Picture supply: Getty Photographs

It has been a banner yr for the London inventory trade in some methods. The FTSE 100 hit an all-time excessive, for instance.

However a temper of gloom pervades a lot of the Metropolis. The UK is struggling to draw and even dangle onto some firms that suppose they might get increased valuations in different markets.

That’s mirrored in valuations and, in some circumstances, dividend yields too. I reckon that really provides an excellent alternative for good traders to take a lifelong approach to building wealth because of the comparatively low cost valuations of some FTSE 100 shares.

The right way to construct wealth over the long term within the inventory market

With regards to constructing wealth by way of share possession, there are principally two potential drivers.

One is for shares to go up in worth in order that they are often bought for greater than was initially paid for them. That worth distinction solely issues when the shares are bought. So whereas holding them, an investor could have a paper loss or paper achieve however that’s all it’s.

The second technique of wealth creation is thru receiving dividends.

Why low share costs may be good not unhealthy information

It might sound {that a} falling share worth is unhealthy information.

However the worth is simply a sign of what an investor would pay to purchase that share, or obtain in the event that they promote it.

So I reckon a falling share worth may be good information if an investor has no plans to promote that share and the funding case is unchanged. It could supply a chance to purchase extra shares than beforehand with the identical amount of cash.

Plus, dividend yields are a product of dividend per share and share worth. If an investor buys a share for £1 with a 5p dividend, they are going to earn a 5% yield. But when that share halves in worth and the dividend is maintained (one thing that’s by no means assured), the yield on supply to patrons turns into 10%, not 5%!

In search of bargains within the blue-chip index

That brings me to the FTSE 100 once more.

One share I personal and have purchased extra of prior to now week is JD Sports activities (LSE: JD).

Even at its present worth, the JD Sports activities dividend yield of 1% doesn’t excite me – there are far increased yields accessible from confirmed FTSE 100 companies.

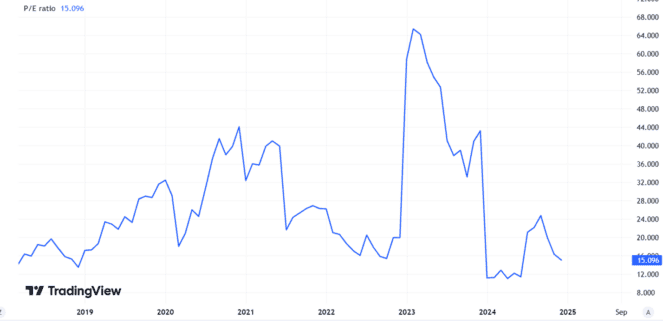

What does excite me, nonetheless, is the valuation. I feel it’s far beneath what JD Sports activities could possibly be value in future.

The retailer’s share has fallen 41% this yr and trades for pennies. I feel that displays dangers like weaker shopper spending hurting gross sales development and revenue margins. A number of revenue warnings this yr have gone down like a lead bomb within the Metropolis.

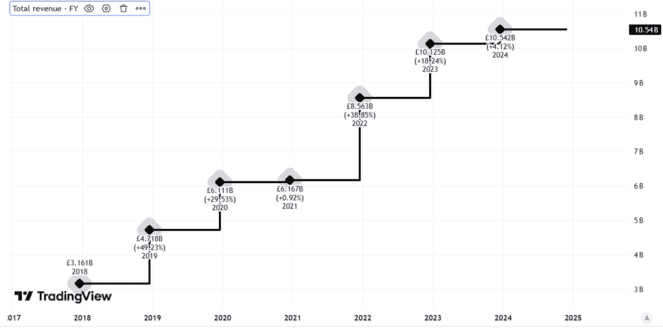

However JD Sports activities has a really sturdy model, in depth worldwide store community, and enormous base of standard clients. Gross sales proceed to develop.

Created utilizing TradingView

It’s spending a lot of rising its store property additional – cash that if it needed to, it might simply maintain as present revenue quite than attempting to develop future profitability.

What concerning the price-to-earnings ratio?

Created utilizing TradingView

A market capitalisation of beneath £5bn appears to be like like a possible cut price to me for a FTSE 100 firm that – even after a revenue warning final month – nonetheless expects full-year revenue earlier than tax and adjusting gadgets to be no less than £955m.