Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The XRP worth fell as little as $2.0238 on Monday, doubtlessly forming an area backside. Since then, the XRP worth is up virtually 6%, nevertheless, the potential for a deeper retracement stays. Two distinguished chartists—CasiTrades (@CasiTrades) and Charting Man (@ChartingGuy)—have shared their views on whether or not the token has discovered its native backside or if additional draw back may nonetheless be on the desk.

Is The XRP Value Backside In?

In response to CasiTrades’ newly published chart, XRP seems to have examined the 0.786 Fibonacci retracement at $2.05 and is now displaying bullish divergences throughout a number of timeframes—from the 15-minute all the best way to the 4-hour chart. CasiTrades notes that these indicators are a optimistic indicator each for short-term bounces and a possible macro restoration.

“Was that the underside for XRP? After reaching the .786 retrace at $2.05, #XRP is printing bullish divergences from the 15min all the best way as much as the 4hr chart. That’s the type of sign we need to see for each short-term backside and macro! The bounce is holding to this point! CasiTrades notes.

Associated Studying

The analyst additionally factors to key resistance at $2.25, suggesting {that a} convincing break above this stage with sturdy momentum would seemingly negate the necessity for an additional retest of help. “If we break above $2.25 with sturdy momentum, that might invalidate the necessity for an additional help retest—a really bullish sign, CasiTrades writes, including “$2.00–2.01 stays a help if the $2.05 doesn’t maintain.”

Furthermore, she highlights a Fib Time Zone 3 that would span your complete month of April, forecasting a “bullish window” for XRP. In response to the chart, as soon as worth meets its goal, a bigger impulse to the upside may follow, with potential resistance lining up at $2.70 and $3.80+.

Associated Studying

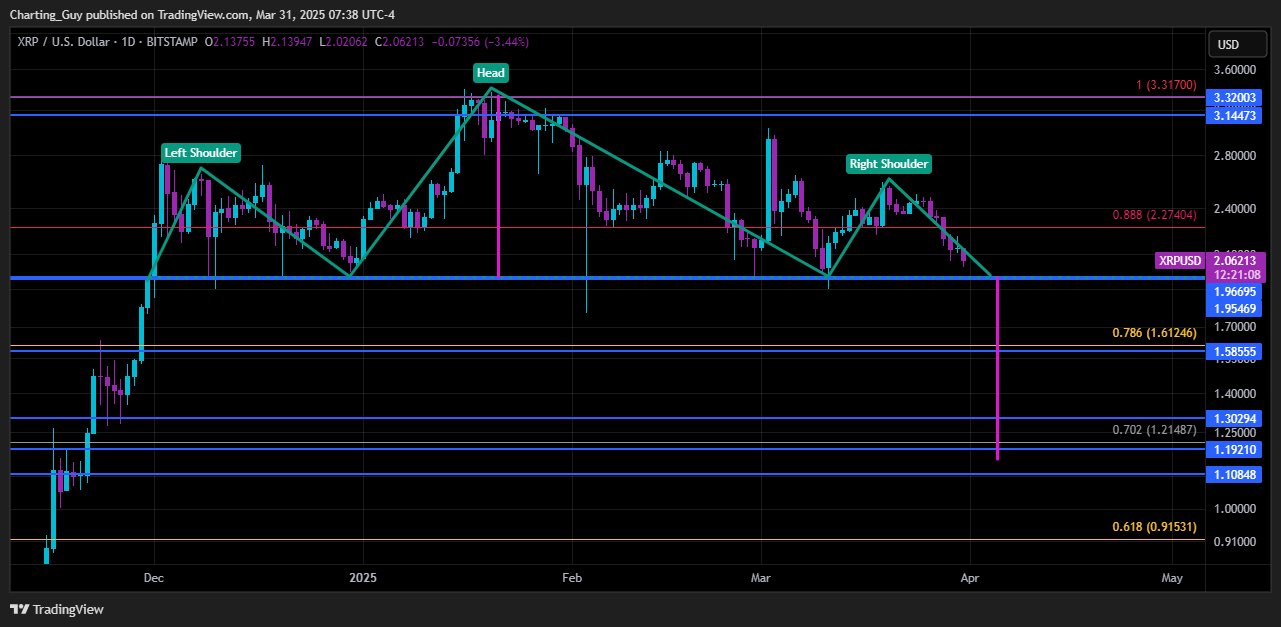

In the meantime, Charting Man addressed that market chatter has surfaced a few possible head and shoulders pattern on the XRP chart, with a projected breakdown goal close to $1.15. Whereas acknowledging this bearish formation as a chance, Charting Man believes it’s unlikely to play out, describing the sample as “irregular and ugly.”

He maintains that XRP’s general development continues to be biased to the upside, characterised by greater highs and better lows.“ Lots of people are posting this attainable head and shoulders that targets $1.15. I personally don’t assume it performs out, but it surely’s a chance. If it does occur, it’s only a golden pocket backtest and the chart stays bullish general,” he says.

Charting Man attracts consideration to the $1.70–$1.90 zone that has repeatedly caught wicks in earlier pullbacks, with each day closes managing to reclaim $2 or above. He believes {that a} remaining corrective dip to fill the March 11 wick lows—doubtlessly all the way down to round $1.90—may mark the tip of the present retracement.

Extra help ranges are positioned on the weekly Ichimoku final analysis at $1.94, the Weekly Supertrend at $1.73 and on the Weekly EMA Ribbon between $1.46 – $1.93.

At press time, XRP traded at $2.14.

Featured picture created with DALL.E, chart from TradingView.com