Considered one of my favourite market datasets simply obtained its annual replace.

Aswath Damodaran at NYU publishes a yearly replace of returns for shares (S&P 500), bonds (10 yr Treasuries), money (3-month T-bills), actual property, gold and inflation going again to 1928. Plus this yr he added small caps to the combo.1

These are the long-term returns for every asset class from 1928-2024:

- Shares +9.94%

- Small caps +11.74%

- Bonds +4.50%

- Money +3.31%

- Actual property +4.23%

- Gold +5.12%

Inflation averaged proper round 3% per yr for the previous 97 years for the true return folks.

Listed below are the annual returns for every sorted by decade beginning within the Nineteen Thirties by means of the tip of 2024:

One factor that stands out is the shortage of crimson on this desk. There are a handful of misplaced many years within the numerous asset courses however they’re uncommon.2

The small cap knowledge is fascinating as a result of they beat massive caps by a large margin over the lengthy haul however this knowledge requires some context.

From 1940-1969 the S&P 500 was up greater than 2,700% in whole, adequate for annual returns of almost 12% over that 30 yr interval. Fairly good. However small caps rose 22,000% in whole or round 20% per yr over the identical 30 yr window.

The issue is most of the shares in that group had been tiny micro caps that had been illiquid and costly to commerce again then. Since 1970, small caps are up extra like 10% per yr, which is kind of in step with the S&P 500. The info is the information however this is a vital caveat when interested by one thing just like the small cap premium.

I don’t imagine you spend money on small cap shares since you’re hoping for a premium over massive caps. The true case is diversification in many years just like the 2000s and Nineteen Seventies when massive caps struggled and small caps picked up the slack.

And huge caps have returned the favor by choosing up the slack within the 2010s and 2020s to this point.

This whole dataset is a billboard for diversification. The leaders and laggards change from decade to decade. There aren’t any constants from one interval to the following.

These cycles by no means look the identical as a result of markets are unpredictable.

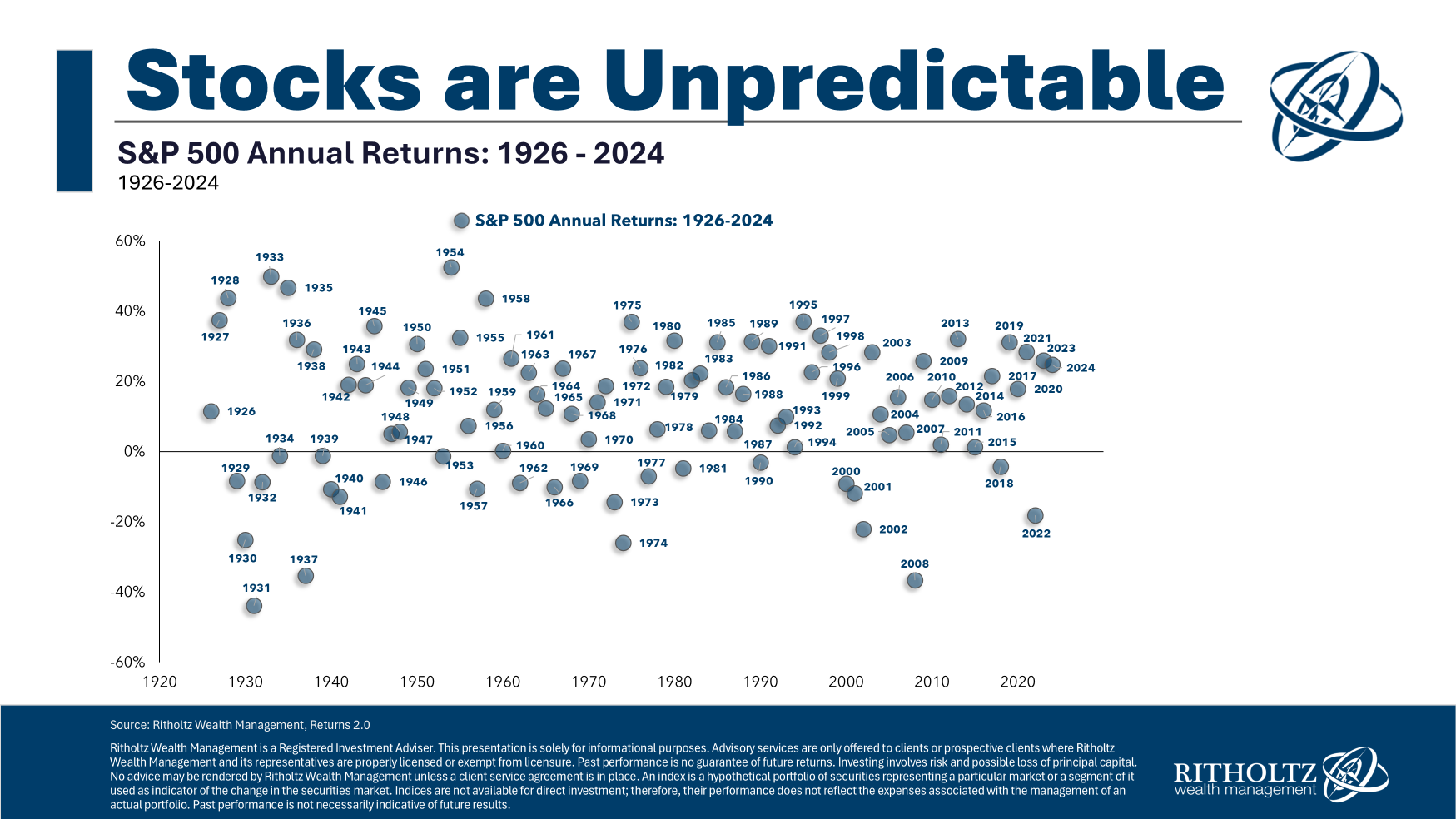

Simply have a look at my up to date scatterplot of yearly inventory market returns:

Returns are everywhere in the map.

Now, efficiency numbers in up years since 2019 have been comparatively related however that’s not the norm. The norm is randomness.

The fascinating factor about learning market historical past is that it makes it clear how tough it’s to foretell the long run.

Additional Studying:

31 Years of Stock Market Returns

1He defines small caps as the underside 10% decile of shares by market cap.

2Midway by means of the 2020s bonds have adverse returns however that must be improved going ahead since beginning yields at the moment are nearer to five%.

This content material, which incorporates security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here shall be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or provide to offer funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.