Picture supply: Getty Pictures

Is funding about timing? It isn’t solely about timing in fact, however timing will be essential. The identical share generally is a sensible performer or a complete canine for an investor, relying on once they purchase or sells it. So when on the lookout for shares to purchase, I think about how engaging the enterprise is – but in addition at what level I might be completely satisfied to speculate.

Listed here are two shares on my watchlist that I believe are glorious companies. I might be completely satisfied to purchase shares subsequent 12 months if their worth comes all the way down to what I see as a beautiful stage.

Dunelm

At face stage, Dunelm (LSE: DNLM) may not even appear costly. In spite of everything, its price-to-earnings ratio of 14 is decrease than that of some shares I purchased this 12 months, similar to Diageo.

Nevertheless, I’ve been burnt proudly owning retailers’ shares earlier than (similar to my stake in boohoo).

Retail tends to be a reasonably low revenue margin enterprise, so earnings can fall considerably for comparatively small seeming causes. Final 12 months, for instance, Diageo’s after tax profit margin was 19%. Dunelm’s was lower than half of that, at 9%.

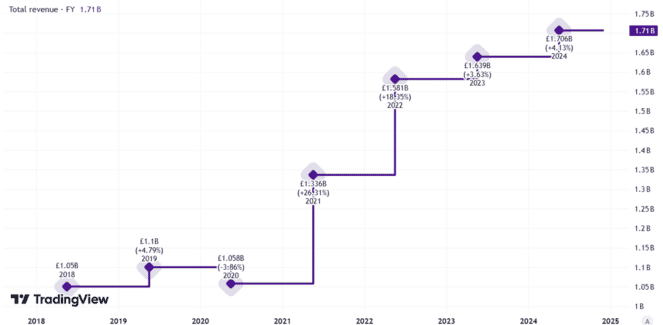

Dunelm’s enterprise is run effectively, it has a big store property, and rising digital footprint and due to many distinctive product strains it might differentiate itself from rivals. Gross sales have grown significantly lately.

Created utilizing TradingVew

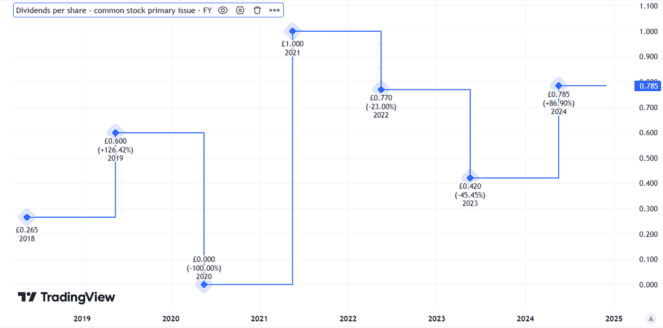

Dunelm is a strong dividend payer too. The yield from odd dividends is round 4.1%.

However the firm has typically paid particular dividends, which means the entire yield has typically been greater than the odd dividend yield alone.

Created utilizing TradingVew

Nonetheless, the Dunelm share worth has risen 57% since September 2022.

That appears steep to me provided that gross sales development in essentially the most just lately reported quarter was 3.5% — completely respectable in my opinion, however not spectacular.

A weak economic system and more and more stretched family budgets might eat into gross sales and earnings in 2025, I reckon. If that occurs and the share worth falls sufficient, my present plan can be to purchase some Dunelm shares for my portfolio.

Nvidia

I reckon it’s straightforward to have a look at the Nvidia (NASDAQ: NVDA) worth chart and instantly suppose “bubble!”

Certainly, the P/E ratio of 53 gives little or no margin of security for dangers similar to a pullback in AI spending as soon as the preliminary spherical of massive installations at present underway has run its course. That helps clarify why I’ve not purchased the shares this 12 months.

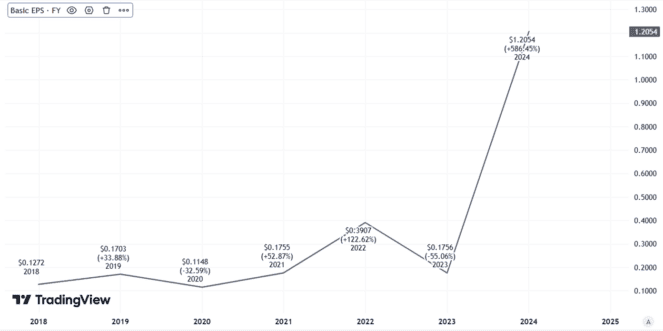

Nonetheless, that P/E ratio is regardless of Nvidia inventory rising 2,175% up to now 5 years alone. The value has soared, however so too have earnings.

Created utilizing TradingVew

Nvidia is just not some meme inventory with no long-term future. It’s a massively worthwhile, profitable firm with a confirmed enterprise mannequin.

Its aggressive moat can also be enormous in my opinion – rivals merely can’t make lots of the chips Nvidia does even when they wish to.

The valuation alone is why I’ve not purchased Nvidia inventory this 12 months. It’s a share I might be completely satisfied to purchase (in spades) in 2025 if the value appears to be like extra cheap to me.