With all the present bearish sentiment and macroeconomic uncertainty swirling round each Bitcoin and the broader world economic system, it’d come as a shock to see miners as bullish as ever. On this article, we’ll unpack the info that implies Bitcoin miners usually are not simply staying the course, they’re accelerating, doubling down at a time when many are pulling again. What precisely do they know that the broader market may be lacking?

For a extra in-depth look into this subject, take a look at a latest YouTube video right here:

Why Bitcoin Miners Are Doubling Down Right Now

Bitcoin Hash Price Going Parabolic

Regardless of Bitcoin’s latest value underperformance, the Bitcoin Hashrate has been going completely vertical, breaking all-time highs with seemingly no regard for macro headwinds or sluggish value motion. Usually, hash fee is tightly correlated with BTC value; when value drops sharply or stays stagnant, hash fee tends to plateau or decline as a consequence of financial stress on miners.

But now, within the face of heightened world tariffs, financial slowdown, and a consolidating BTC value, hash fee is accelerating. Traditionally, this stage of divergence between hash fee and value has been uncommon and sometimes important.

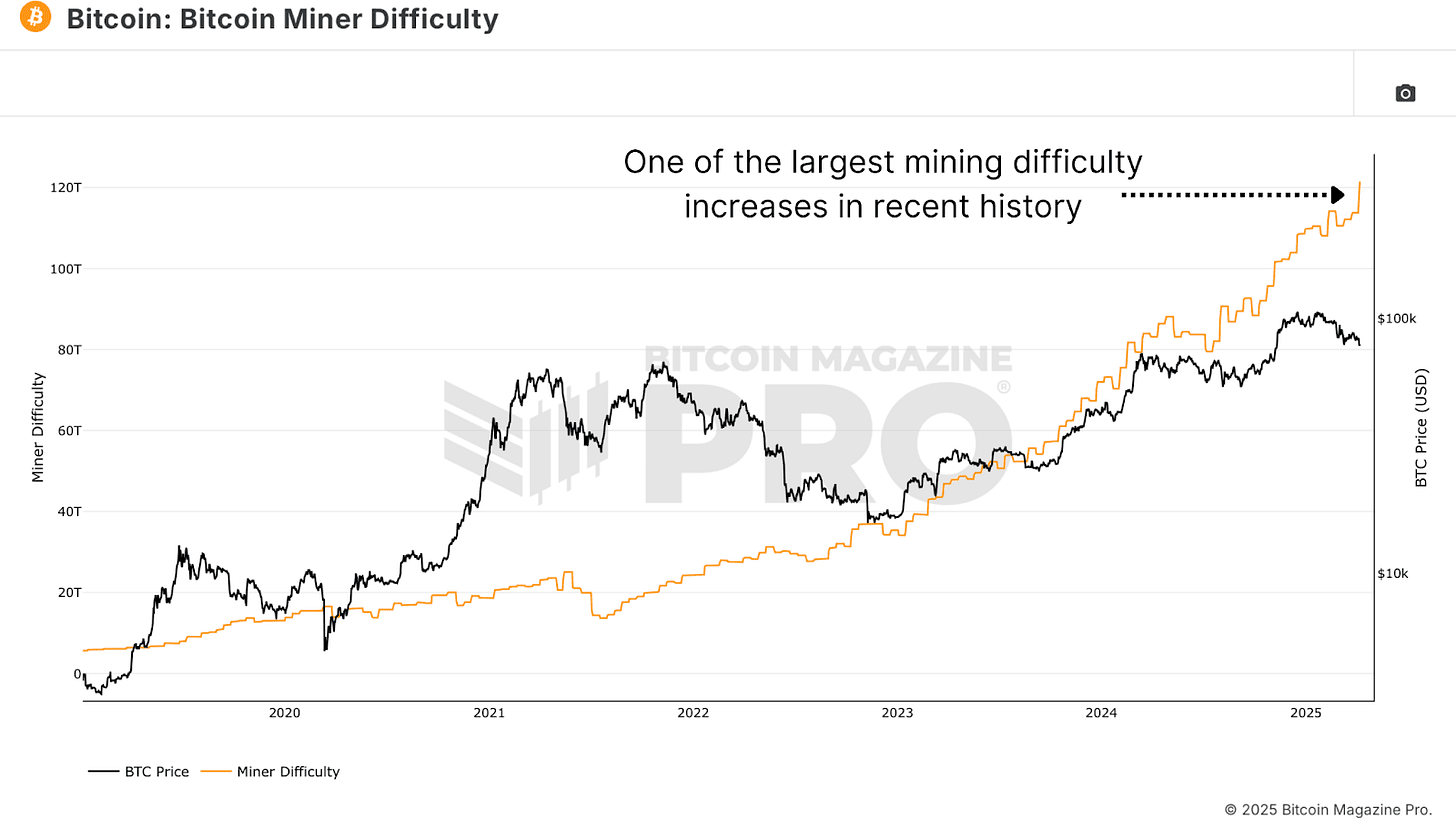

Bitcoin Miner Difficulty, an in depth cousin to hash fee, simply noticed considered one of its largest single changes upward in historical past. This metric, which auto-adjusts to maintain Bitcoin’s block timing constant, solely will increase when extra computational energy floods the community. A problem spike of this magnitude, particularly when paired with poor value efficiency, is almost unprecedented.

Once more, this means that miners are investing closely in infrastructure and sources, even when BTC value doesn’t seem to help the choice within the quick time period.

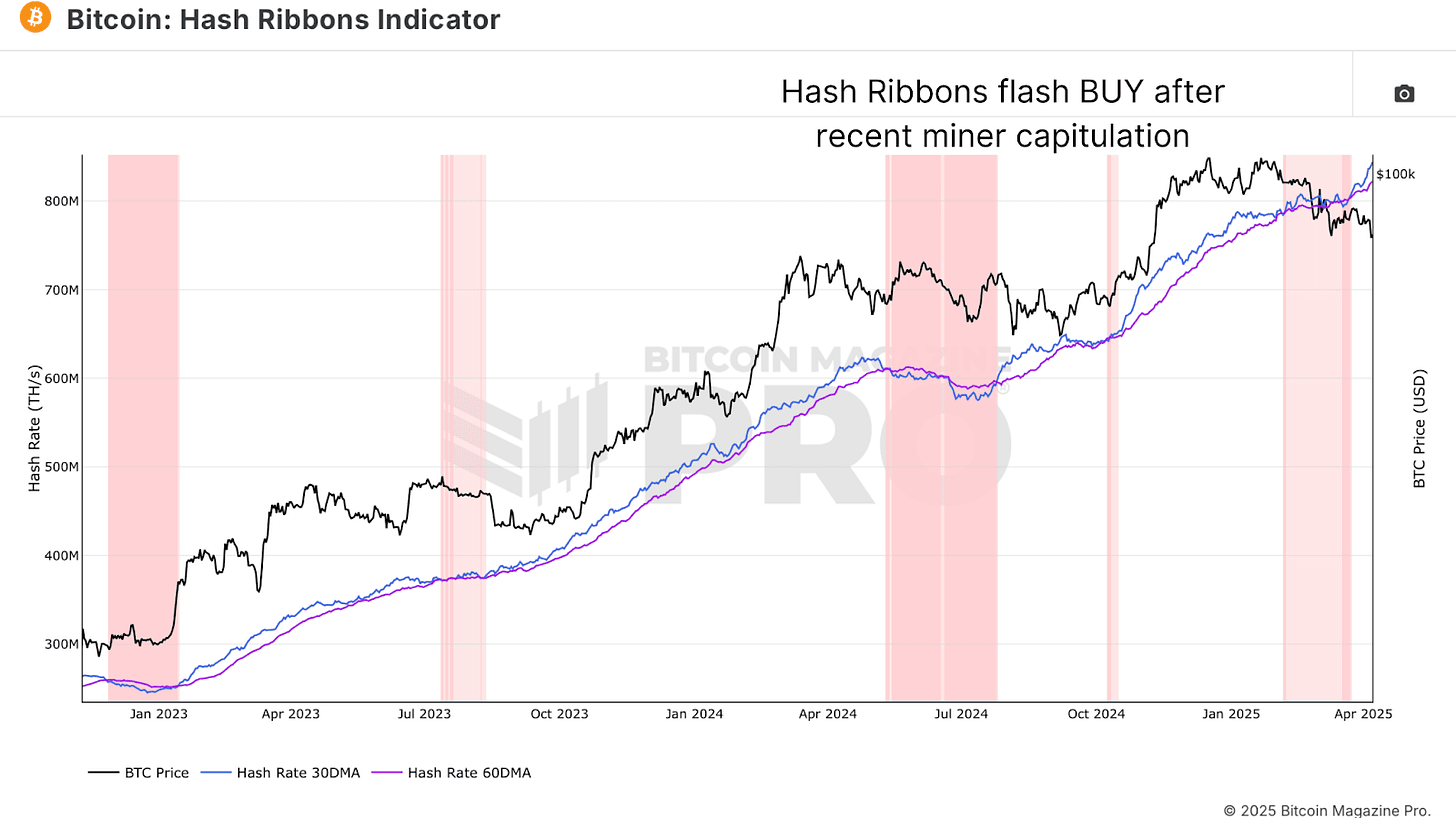

Including additional intrigue, the Hash Ribbons Indicator, a mix of quick and long-term hash fee shifting averages, just lately flashed a traditional Bitcoin purchase sign.

When the 30-day shifting common (blue line) crosses again above the 60-day (purple line), it alerts the top of miner capitulation and the start of renewed miner power. Visually, the background of the chart shifts from pink to white when this crossover happens. This has typically marked highly effective inflection factors for BTC value.

What’s placing this time round is how aggressively the 30-day shifting common is surging away from the 60-day. This isn’t only a modest restoration, it’s an announcement from miners that they’re betting closely on the longer term.

The Tariff Issue

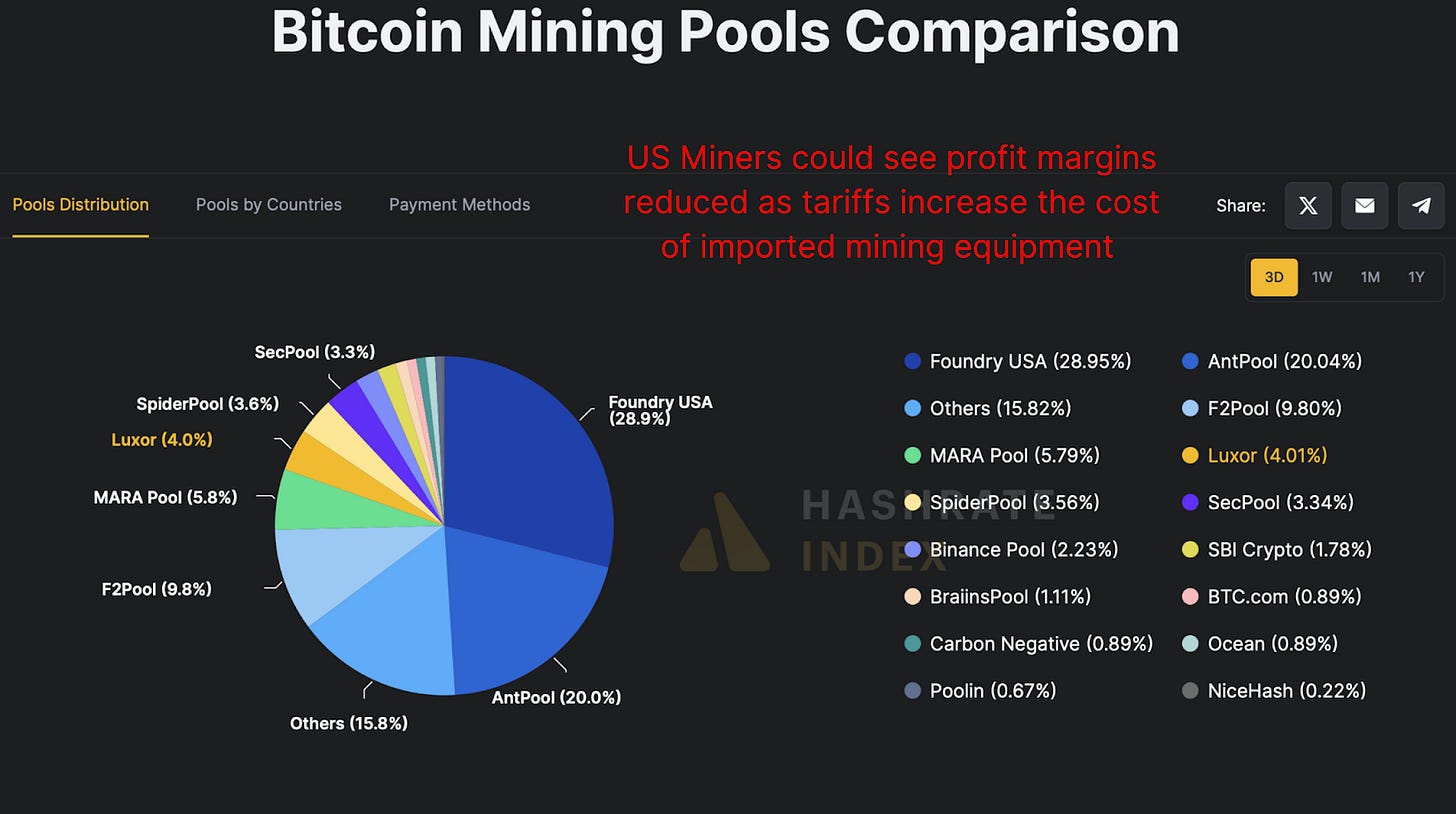

So, what’s fueling this miner frenzy? One believable rationalization is that miners, particularly U.S.-based ones, try to front-run the impression of looming tariffs. Bitmain, the dominant producer of mining gear, is now within the crosshairs of commerce insurance policies that might see gear costs surge by 30–50%, doubtlessly to even over 100%!

Provided that over 40% of Bitcoin’s hash fee is managed by U.S.-based swimming pools like Foundry USA, Mara Pool, and Luxor, any value enhance would drastically scale back revenue margins. Miners could also be aggressively scaling now whereas {hardware} continues to be (comparatively) low-cost and accessible.

Bitcoin Miners Hold Mining

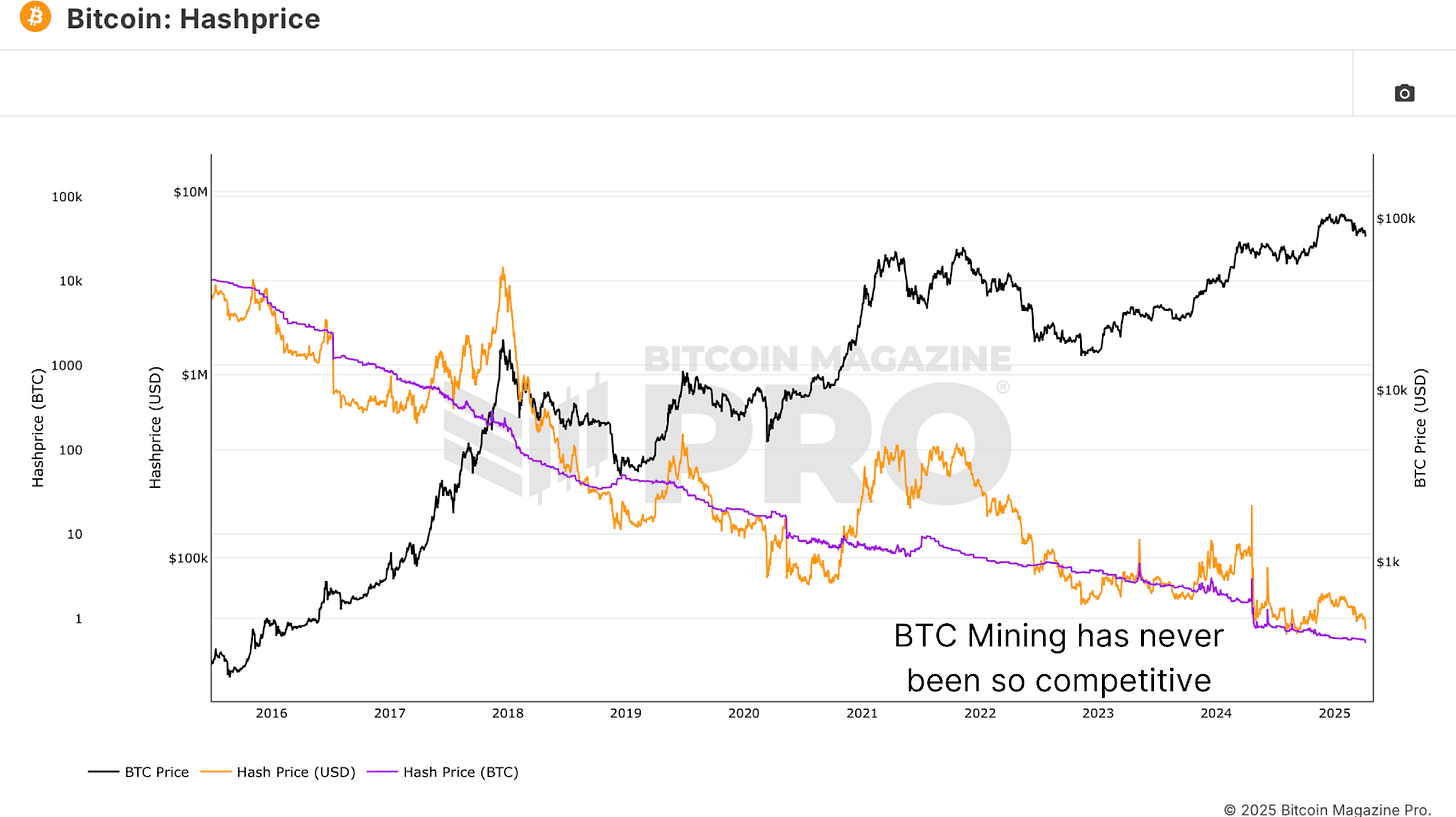

Hashprice, the BTC-denominated income per terahash of computational energy, is at historic lows. In different phrases, it’s by no means been much less worthwhile in BTC phrases to function a Bitcoin miner on a per-terahash foundation. Usually, we see hash value enhance towards the tail-end of bear markets, as competitors fades and weaker gamers exit the area.

However that’s not occurring right here. Regardless of horrible profitability, miners usually are not solely staying on-line, they’re deploying extra hash energy. This might suggest considered one of two issues; both miners are racing towards deteriorating margins to front-load BTC accumulation, or, extra optimistically, they’ve robust conviction in Bitcoin’s future profitability and are shopping for the dip aggressively.

Bitcoin Miners Conclusion

So, what’s actually occurring? Both miners are desperately front-running {hardware} prices, or, extra probably, they’re signaling one of many strongest collective votes of confidence in the way forward for Bitcoin we’ve seen in latest reminiscence. We’ll proceed monitoring these metrics in future updates to see whether or not this miner conviction is confirmed proper.

If you happen to’re desirous about extra in-depth evaluation and real-time information, take into account testing Bitcoin Magazine Pro for invaluable insights into the Bitcoin market.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding selections.