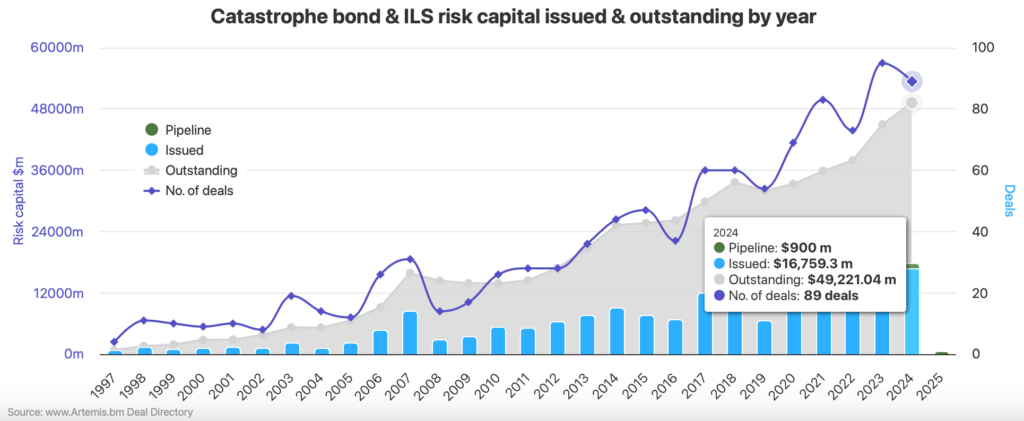

Disaster bond market data are falling in 2024 and set to be crushed on most fronts, with general issuance recorded within the Artemis Deal Directory reaching a brand new excessive of virtually $17.7 billion for this 12 months, together with a document $17.24 billion of Rule 144A cat bonds, driving a brand new end-of-year excellent market document and cat bond market progress of 10%.

The excellent market, throughout 144A property disaster bonds, 144A cat bonds masking different traces of insurance coverage and reinsurance enterprise similar to cyber, and in addition the personal cat bonds that we monitor, is now projected to succeed in over $49.44 billion.

That represents greater than 10% progress of disaster bond danger capital excellent for the reason that finish of 2023, throughout these classes of offers.

We’ve been monitoring disaster bond issuance since 1996 and this 12 months has been one of many busiest ever seen.

Whereas the variety of offers issued and tracked by Artemis is about to fall simply barely behind final 12 months’s 95, reaching 92 as soon as the three yet-to-settle issuances are included, 2024 has seen the second highest variety of new bond points in on a regular basis we’ve analysed the disaster bond market.

At this stage of the 12 months, there stays $900 million in danger capital within the pipeline, from three cat bonds scheduled to settle subsequent week (another settles at this time which is included in our figures, as of at this time).

With no signal of another new offers coming for settlement earlier than year-end, we will now give firmer projections for the top of 2024 annual cat bond issuance and market dimension totals.

Complete issuance tracked by Artemis, throughout 144A property cat and different line of enterprise cat bonds, in addition to personal cat bonds we’ve seen, is about to succeed in a brand new document of virtually $17.7 billion for 2024, which is a 7.4% enhance on the earlier document set a 12 months in the past.

Artemis’ chart that tracks catastrophe bond issuance, the size of the outstanding market and the number of new cat bond deals by year (beneath) exhibits this projected complete of almost $17.7 billion in case you add collectively the settled issuance to this point and the pipeline of latest offers that each one settle and are available into the market subsequent week.

Wanting solely on the 144A disaster bonds that have been issued in 2024, the full is about to succeed in nearly $17.24 billion by the top of this 12 months, which is a 9% enhance on the earlier document quantity of annual issuance set in 2023.

That is reflective of the sturdy demand for brand spanking new funding paper from the cat bond investor group and its fund managers, in addition to sturdy demand from repeat sponsors for defense, plus rising curiosity from new market entrants sponsoring their first cat bond offers.

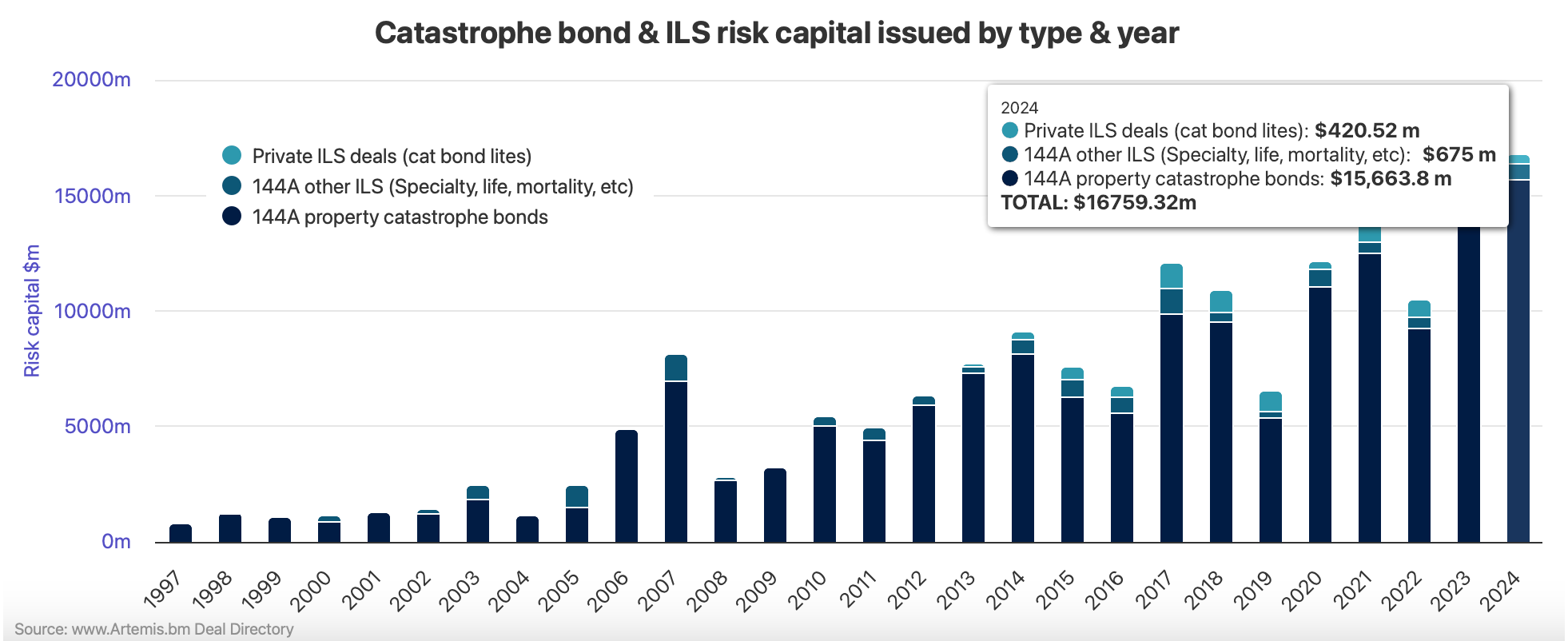

The core of the market stays Rule 144A property disaster bonds although and right here the document set in 2024 is much more spectacular.

144A property cat bond issuance for 2024 is now set to succeed in a really spectacular nearly $16.6 billion, which is nearly 11% up on the earlier document from 2023.

It’s attainable to track the different segments of the cat bond market that we analyse here at Artemis using this chart that breaks down annual cat bond issuance by type of deal (observe, this chart doesn’t characteristic the pipeline).

With that core of the cat bond market (144A property cat offers) nonetheless increasing, because of extra bigger points, rising numbers of latest cat bond sponsors and rising investor curiosity, in addition to new cat bond funds having been launched to extend the capital provide, it bodes nicely for one more sturdy 12 months in 2025.

Even with out the pipeline of $900 million of latest cat bond danger capital that isn’t as a result of settle till subsequent week, the market has already damaged all of those data we’ve talked about, as of at this time.

One notable truth about 2024 disaster bond issuance although, is that the second-half of the 12 months and the third and fourth quarters in isolation, haven’t damaged issuance data.

The entire progress of the market got here within the first-half of the 12 months, with H1 issuance tracked by Artemis reaching over $12.6 billion. Nonetheless, the second-half of 2024 will probably be solely the second time H2 has seen greater than $5 billion of latest cat bonds issued, so it’s nonetheless very notable.

You can track issuance by month using this interactive chart, the place you’ll be able to deselect months to exclude them out of your evaluation to only have a look at halves and quarters of issuance years (keep in mind that is minus the pipeline of offers left to settle).

Our common readers know that our vary of disaster bond market charts can hold you recent on the state of the market at any time limit, whereas additionally aiding in projecting issuance and serving to them analyse market tendencies in real-time on any day of the 12 months.

One of many key knowledge factors that may outline market dynamics is the volume of maturing catastrophe bonds and the schedule for those maturities to occur, which you can now also analyse with Artemis.

With greater than $10 billion of disaster bonds maturing within the first-half of 2025, the market goes to have a major amount of money and liquidity coming again that may ideally want recycling into new cat bond funding alternatives.

This can be a sturdy sign for sponsors (and potential cat bond sponsors) that execution within the disaster bond market is prone to proceed to be beneficial for defense patrons, with buyers and fund managers in a position to help giant deal sizes over the approaching months.

All of which ought to make for one more busy first-half to subsequent 12 months. Though, full-year 2025 maturities, it suggests the market can even have to see new capital inflows coming in, whether it is to get close to to, or beat, the brand new disaster bond market data which have now been set in 2024.

Our full report on the fourth-quarter and full-year of 2024 will probably be out there early in January and, after all, you’ll be able to hold updated on the disaster bond market in real-time utilizing our Deal Listing and interactive charts each single day.

We’ll hold you up to date as we transfer into 2025 and the brand new 12 months progresses. So keep tuned to Artemis.

The Artemis Deal Directory lists all disaster bond and associated transactions accomplished for the reason that market was shaped within the late 1990’s. The listing additionally lists the cat bonds ready to settle, that are highlighted in inexperienced on the high of the checklist.

Download our free quarterly catastrophe bond market reports.

We monitor catastrophe bond and related ILS issuance data, probably the most prolific sponsors in the market, most energetic structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus a lot more.

Find all of our charts and data here, or by way of the Artemis Dashboard which offers a useful one-page view of cat bond market metrics.

All of those charts and visualisations are up to date as quickly as a brand new cat bond issuance is accomplished, or as older issuances mature.