On April 1st, on the KPMG places of work in Tel Aviv, a number of dozen individuals gathered for a gathering of the “CBDC IL Discussion board” to listen to representatives from academia, the Financial institution of Israel, and KPMG current findings from a research carried out by the Financial institution of Israel by means of “Roschink” analysis institute. The research included round 1,000 members, and the results were published on the Financial institution of Israel’s web site. On this article, I’ll evaluation key factors from the assembly, touch upon the analysis revealed by the Financial institution of Israel, and share what I had mentioned to attendees on the finish of the discussion board assembly.

Examine: The Israeli Public’s Willingness to Undertake a Digital Shekel

Dr. Nir Yaacobi from the Digital Shekel workforce on the Financial institution of Israel shared that members within the research had been randomly chosen and characterize all inhabitants segments. “The analysis institute works with these people, and they’re paid for his or her participation,” he mentioned. The quantity paid was not disclosed. Prof. Ruth Plato-Shinar, one of many research’s authors, talked about that the questionnaires had been in a digital format. She famous that even individuals with very primary telephones may take part, however acknowledged that these with none digital entry seemingly didn’t take part and doubtless don’t perceive what a digital shekel is.

Evaluation of the research document reveals a number of methodological points:

- Sampling methodology: A web based panel was used, which means members had been already enrolled in digital survey platforms—probably biasing the pattern towards tech-savvy people and skewing attitudes a few digital foreign money.

- Pattern illustration: The random sampling underrepresented sure teams, particularly Arab residents. Reweighting was used to right this by doubling responses of some members, probably compromising authenticity.

- Dangers resembling lack of privateness, authorities overreach, and influence on money economies could also be underrepresented on account of a bias towards digitally-inclined respondents.

- Participant dropout: 115 members dropped out between the primary and second questionnaires, which can point out a range bias—these extra within the subject stayed on.

Regardless of efforts to make sure a consultant pattern, these methodological limitations might have an effect on the research’s validity.

Avoiding Disclosure of Digital Shekel Dangers

On the finish of the assembly, I spoke critically concerning the partial and primarily optimistic data introduced to review members and the CBDC IL Discussion board attendees. The general public wasn’t uncovered to potential dangers and limitations of such a system, which I’ve elaborated on in lots of my keynote speeches, articles and podcasts.

The next video exhibits that the best way the digital shekel was introduced to review members was missing. The outline of the digital shekel and its system targeted on the benefits, as learn by Prof. Plato-Shinar on the CBDC IL discussion board assembly:

As well as, the research doesn’t comprehensively tackle potential dangers for finish customers—resembling the potential of state management over monetary habits, lack of privateness, asset seizure, use of the foreign money as a surveillance instrument, restricted entry to funds on account of regulatory choices, and extra. The dearth of emphasis on these dangers is very problematic for people involved about authorities overreach and privateness violations, but in addition for many who are merely unaware of the potential risks and their implications.

The research does point out:

- Restricted privateness claims: It’s acknowledged that “the central financial institution is not going to have entry to recognized details about balances and transactions in customers’ wallets,” but in addition that privateness ranges can be outlined in accordance with person kind—which means that privateness is just not absolute.

- Enforcement capabilities and restrictions: “The system will assist the implementation and enforcement of restrictions” on pockets balances, which may point out the potential for utilization limitations. The digital shekel is being designed with technical capabilities to impose limits on pockets balances—which means it is going to be potential to outline how a lot cash an individual is allowed to carry of their digital pockets and monitor that in actual time. Though the doc doesn’t specify who can be licensed to implement these limitations, the mere existence of enforcement capabilities signifies a management mechanism that might theoretically permit freezes, blocks, or different restrictions on utilization—elevating questions on monetary freedom, privateness, and institutional energy.

- Authorities management: The Financial institution of Israel can be “the only real authority empowered to subject and redeem the digital shekel,” which means there can be no decentralized alternate options like cryptocurrencies resembling Bitcoin.

Implications for Money-Based mostly Communities

The research does discuss with the extent of curiosity amongst totally different inhabitants teams and notes that among the many ultra-Orthodox neighborhood, curiosity within the digital shekel is among the many lowest. Nonetheless, it doesn’t explicitly talk about the implications of transitioning to a digital foreign money for communities that rely closely on money. The digital shekel might pose a big problem to those teams if money utilization is finally curtailed.

Potential causes for low curiosity among the many Haredi (ultra-Orthodox) neighborhood:

- Clear desire for money: Most Haredim use money on account of privateness considerations, a need to keep away from dependence on banks, and a few maintain conventional opposition to trendy monetary methods.

- Digital literacy gaps: Monetary digital literacy in elements of the ultra-Orthodox neighborhood is decrease than the final inhabitants.

- Worry of regulatory management: Money provides a level of financial independence, whereas a digital shekel might enhance authorities management over funds.

Senior Residents

In 2023, the Israeli Web Society conducted a survey amongst Israelis aged 65 and older. It discovered that roughly 30% don’t use the web in any respect, and “it may be mentioned that at the very least a few of them haven’t bridged the entry hole.” This inhabitants phase (60+) includes round 25.3% of Israel’s complete inhabitants (data from 2020). That is one other instance of a gaggle whose entry to expertise is restricted—and subsequently will seemingly even be restricted of their skill to make use of a digital shekel.

Because the research was carried out digitally, that 30% phase of this inhabitants seemingly was not represented within the pattern. That mentioned, solely 13% of the research members had been aged 60+ (13% within the first survey and 12% within the second), which means individuals aged 60 and over had been underrepresented within the pattern—at about half their proportion within the basic inhabitants.

This raises a number of considerations:

- Digital exclusion: A good portion of these aged 65+ merely couldn’t take part within the survey.

- Overestimated tech readiness: If solely aged individuals with digital abilities participated, the research might overestimate curiosity among the many aged.

- Accessibility gaps: Individuals who battle with expertise may additionally battle to make use of the digital shekel—however their views weren’t captured.

All of those elements might introduce bias that must be taken under consideration when decoding the findings. To attain a extra correct image, the researchers may have included different analysis strategies (resembling telephone or in-person interviews) to succeed in these with out digital entry.

What’s New within the World of CBDCs

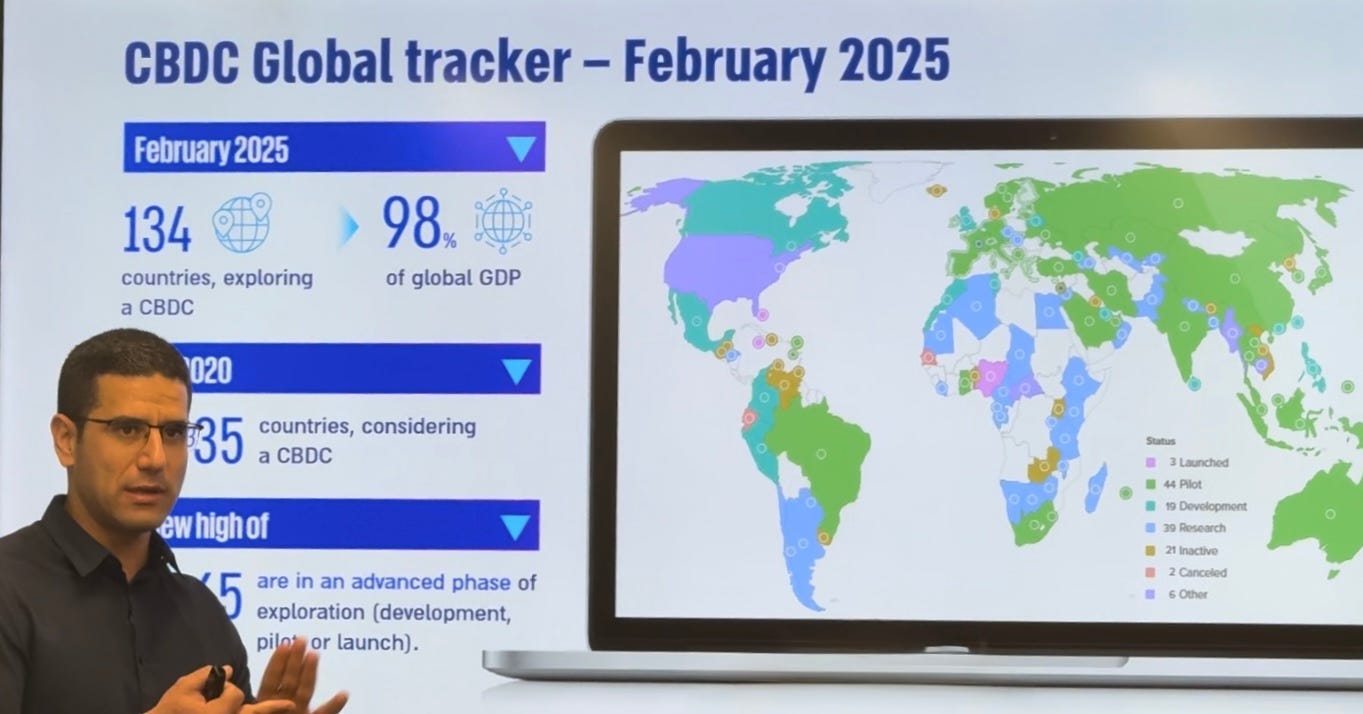

On the assembly, Ben Benakot of KPMG Israel introduced developments within the CBDC house. He famous that the majority nations on this planet are exploring CBDC options at numerous levels, and that 65 nations are in superior analysis levels.

One case research he introduced was Brazil, the place the central financial institution launched the PIX retail fee system throughout the COVID-19 interval. It noticed speedy adoption. At present, Brazil’s central financial institution is engaged on DREX, a wholesale CBDC system, and has accomplished a collaboration with Meta to allow funds through WhatsApp utilizing PIX.

Ben identified that no superior Western nations have launched CBDC methods but—seemingly one purpose the Financial institution of Israel is just not speeding to decide. The Financial institution of Israel has beforehand acknowledged it’s monitoring the EU central financial institution as a mannequin.

Balancing the Narrative on the EU and China

In my closing statements on the CBDC IL discussion board assembly, I additionally referred to a research carried out not too long ago within the EU with lower than flattering outcomes; This research was clearly not talked about by any of the discussion board’s specialists. I discovered it necessary to stability the overly optimistic narrative and convey the next to attendees’ consideration:

On March 12, the European Central Financial institution (ECB) revealed a working paper titled “Client Attitudes Towards CBDC,” surveying roughly 19,000 respondents throughout 11 Eurozone nations. The report highlighted vital communication challenges which might be anticipated to hinder adoption of the digital euro. It discovered that Europeans present little curiosity in a digital euro, strongly want present fee strategies, and see no actual added worth in a brand new fee system given the various alternate options.

Nonetheless, the European Central Financial institution not too long ago introduced that it’ll start the rollout of the digital euro in October 2025, pending regulatory approvals.

Learn extra concerning the EU’s CBDC plans in my latest article, ECB Prepping the Ground for Digital Euro Launch.

Furthermore (at the CBDC IL meeting), I went on to explain that the high adoption rate of the CBDC in China is not necessarily a result of public enthusiasm, but rather of a top-down market strategy led by the central bank—a “If you can’t beat them, join them” approach. In the early years of the e-CNY (China’s CBDC), the project was considered a failure due to low adoption. Eventually, the central bank instructed main retail and tech corporations to combine e-CNY into their hottest apps (DiDi, Meituan, Ctrip, WeChat Pay, and Alipay)—a transfer that enabled vast adoption. At present, the e-CNY has about 180 million digital pockets customers and a cumulative transaction quantity of $1 trillion.

The Belief Issue

70% of Israel’s research members expressed belief within the Financial institution of Israel. On the assembly, Ben Benakot of KPMG commented on the belief subject: “If we don’t belief the federal government, this turns into a problematic subject, as a result of theoretically, CBDCs give the state extra knowledge.” Benakot famous that though the Financial institution of Israel is designing the system in order that it received’t have direct entry to person data—solely licensed fee suppliers will—there’s no assure {that a} future authorities received’t change the system and acquire direct entry to accounts and private knowledge.

He additionally talked about that at this time, for instance, the Israeli tax authority already has the flexibility to watch monetary knowledge on residents (albeit not instantly or instantly on account of oversight). In idea, the digital shekel is just not very totally different.

Public Consciousness and Messaging

One other level I raised on the assembly was the Financial institution of Israel’s duty to tell the general public in a good, sincere, and balanced approach. I requested: if the Financial institution actually seeks to know the general public’s willingness to undertake the digital shekel—why hasn’t it launched a nationwide marketing campaign prefer it did throughout Covid-19, when the federal government mobilized all its assets to coach the general public by means of specialists, influencers, media, social platforms, billboards, and extra?

Why, not like throughout Covid, isn’t the Financial institution of Israel making an effort to current the total image—together with the dangers and disadvantages—not simply the flattering, optimistic elements?

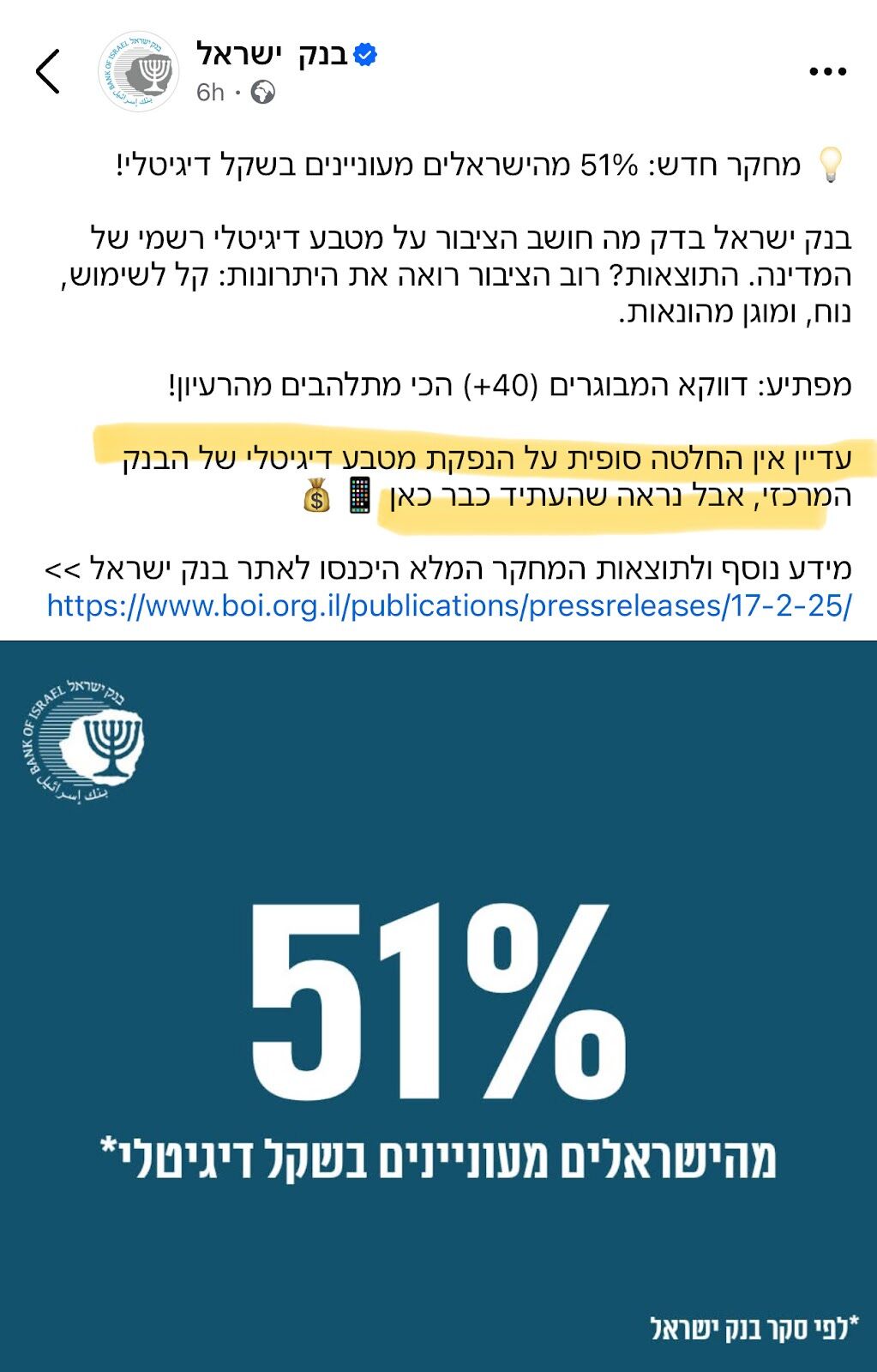

As somebody with about 20 years of expertise in advertising and marketing, I additionally identified the haste with which the Financial institution moved from releasing the research and press announcement, to publishing a submit the very subsequent day (!) on social media (Instagram, Fb) stating: “51% of the general public needs a digital shekel.”

Each newbie marketer is aware of that whenever you spotlight the sure, you obscure the no. Sure, there’s curiosity—however what concerning the different 49%?

The submit learn: “Many of the public sees the advantages: straightforward to make use of, handy, and protected against fraud.” Many of the public? Based mostly on a 1,000-person research the place 51% expressed curiosity?

It additionally states: “No ultimate resolution has been made, nevertheless it appears the longer term is already right here.” That appears like the choice’s already been made—solely the launch date is lacking.

Conclusion

Dr. Nir Yaacobi from the Financial institution of Israel’s Digital Shekel workforce mentioned on the assembly: “We’re coming into uncharted territory, and we don’t at present have a technique”—referring to which digital monetary answer can be chosen in Israel.

“We’re engaged on three fronts: a digital shekel (CBDC), stablecoins, and tokenized industrial financial institution deposits.” He added: “Possibly we’ll go along with one answer—just like the digital shekel—or perhaps all three. If we launch a wholesale CBDC, laws seemingly received’t be wanted. If it’s retail—sure.”

After I completed my remarks, Assaf David-Margalit from the Digital Shekel workforce responded and mentioned that a few of what I mentioned was correct—however most of it was not. After I requested what wasn’t correct, I obtained no response. My invitation to Mr. David-Margalit to reply with particular clarifications stays open.

To conclude: I consider it’s critical to lift public consciousness across the digital shekel, as a result of clearly “the longer term is already right here.” For that purpose, it’s important to overtly current each the dangers and advantages of a digital shekel system in order that an knowledgeable public can take part meaningfully within the dialog and make related decisions about their lives.

This can be a visitor submit by Efrat Fenigson. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.