCS) and twister outbreak in the USA would be the costliest extreme climate occasion of 2025 thus far, with an estimate for insurance coverage business losses of as much as $3 billion.

The occasion, which we covered at the start of this week highlighting the potential for a meaningful loss, noticed quite a few peril hazards occurring over components of the US from March thirteenth to sixteenth, together with a multi-day extreme convective storm (SCS) outbreak, fires, synoptic-driven (non-thunderstorm) winds, heavy rain, and wintry circumstances.

Greater than 106 tornadoes have been confirmed, with 3 reported to be at EF4 energy and 10 at EF3 depth.

Whereas massive hail massive hail exceeding 2 inches (5.0 centimeters) in diameter is estimated to have affected 28,000 folks throughout components of the states of Alabama, Kentucky, Louisiana, Missiouri, Mississippi, and Texas.

Gallagher Re commented, “Many of the wind and hail-related injury from the outbreak was anticipated to be lined by

insurance coverage, with losses for the personal insurance coverage business initially anticipated within the vary of USD1 billion to USD3 billion.”

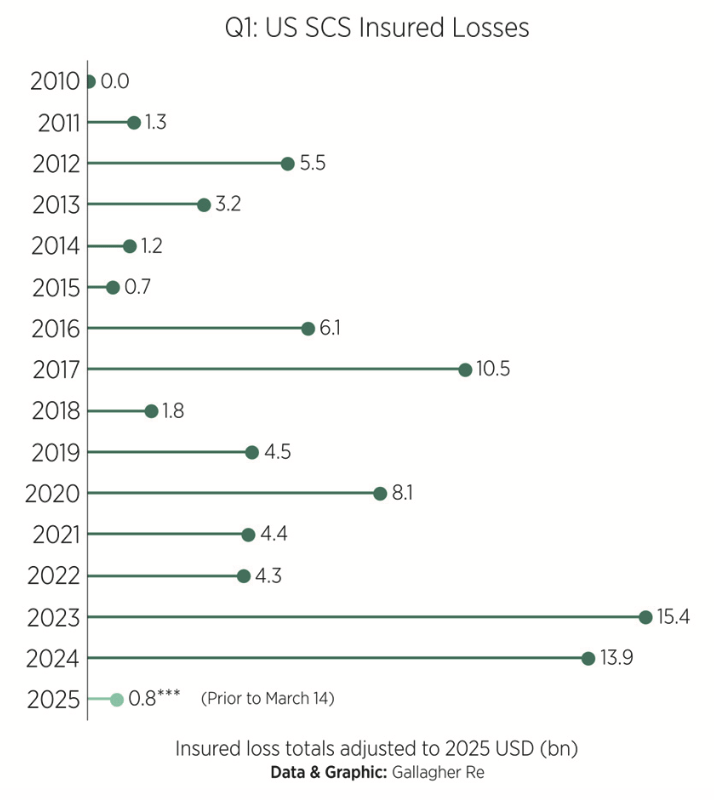

Including that, “Previous to this occasion, the US had seen a comparatively benign begin to 2025 for extreme convective storm losses with the mixture whole at roughly USD1 billion.”

Inside that estimate for as much as $3 billion of insurance coverage business losses, the reinsurance dealer is just together with the extreme thunderstorm associated impacts, of tornadoes, hail and SCS winds.

“Probably the most appreciable losses to properties, industrial belongings, vehicles, and agriculture have been seen in components of notably populated areas of the Midwest, Southeast, and alongside the East Coast. This could mark the primary billion-dollar US SCS occasion of the yr.

“Extra non-negligible losses ensuing from an outbreak of wildfires in components of Oklahoma and Kansas that have been ignited because of very excessive non-thunderstorm pushed winds,” Gallagher Re additional defined.

Steve Bowen, Chief Science Officer and Meteorologist at Gallagher Re commented, “As we head into the historic peak of US SCS season (April via June), the query turns into whether or not 2025 exercise will speed up and proceed the 15+ yr pattern of extra damaging occasions driving appreciable combination loss prices for the peril.

“Each 2023 and 2024 every resulted in 10 particular person multi-billion-dollar US SCS occasions; a report.”

Gallagher Re additional defined, “The rising monetary price of US extreme thunderstorms has turn out to be a significant subject of dialog within the insurance coverage business as underwriters search to enhance mixed ratio efficiency with the peril. After a difficult yr in 2023, US market mixed ratios have been improved in 2024.

“The SCS peril has transitioned to a ‘new regular’ during which annual nominal insured losses are actually recurrently exceeding USD40 billion.”

At as much as $3 billion, this SCS and twister outbreak does have the potential to be a disaster loss that additional erodes some combination deductibles within the disaster bond house, though given the large space affected it’s unlikely to be a very significant occasion for any combination buildings within the cat bond and retrocession house by itself.

Whether or not combination cat bonds, or retro preparations, which have seen their deductibles severely eroded by the wildfires earlier this yr, make it to the tip of their threat intervals on the mid-year with out attaching stays to be seen. Extra billion greenback occasions occurring will start to threaten some, though there may be some location dependence to the place the losses happen for a few of the eroded cat bonds.