Picture supply: Getty Pictures

Reaching monetary independence via passive revenue is a high precedence for a lot of UK buyers. And with the common UK wage projected to hit £37,000 in 2025, I’m questioning how a lot somebody must spend money on an ISA to generate this quantity.

The numbers behind the dream

To earn an annualised £37,000 yearly, an investor would wish round £740,000 in an ISA. That’s based mostly on the idea that an investor might obtain a median dividend yield of 5%. This could imply incomes a passive revenue with out drawing down the steadiness of the portfolio. Whereas £740,000 may sound like some huge cash to succeed in, it’s achievable. The one factor is, it takes time.

Shares and Shares ISAs have outperformed their money counterparts, providing a median return of 11.9% within the yr main as much as February 2025, in comparison with simply 3.8% for Money ISAs. This vital distinction underscores the potential of equity-based investments for long-term wealth technology.

Nonetheless, it’s necessary to notice that investing in shares carries dangers, and previous efficiency is not any assure of future returns. Diversification and a long-term technique are key to mitigating these dangers and maximising returns.

The street to £740,000

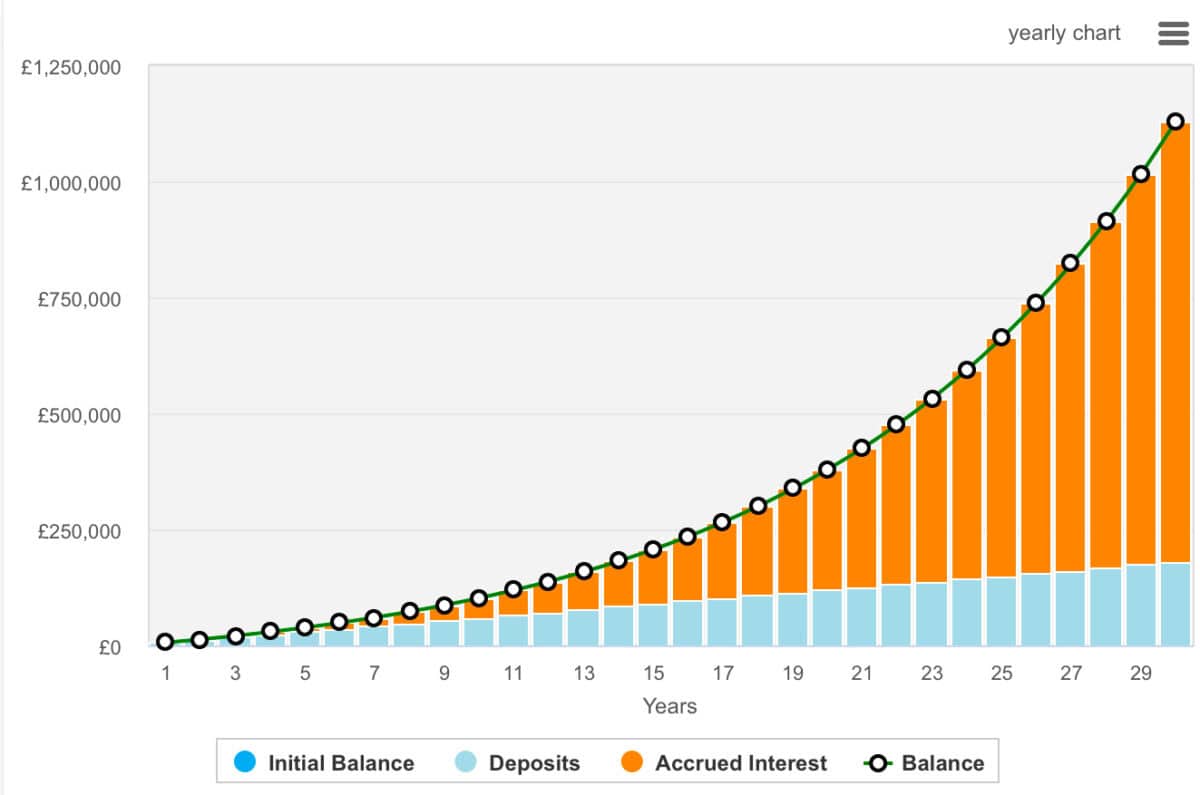

For many buyers, accumulating £740,000 is not any imply feat. It requires constant saving, disciplined investing, and a transparent monetary plan. That’s simply the beginning. It additionally requires buyers to speculate correctly, and as Warren Buffett states, to keep away from losses. Within the instance beneath, I’ve assumed £500 of month-to-month contributions and a ten% annualised return. Beneath these circumstances it will take 26 years to compound to £740,000.

Nonetheless, not everybody can obtain 10% yearly. With 8% progress, it will take 30 years and decrease proportion returns would take even longer.

A actuality test

Whereas the thought of incomes the common UK wage passively is attractive, it’s essential to method this purpose with real looking expectations. Market volatility, inflation, and unexpected bills can impression funding returns. It’s additionally the case that, assuming a continuing inflation price of two.5% per yr, £37,000 in the present day will really feel like roughly £19,558.47 in in the present day’s cash after 26 years.

An funding to contemplate

Right here’s one from my daughter’s SIPP that buyers might need to contemplate.

The Monks Funding Belief (LSE:MNKS) is a globally-focused funding belief managed by Baillie Gifford, aiming to ship long-term capital progress via a diversified portfolio of growth-oriented equities. Its technique emphasises adaptability, investing in corporations positioned to thrive amid structural and cyclical adjustments.

The belief’s method consists of figuring out companies that innovate to scale back prices or enhance service high quality, making certain resilience throughout market cycles. Over the long run, Monks has carried out properly, with a web asset worth (NAV) complete return of 173.2% over 10 years as of March 2025.

Nonetheless, the belief employs gearing (borrowing to speculate), which might amplify returns but in addition will increase danger. If investments underperform, the price of borrowing can result in vital losses, notably throughout market downturns.

Regardless of this, the belief’s disciplined danger administration and concentrate on long-term fundamentals make it a horny possibility. It’s one thing I’ll purchase extra of, for my daughter’s SIPP at the very least.