Key Takeaways

- Bitcoin value fell below $100,000 because of a hawkish Federal Reserve stance.

- Meme tokens skilled sharp declines amid market sell-off.

Share this text

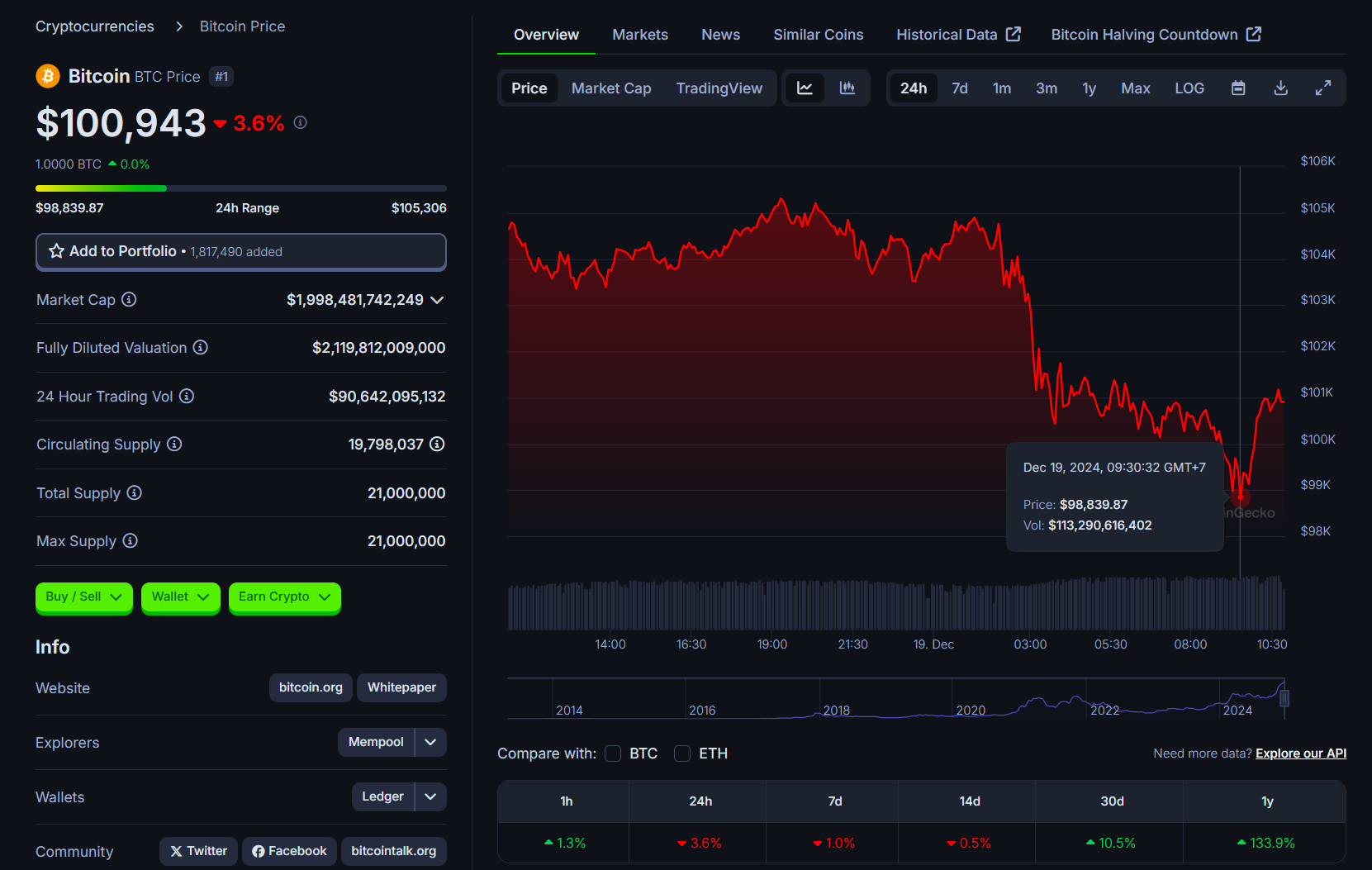

Bitcoin fell shut to six%, buying and selling below $100,000 amid a market-wide sell-off after the Fed adopted a hawkish tone at Wednesday’s FOMC assembly, in response to data from CoinGecko.

The Fed minimize its benchmark rate of interest by 25 basis points as anticipated however projected solely two fee cuts in 2025, down from its earlier forecast of 4 cuts. Fed Chair Jerome Powell indicated that the central financial institution can be extra cautious when contemplating additional changes to its coverage fee.

The Fed’s surprisingly hawkish stance has prompted analysts to regulate their fee minimize forecasts. Analysts at Morgan Stanley famous that they now not count on a fee discount in January 2025.

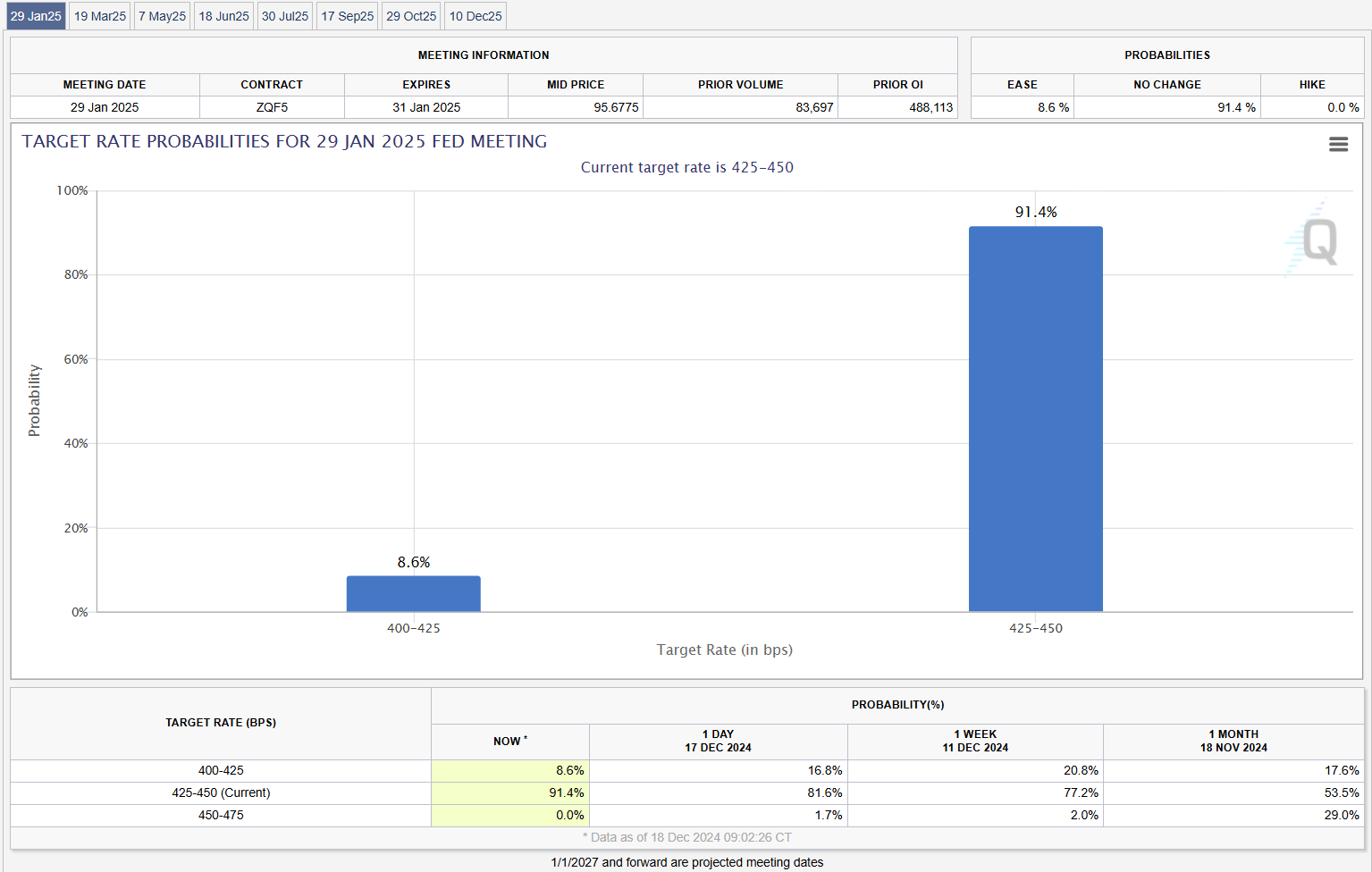

Likewise, market expectations for a fee minimize on the Fed’s January assembly have diminished. The likelihood of a fee minimize on the Fed’s January assembly fell to eight.6%, primarily based on CME FedWatch Device data, whereas the chance of sustaining present charges rose to 91% from about 81% a day earlier.

Inventory and crypto markets reacted strongly to Powell’s hawkish alerts. The Nasdaq dropped greater than 3%, and the Dow recorded its longest dropping streak in 50 years. The greenback reached a two-year excessive as bond yields elevated throughout the curve.

Bitcoin briefly misplaced $5,000 throughout Powell’s speech and fell to $98,900 on Wednesday night earlier than recovering above $100,000. Different crypto property additionally declined, with Ethereum falling over 5% to $3,600, Ripple dropping almost 9%, and Dogecoin declining 8%, per CoinGecko information.

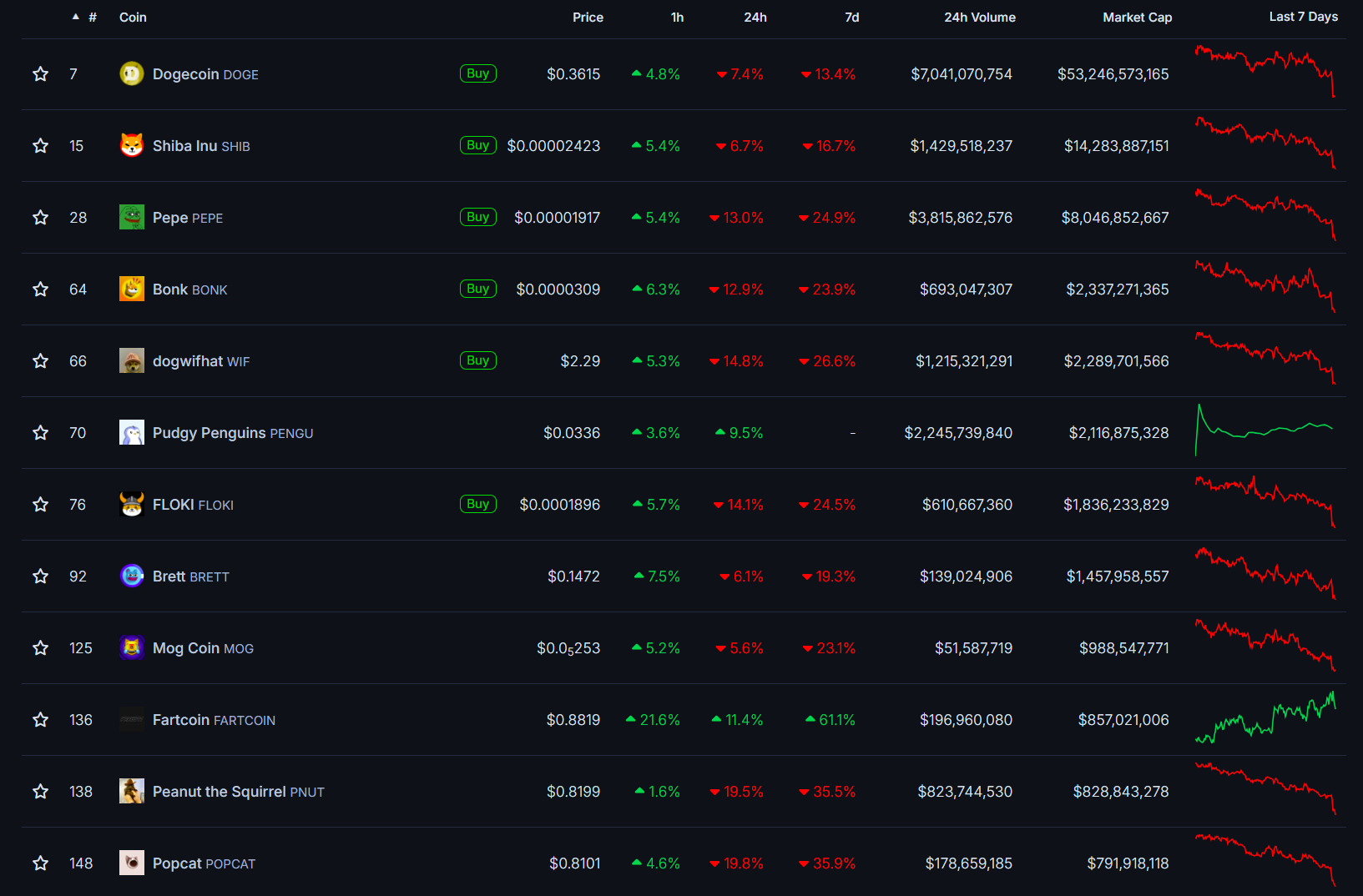

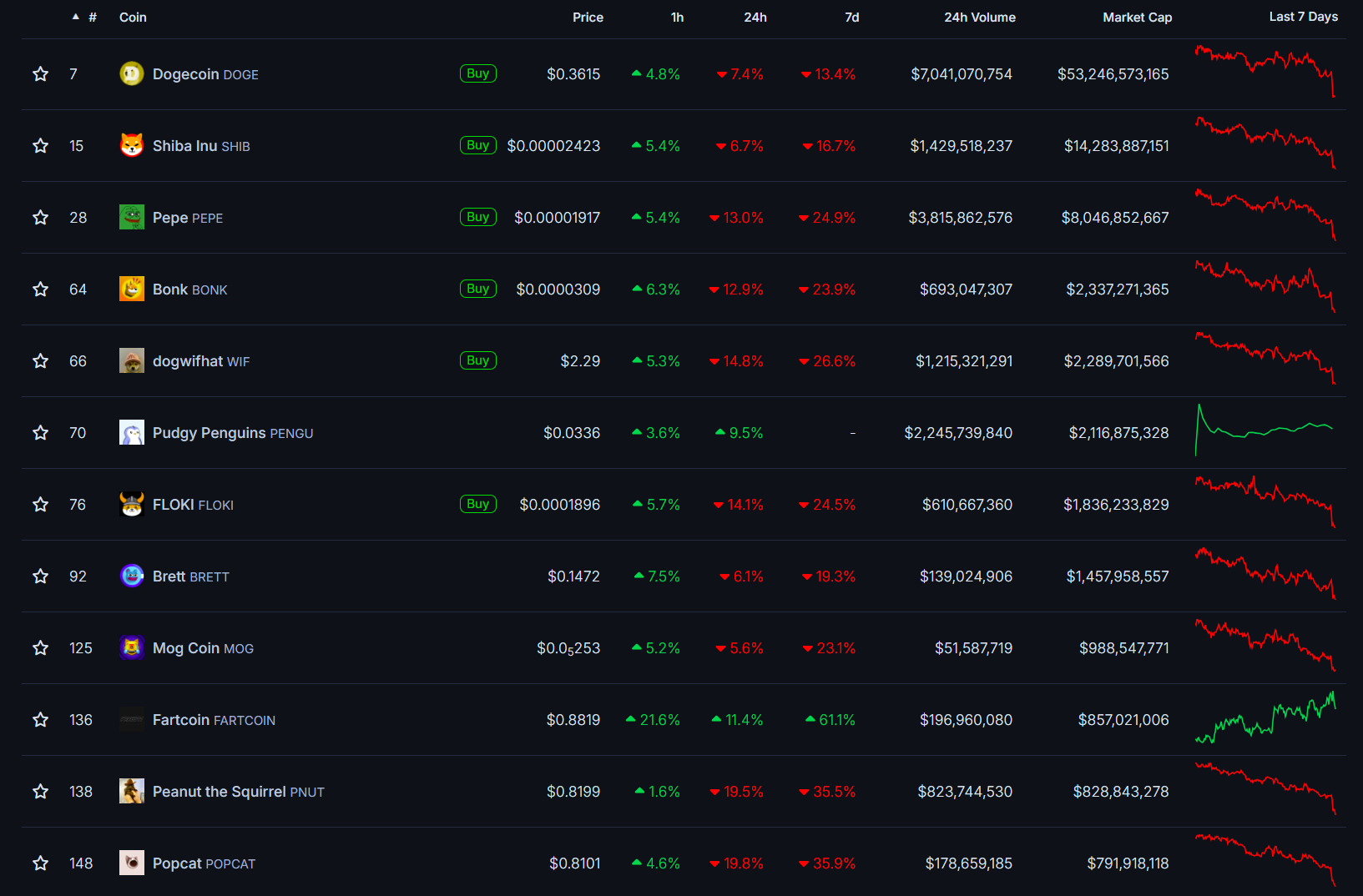

Meme tokens skilled the steepest declines over 24 hours, with Popcat (POPCAT) falling 20% and Peanut the Squirrel (PNUT) dropping 19%. Different meme cash together with Pepe (PEPE), dogwifhat (WIF), Bonk (BONK), and Floki (FLOKI) all recorded double-digit losses.

Share this text