Some issues I like and don’t like in the intervening time:

I like massive up years within the inventory market. Final 12 months the S&P 500 was up 26%. This 12 months it’s up almost 29%.

Since 1928 there have solely been three different cases of 25%+ returns in back-to-back years:

- 1935 (+47%) and 1936 (+32%)

- 1954 (+53%) and 1955 (+33%)

- 1997 (+33%) and 1998 (+28%)

So what occurred subsequent?

One thing for everybody:

- 1937: -35%

- 1956: +7%

- 1999: +21%

Horrible, respectable and nice. Not useful.

It’s unattainable to attract many conclusions from an N=3 pattern dimension but it surely’s essential to recollect one or two years of returns doesn’t assist a lot in relation to predicting subsequent 12 months’s returns.

Your guess is nearly as good as mine.

I don’t just like the housing market. The housing market has been broken for just a few years now however the longer the present scenario goes the more severe it will likely be sooner or later.

Permit me to clarify utilizing a chart from The Washington Post:

Right here’s Heather Lengthy on our lack of constructing in America:

In 1972, when the U.S. inhabitants was simply over 200 million, almost 2.4 million new properties have been constructed. Final 12 months, just one.4 million properties have been added, for a inhabitants of 335 million. Realistically, at the very least 2 million new properties must be constructed yearly.

Extra folks and fewer homes being constructed.

With 7% mortgage charges this quantity gained’t be rising wherever near the two million properties we’d like added yearly.

Clearly, individuals who already personal a house and/or have a 3% mortgage profit from ever-rising costs. Nonetheless, it makes issues worse for housing exercise, which is a giant a part of the financial system.

And younger individuals who need to purchase a home are out of luck.

I like The Company. I don’t know the way many individuals have Showtime on Paramount+ (typically the streamers are so complicated) however The Company is the very best new present of the 12 months.

It’s obtained Michael Fassbender, Jeffrey Wright, Richard Gere, CIA/spy stuff.

That is the form of present the place you set your cellphone down for an hour and don’t have a look at it even as soon as.

The Company is a depraved sensible present.

I don’t like how each assembly is a Zoom assembly. I perceive why video conferences took off in the course of the pandemic. Distant work turned a factor. It was an effective way to remain related.

Typically it’s good to see folks in a gathering.

However all conferences? Critically?

Can we sprinkle in a very good outdated convention name each every so often?1

I like having conversations in regards to the potential for AI. I don’t use Chat GPT or Claude or Perplexity all that a lot but. I’ve performed round with all of them however AI isn’t a part of my every day routine.

However I’ve had a number of conversations and demos with individuals who use these instruments recurrently, and it makes me excited for the longer term.

I benefit from the honeymoon section of expertise like this.

I additionally suppose AI goes to make out lives extra environment friendly in so some ways.

I don’t like all of the Dwelling Alone films after the primary two. Look, Dwelling Alone 2 was a money seize following the success of the unique but it surely was nonetheless good.

Nevertheless, all 4-5 (?) iterations that attempted to recreate lightning in a bottle are unwatchable.2

Dwelling Alone is the best household film of all-time so I get why they tried to do that.

So far as I’m involved, Dwelling Alone stopped after quantity two in New York Metropolis.

I like this story about Woj. Sports Illustrated had a narrative about why Adrian Wojnarowski walked away from his job at ESPN. This half hits arduous:

In Could, Woj traveled to Rogers, Ark., for a memorial for Chris Mortensen, the longtime NFL insider who died in March from throat most cancers. Mortensen spent greater than three a long time at ESPN. When Woj arrived in Bristol in 2017, Mortensen was among the many first to welcome him. Many ESPNers made the journey to Arkansas. What Woj was struck by was what number of didn’t. “It made me keep in mind that the job isn’t every part,” Woj says. “In the long run it’s simply going to be your loved ones and shut mates. And it’s additionally, like, no one offers a s—. No one remembers [breaking stories] in the long run. It’s simply vapor.”

Work is essential. I like my job. It’s not every part.

I don’t prefer it when markets appear too simple. Market cycles are taking place sooner than ever today.

This decade alone we’ve skilled the next:

- 2020: The Covid crash, placing the financial system on ice, 14% unemployment, unfavourable oil costs and an insane restoration to new all-time highs in report time.

- 2021: The meme inventory bubble that burst in a painful method.

- 2022: 4 decade-high inflation, rates of interest going from 0% to five%, everybody assumes a recession is imminent and housing costs that refuse to crash.

- 2023: Inflation falls from 9% to sub-3% but we don’t have a recession, the inventory market booms and customers simply preserve spending.

- 2024: The Fed lowers charges however bond yields go up, the inventory market/crypto preserve booming and leverage takes off.

That’s lots to digest and it appears like I’m solely scratching the floor of all of the stuff that occurred.

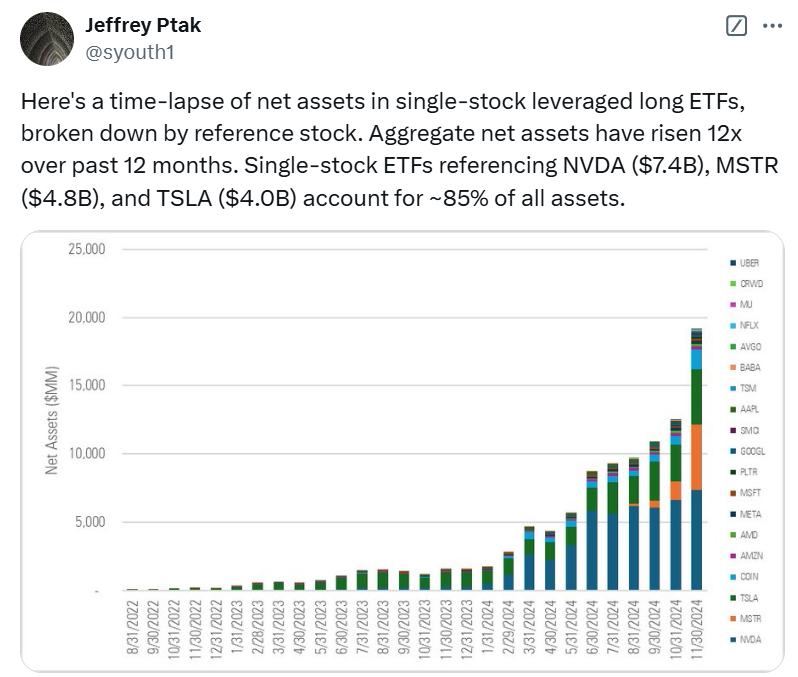

Take a look at this chart from Morningstar’s Jeff Ptak on the insane progress in single-stock leveraged ETFs in recent times:

Persons are going loopy for these automobiles.

I’m certain loads of buyers (speculators?) have made cash in these funds. Good for them.

I simply grow to be a bit uneasy when it looks as if persons are making simple cash.

Investing may be made easy but it surely’s by no means simple…at the very least over the long-term.

Additional Studying:

Are U.S. Stocks Overvalued

1I do know you may flip your video off however in the event you’re the one one it makes you appear to be a curmudgeon. I would like everybody to make use of no video.

2My youngsters made us attempt all of them.