Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Meme cash have confronted important stress in latest weeks, with uncertainty and macro-driven promoting hitting threat property throughout the board. Amongst them, Dogecoin stays in a consolidation vary, buying and selling between essential value ranges. Regardless of holding above key assist, bulls have been unable to generate sufficient momentum to reclaim increased ranges and set off a restoration rally.

Associated Studying

As volatility tightens, all eyes are actually on the following main transfer for DOGE. Analysts warn {that a} breakout—up or down—is imminent, because the market compresses and sentiment stays divided. Bulls should reclaim ranges above $0.18 to shift short-term momentum and keep away from additional draw back.

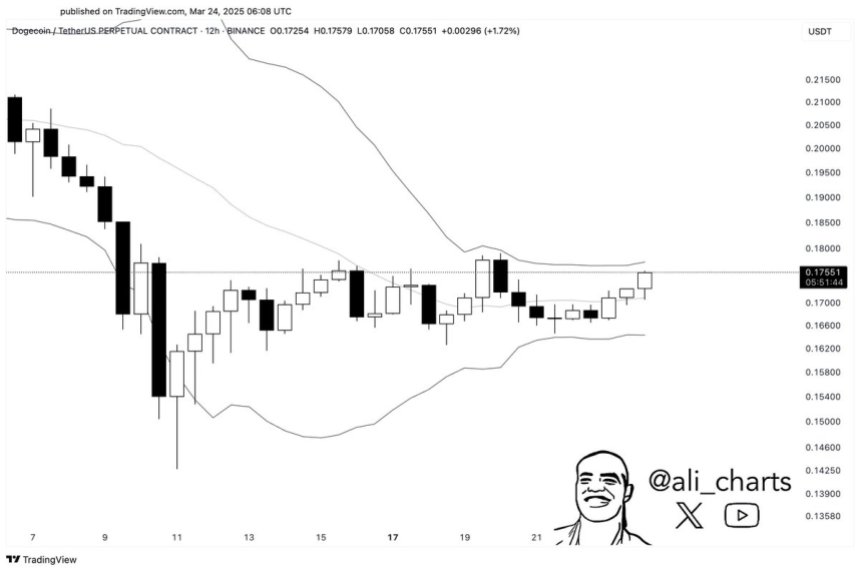

Prime analyst Ali Martinez shared technical insights on X, pointing to a notable sample rising on the 12-hour chart. Based on Martinez, Dogecoin’s Bollinger Bands are narrowing, a technical sign that usually precedes a major value transfer. This “tight squeeze” means that DOGE could also be on the verge of breaking out of its present vary, with the path possible decided by broader market sentiment and short-term buying and selling exercise.

For now, merchants are watching intently, as Dogecoin approaches a critical point the place its subsequent transfer may form the pattern for the times forward.

Dogecoin Tightens as Volatility Builds

Dogecoin has been locked in a good consolidation vary since March 11, hovering between $0.16 and $0.18 as broader market uncertainty continues to weigh on investor sentiment. Whereas many altcoins have struggled beneath promoting stress, meme cash like DOGE typically see amplified volatility throughout such phases—making the following transfer particularly necessary for short-term merchants and long-term holders alike.

With no clear path established, market individuals are actually ready for a catalyst to push Dogecoin decisively in both path. Some analysts stay optimistic, anticipating the market to get well quickly as financial fears stabilize. Others are extra cautious, warning that continued macroeconomic uncertainty and inflation dangers may result in a deeper bear part for crypto.

Amid this backdrop, Martinez has highlighted a technical setup which will sign what’s subsequent for DOGE. On the 12-hour chart, the Bollinger Bands are tightening considerably—a sample referred to as a “squeeze.” Traditionally, this setup has typically preceded sharp value actions, signaling {that a} breakout (or breakdown) might be close to.

The narrowing of the bands displays a decline in volatility, however this calm is unlikely to final. As soon as Dogecoin escapes its present vary, the transfer might be swift and decisive. Merchants ought to watch intently as a breakout from this setup may outline DOGE’s pattern for the weeks forward.

Associated Studying

DOGE Value Caught in Tight Vary — A Breakout or Breakdown Looms

Dogecoin is at the moment buying and selling at $0.176 after a number of days of sideways consolidation inside a good vary. Value motion has remained muted, with DOGE struggling to push above the important thing $0.18 resistance degree. This consolidation indicators a buildup in stress, and a breakout may quickly comply with. Bulls are eyeing a transfer above $0.18 as a crucial step towards reclaiming momentum and confirming a possible restoration rally.

If DOGE can break by way of $0.18 with quantity and reclaim the psychological $0.20 degree, it will sign energy and will appeal to recent demand. The $0.20 degree, particularly, serves as a powerful resistance and should be cleared for a broader uptrend to take form.

On the draw back, nonetheless, failure to carry present ranges—particularly a drop beneath the $0.15 mark—could be regarding for bulls. A breakdown beneath this key assist may set off a wave of panic promoting, sending DOGE right into a deeper retrace and testing decrease demand zones.

Associated Studying

As market volatility stays low and technical indicators tighten, all eyes are on DOGE’s subsequent transfer. Whether or not it breaks upward or downward, the consequence will possible set the tone for Dogecoin’s trajectory within the coming weeks.

Featured picture from Dall-E, chart from TradingView