Picture supply: Getty Pictures

On the lookout for one of the best funding trusts to purchase for a successful passive revenue? Listed here are three I believe deserve an in depth look.

As you’ll see, their ahead dividend yields are greater than double the common for FTSE 100 shares.

Greencoat Renewables

Dividend yield: 8.3%

The secure nature of power demand gives trusts investing in power-generating property with glorious stability. As a consequence, they’ve the means and the boldness to pay first rate and infrequently rising dividends over time.

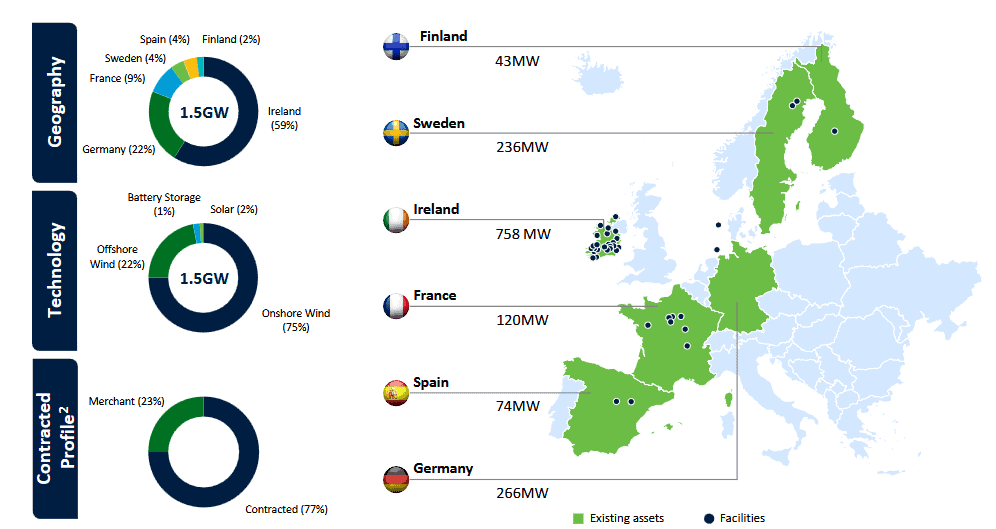

That is the case with Greencoat Renewables (LSE:GRP), which specialises in onshore and offshore wind throughout Eire and Continental Europe. It’s supplied a rising annual payout in six of the previous seven years.

Unfavourable climate circumstances can considerably influence returns from these firms. When the wind doesn’t blow, as an illustration, their generators can’t produce profit-making electrical energy.

Nevertheless, Greencoat Renewables’ large geographic footprint reduces the influence of localised climate points at group degree, offering earnings (and thus dividends) with glorious stability.

The belief predicts Europe’s investible renewables market shall be value €1.3trn by 2030, and €2.5trn by 2050. This implies monumental long-term funding potential.

Grocery store Earnings REIT

Dividend yield: 8.9%

Trusts that specialize in meals retail additionally get pleasure from glorious earnings stability from 12 months to 12 months. That is what could make Grocery store Earnings REIT (LSE:SUPR) such an incredible funding for risk-averse revenue seekers.

In the present day it owns 73 grocery properties that it lets out to among the trade’s largest gamers. These embrace Tesco, Sainsbury‘s, Aldi, and Morrisons. For sure, Grocery store Earnings doesn’t have to fret about lease assortment issues with blue-chip tenants like these.

The regular progress of e-commerce poses a structural menace to the belief. Nevertheless, its concentrate on omnichannel supermarkets servicing each bodily and on-line clients is — in the intervening time, at the least — serving to to mitigate this menace.

One ultimate cause I like Grocery store Earnings is due to its classification as an actual property funding belief (REIT). REITs are obligated to pay at the least 90% of annual rental earnings out within the type of dividends, whether or not they prefer it or not.

This gives dividend-hungry buyers with added peace of thoughts.

Please word that tax therapy is dependent upon the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is supplied for info functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation.

CVC Earnings & Development

Dividend yield: 8.4%

The London inventory market hosts loads of trusts that derive their earnings from debt devices. Nevertheless, CVC Earnings & Development‘s (LSE:CVCG) concentrate on sub-investment-grade credit score means it may cost far greater rates of interest than different trusts, supercharging the earnings it makes.

This in flip fuels its monumental dividend yields.

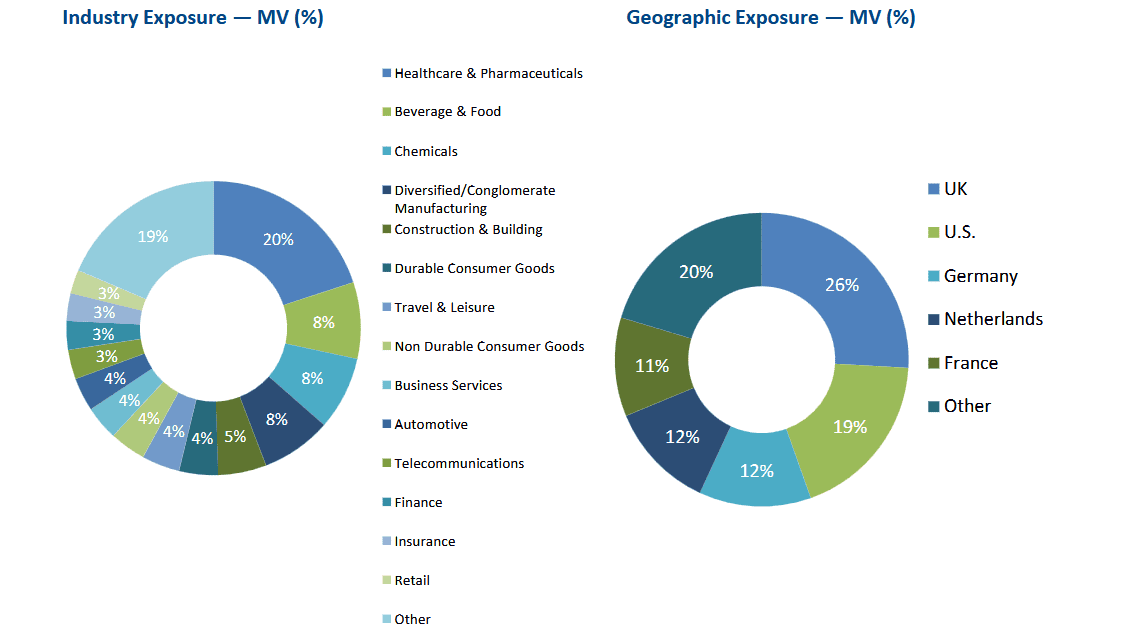

Returns right here could be in danger if a number of firms fail to satisfy their debt obligations. Nevertheless, the belief’s spectacular diversification means such occasions could be absorbed with out decimating complete returns.

CVC Earnings & Development has investments in between 40 and 60 firms at anyone time. And these are fairly evenly unfold throughout all kinds of sectors and areas, a top quality that reduces threat nonetheless additional.

Like Grocery store Earnings and Greencoat Renewables, I believe it’s value severe consideration from savvy buyers.