Nov. 06, 2024 1:45 AM ETPalantir Technologies Inc. (PLTR) Stock7 Comments

2.58K FollowersPlay

(10min)

Abstract

- Palantir stunned the market with a 30% YoY income development.

- I argue that this isn’t excellent news, it’s nice information. I count on this type of development to be sustainable, given what administration has proven us is feasible.

- This text covers the Q3 earnings report, and takes a pulse on Palantir.

- I’m issuing an improve to robust purchase on continued shock power, robust treasury, no debt, and continued profitability.

hapabapa

Introduction

I first advisable Palantir Applied sciences Inc. (NYSE:PLTR) again in June with a purchase score, once I wrote Don’t Underestimate Palantir’s B2B Prowess. Since then, the inventory has greater than doubled.

Looking for Alpha

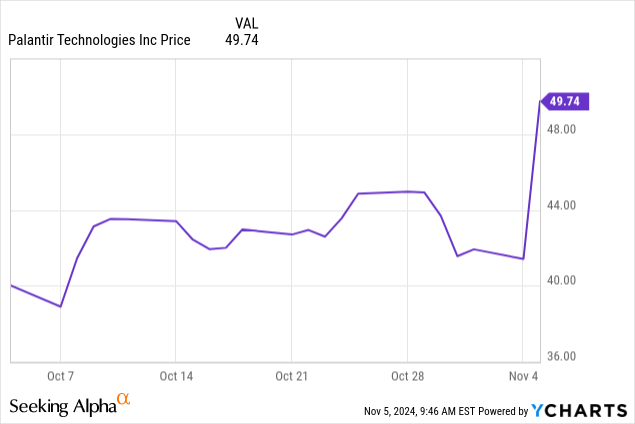

I’m personally lengthy Palantir; I purchased in shortly after the article was printed, and am additionally up over 100% since then. Nevertheless, I’m not essentially right here to brag, however to cowl Palantir’s Q3 earnings report, which was launched this week, and resulted in a convincing approval from the market.

Knowledge by YCharts

That single day soar was shut to fifteen%, which was an thrilling day. Palantir has now eclipsed its former heights and reached a brand new one.

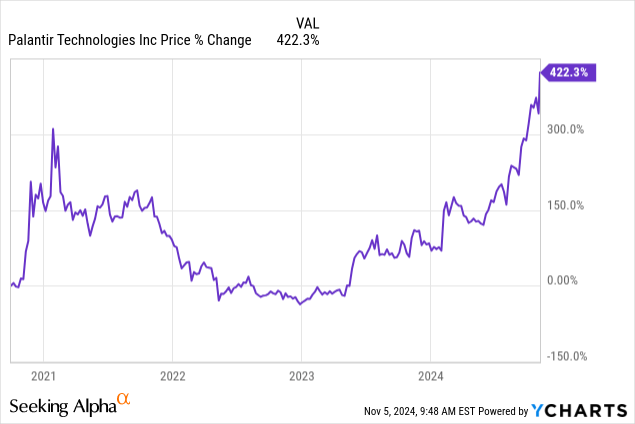

Knowledge by YCharts

Quick Historical past

“Knowledge analytics” is a moderately obscure time period, and far of Palantir’s enterprise is obfuscated by means of that form of hand-waving jargon. For instance, right here is Palantir’s clarification of what they do, from their web site,

We construct software program that empowers organizations to successfully combine their information, selections, and operations.

One of the best ways I can put it for almost all of readers to know: Palantir develops software program that’s designed to be the spine of an organization. All of their information is fed into this software program (which I’m going to name an “working system” or “OS” from right here on out), after which the software program analyzes that information utilizing AI fashions and proprietary algorithms to search out deficiencies, misallocated sources, and inefficient processes. The OS then allows “operators” (from companies to governments to NGOs) to resolve these points and streamline their operations from high to backside.

The first “talent” being employed by the software program is sample recognition. The Palantir platforms can pour by means of thousands and thousands of information factors and “discover the needle within the haystack” so to talk; that’s, some sample within the information that human operators missed or didn’t have the sources or time to guide pour over. In our world, the pool of information on people and on this planet climbs day-after-day.

They’ve obtained just a few large accomplishments underneath their belt from their 20-year tenure within the information enterprise:

- An early investment from the CIA’s enterprise capital fund, In-Q-Tel

- Uncovered “GhostNet,” a Chinese language-based spy ring of practically 1,300 contaminated computer systems that had infiltrated the Dalai Lama’s workplace, a NATO system, and nationwide embassies

- Deployed throughout the Medicare and Medicaid networks to search out fraud

- Assisted in the location of Al-Qaeda chief and 9/11 orchestrator, Osama bin Laden

- Its software program was used to source recordsfor Bernie Madoff’s conviction

- Current and former clients embrace the CIA, the Division of Homeland Safety, the NSA, the FBI, the CDC, US Marine Corps, Air Power, and Particular Operations Command; the FDA, Los Angeles PD, US ICE, the English NHS, and extra

Welcome to the S&P 500

The announcement of the agency’s inclusion into the S&P 500 was a giant one, because it lends extra legitimacy to the corporate in addition to offers a lift to the share worth since funds that observe the index might want to purchase PLTR shares at their subsequent rebalance (relying on the fund).

This type of announcement hype is just not at all times long-lived, so I’m cautious of it, however for now, it’s a boon to PLTR.

Palantir Q3 Earnings

Our third quarter outcomes for PLTR had been attention-grabbing, principally due to the headline 30% increase to income.

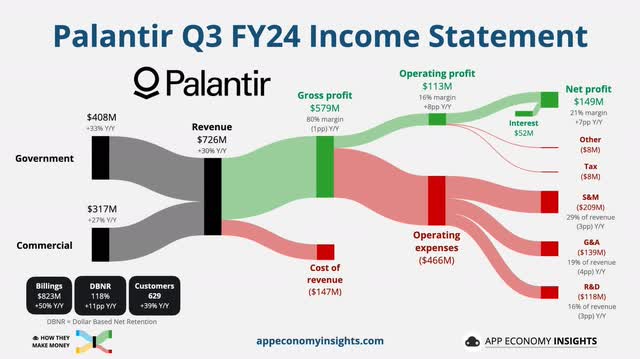

Right here’s a fast overview of the place the cash got here from and went to.

I actually recognize the creator of this specific sequence, App Economic system Insights on Threads.

App Economic system Insights

Different notable efficiency metrics that administration famous apart from the broad enhance in enterprise extra typically are:

- Home income grew 44% YoY

- Closed 104 offers over $1M in Q3

- Rule of 40 rating of 68% (a brand new excessive)

- Partnership with Ukrainian authorities to work on de-mining operations

- Enlargement of Maven program with continued US funding

Financials

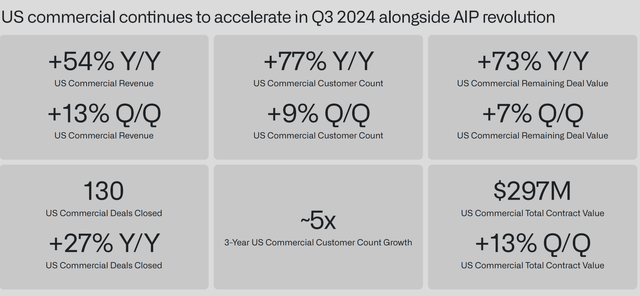

Palantir continued to broaden its business operations, one of many aspects of PLTR that I’m most bullish on, and expanded their income 13% QoQ, and 54% YoY. This was coupled with a 77% YoY enhance in buyer rely, additional diversifying their base and income streams. This assuages some buyer focus danger PLTR has with its US army enterprise.

Palantir

Most significantly, we will see that the entire worth of the present business contracts has elevated at a quicker price than buyer rely, exhibiting us that these new prospects are, on common, larger paying prospects than present ones. If all prospects paid the identical tabs, we must always count on a linear relationship between these metrics.

I’m additionally impressed with how a lot business income has grown, because it used to make up such a small piece of PLTR’s total, with the federal government contracts formally dominating their portfolio. Now, these two figures are virtually neck-and-neck.

GAAP web revenue was as much as $143M, up 100% YoY. GAAP EPS was at $0.06. This was nice information, as profitability continues and strengthens. A doubling of GAAP earnings is a really optimistic signal for any firm, and may justify a worth motion of comparable stature.

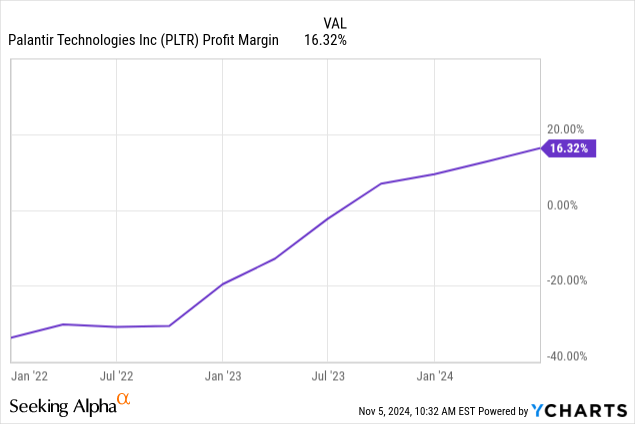

Alongside this, margins grew to 16%, from a several-year-low of practically (40%). The turn-around time was fast, however we will see the pattern slowing as we start to strategy diminishing returns on margin development.

Knowledge by YCharts

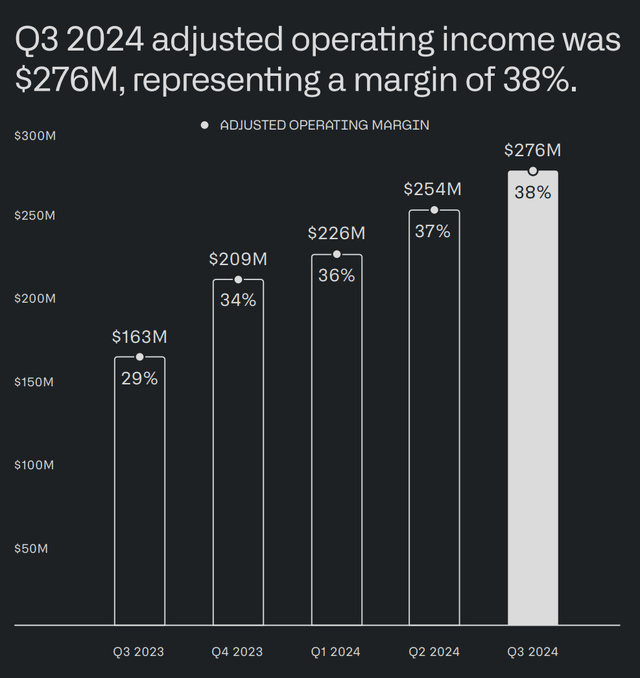

This cash, and the brand new heights in revenue margins, is paid invested “aggressively,” as administration put it within the earnings presentation. They are saying that this has introduced their working margin as much as 38%.

Palantir

They ended Q3 with a ton of money sitting readily available, and no debt to talk of. It is a great spot for a enterprise to be working at, because it implies that their solvency is with out query. They ended the quarter with $4.6B in money and equivalents.

For context, there are 25 international locations with much less money of their international reserves.

Expectations

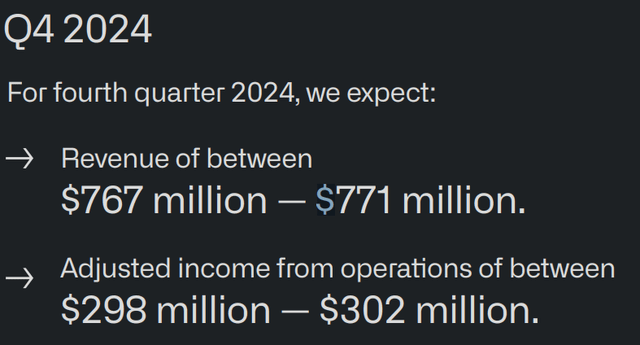

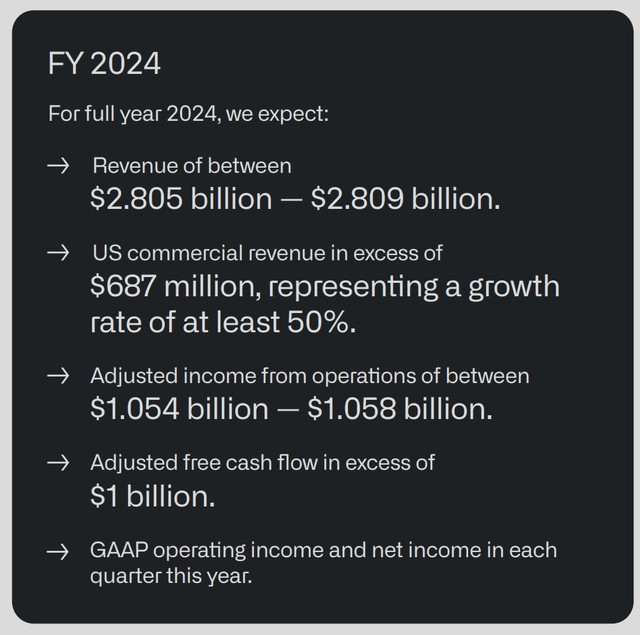

For the subsequent quarter, PLTR is anticipating a 5-6% QoQ enhance in income, and an identical change in working revenue. This might maintain them on the fitting development trajectory to proceed justifying their valuation.

Palantir

For FY 2024, they’re projecting a 50% development in business income, and FCF of $1B+, one thing they’ve but to succeed in. This fall might want to impress to maintain these numbers up.

Palantir

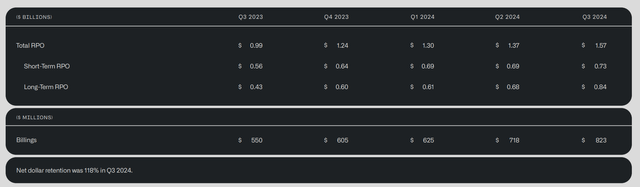

Different metrics to incorporate is the entire RPO, or remaining efficiency obligation, the quantity they’ll count on to earn from, unfulfilled contracts. As they’ve added on extra prospects and extra contracts, closing these 100+ offers, this determine has elevated. Locking in contract worth is a boon for PLTR, because it means they’ll challenge some degree of ahead earnings from these.

Palantir

Valuation

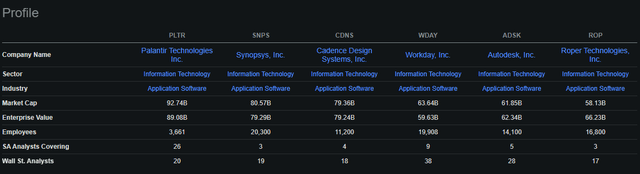

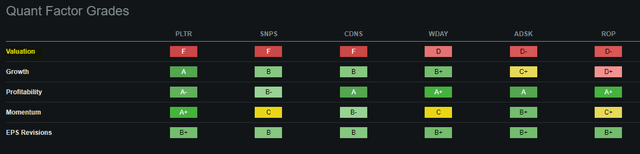

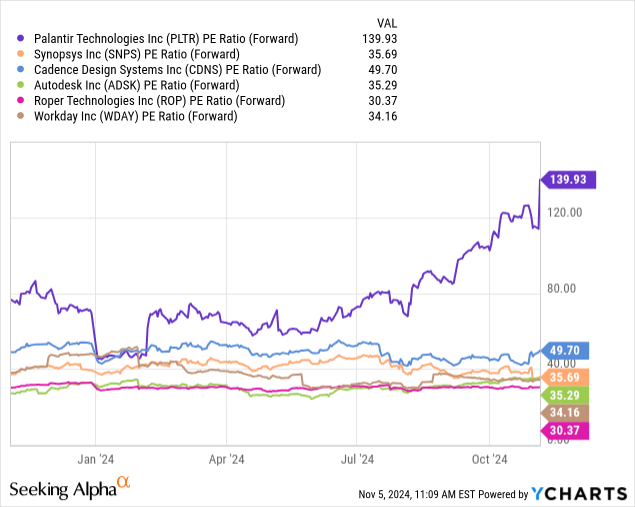

Right here is the elephant within the room. When shares run up like PLTR has, they’ll let their valuations get away from them. In comparison with its rivals, PLTR carries a excessive PE ratio.

Looking for Alpha

To be honest, SA Quant charges all of them poorly from a valuation standpoint.

Looking for Alpha

Once we have a look at ahead PE, we see a greater facet of the story, however nonetheless, one which reveals PLTR as very overvalued in comparison with its friends. One would want to set this apart to be snug proudly owning this inventory.

Knowledge by YCharts

The most important danger to PLTR is that it stands to fall a lot farther than its friends within the SaaS house due to this heightened pricing. If we enter a recession and PLTR’s enterprise slows, it could be hammered far worse than some rivals.

I consider that might solely be a purchase sign, nevertheless, as I’m very bullish on PLTR and consider in its continued justification of its excessive valuation. With the form of development that it’s projecting, it is sensible to worth it above different, slower enterprises.

Conclusion

PLTR is a inventory that has run up tremendously, however dangers stay in its valuation. Q3 earnings had been very spectacular, with lots of the “should watch” metrics like buyer counts and contract worth up over earlier expectations. The headline 30% income development shook markets and propelled PLTR to new heights. Whether or not it may preserve these heights is but to be seen, however for now, it appears to justify its insanely excessive valuation.

Business buyer development, additional integration into the armed forces, and heightened income are all very bullish components for PLTR which have led me to present it an improve to a robust purchase, as I consider that it’s going to ultimately justify its valuation and are available again to Earth, however that it nonetheless has extra room to run. The corporate has simply joined the S&P 500 and reveals super promise.

Simply keep in mind that dangers nonetheless stay, particularly with firms which have run up as a lot as PLTR has. It has plenty of room to doubtlessly fall.

Thanks for studying.

2.58K Followers

Monetary advisor and analysis analyst from Southern California.My work covers equities, funds, and glued revenue; macroeconomic and geopolitical evaluation; asset allocation, technical evaluation, portfolio administration, options, and derivatives.”Historical past doesn’t repeat, however it does instruct.” — Timothy Snyder, On TyrannyFollow me @ https://linktr.ee/realjbowman

Analyst’s Disclosure: I/we’ve got a useful lengthy place within the shares of PLTR both by means of inventory possession, choices, or different derivatives. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Looking for Alpha). I’ve no enterprise relationship with any firm whose inventory is talked about on this article.

Looking for Alpha’s Disclosure: Previous efficiency isn’t any assure of future outcomes. No advice or recommendation is being given as as to whether any funding is appropriate for a selected investor. Any views or opinions expressed above might not replicate these of Looking for Alpha as a complete. Looking for Alpha is just not a licensed securities vendor, dealer or US funding adviser or funding financial institution. Our analysts are third occasion authors that embrace each skilled buyers and particular person buyers who might not be licensed or licensed by any institute or regulatory physique.