Whereas Ethereum (ETH) has as soon as once more failed to interrupt by the cussed $4,000 resistance stage, BlackRock’s iShares Ethereum Belief ETF has quietly accumulated over a million ETH. This milestone displays sturdy institutional demand for Ethereum, at the same time as its value efficiency in 2024 stays lackluster.

Institutional Curiosity In Ethereum On The Rise

12 months-to-date (YTD), Ethereum – the second-largest cryptocurrency by market cap – has risen by 43%, climbing from roughly $2,280 on January 1 to $3,283 on the time of writing. Whereas that is notable, ETH’s efficiency has been overshadowed by different cryptocurrencies like XRP, Solana (SOL), and SUI, which have posted considerably larger good points in the identical interval.

Nonetheless, Ethereum holds a key benefit over most altcoins – direct entry to institutional buyers by regulated ETFs, akin to Bitcoin’s place available in the market. In a current post on X, crypto entrepreneur Dan Gambardello highlighted that BlackRock’s Ethereum ETF has now surpassed a million ETH in holdings.

Gambardello famous that ETH’s consolidation under its all-time excessive (ATH), mixed with rising institutional curiosity, units the stage for a possible altcoin season “in contrast to any we’ve ever seen.” Current ETH ETF influx information seems to help this outlook.

In accordance with data from SoSoValue, US spot ETH ETFs have had 4 steady weeks of web inflows, attracting greater than $2 billion in capital. The overall web property held throughout all US spot ETH ETFs stand at $12.15 billion, equal to nearly 3% of Ethereum’s complete market cap.

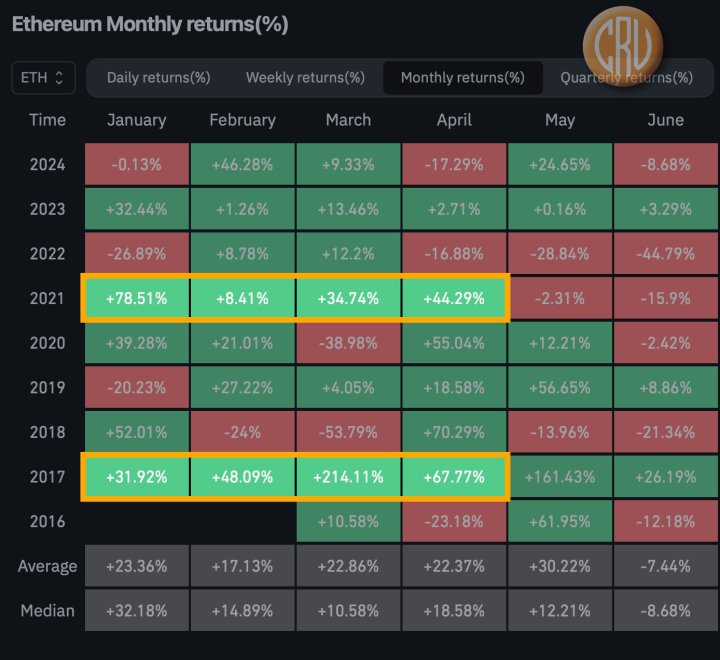

Crypto analysts stay optimistic that Ethereum, the main smart-contract platform, is on track to achieve a brand new ATH. As an example, CryptosRus identified that traditionally, Ethereum has demonstrated bullish value motion through the first 4 months of the subsequent 12 months, following US presidential elections.

The chart under reveals that after the 2016 US election, ETH rallied considerably through the first quarter of 2017. An analogous sample was noticed in 2021 following the 2020 election, with Ethereum recording 4 consecutive weeks of value will increase.

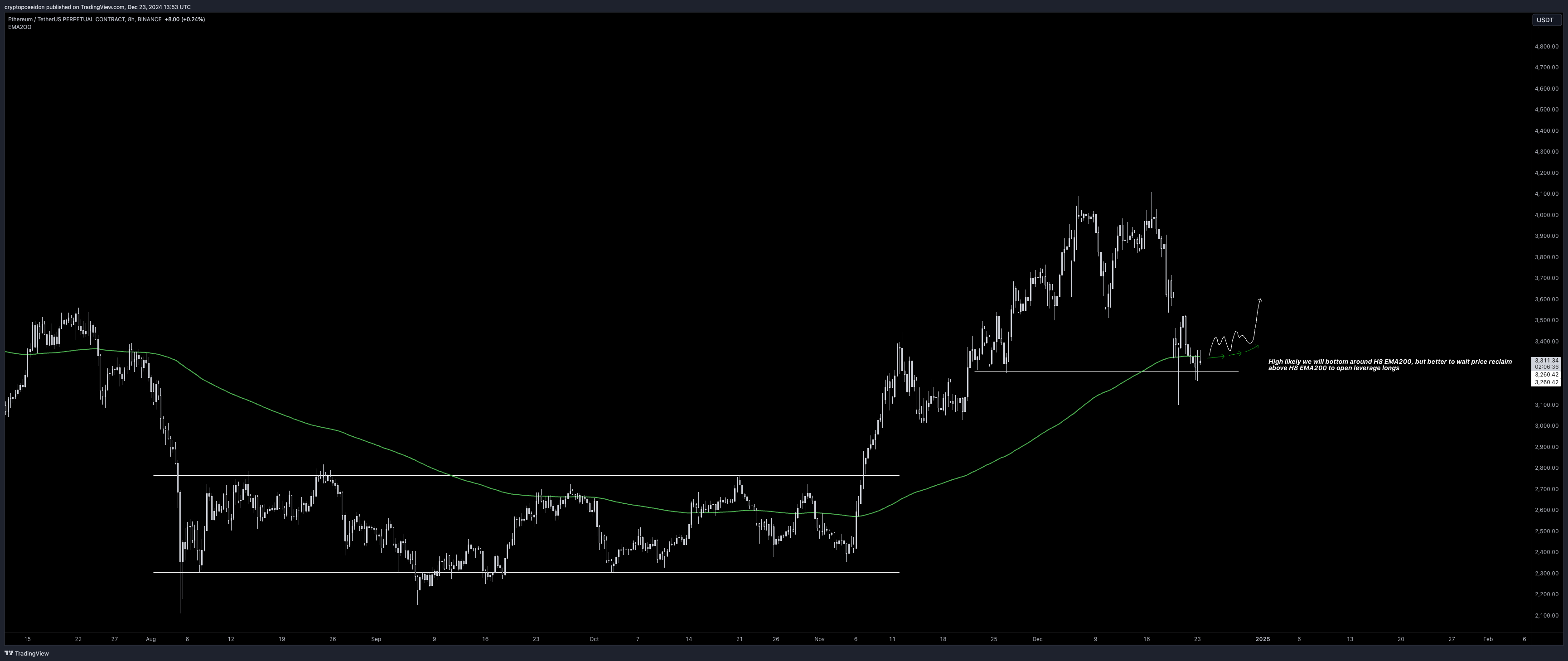

From a technical perspective, crypto analyst @CryptoPoseidonn shared an 8-hour ETH chart, suggesting that ETH could backside across the 200-day exponential transferring common (EMA), marked in inexperienced. The analyst said:

The primary pullback because the final important upside transfer, and concern is at its peak. I imagine that is the place we print the next low. Dips like these are alternatives to extend your spot publicity.

Is The Market Correction Nearing Its Finish?

The overall crypto market cap has dropped from $3.9 trillion on December 16 to $3.4 trillion on the time of writing – a $500 billion loss in every week. Information from Coinglass reveals that over $289 million value of liquidations occurred prior to now 24 hours alone.

Regardless of this downturn, seasoned crypto analyst Pentoshi suggested on the 3-day chart that the crash may function a retest of the earlier crypto market cap ATH recorded in November 2022. If that’s the case, this stage may act as a base for the subsequent upward rally.

Nonetheless, not all analysts are bullish within the brief time period. Famend crypto entrepreneur Arthur Hayes lately warned of a possible market downturn round Donald Trump’s inauguration in January. At press time, ETH trades at $3,283, up 1.2% prior to now 24 hours.

Featured Picture from Unsplash.com, Charts from X and TradingView.com